FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

calculate

1

2 double declining balance method

3 requirement given in image

please solve three subparts without handwritten thanku

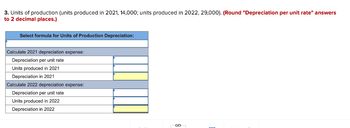

Transcribed Image Text:3. Units of production (units produced in 2021, 14,000; units produced in 2022, 29,000). (Round "Depreciation per unit rate" answers

to 2 decimal places.)

Select formula for Units of Production Depreciation:

Calculate 2021 depreciation expense:

Depreciation per unit rate

Units produced in 2021

Depreciation in 2021

Calculate 2022 depreciation expense:

Depreciation per unit rate

Units produced in 2022

Depreciation in 2022

S

-

![Required information

Exercise 11-3 (Algo) Depreciation methods partial periods [LO11-2]

[The following information applies to the questions displayed below.]

On October 1, 2021, the Allegheny Corporation purchased equipment for $157,000. The estimated service life of the

equipment is 10 years and the estimated residual value is $3,000. The equipment is expected to produce 350,000 units

during its life.

Required:

Calculate depreciation for 2021 and 2022 using each of the following methods. Partial-year depreciation is calculated

based on the number of months the asset is in service.](https://content.bartleby.com/qna-images/question/19d3d1de-345d-44bc-9457-16ca6fdc82b7/2fbddfc0-85de-4deb-95e3-1e49f8855830/zb8hfto_thumbnail.jpeg)

Transcribed Image Text:Required information

Exercise 11-3 (Algo) Depreciation methods partial periods [LO11-2]

[The following information applies to the questions displayed below.]

On October 1, 2021, the Allegheny Corporation purchased equipment for $157,000. The estimated service life of the

equipment is 10 years and the estimated residual value is $3,000. The equipment is expected to produce 350,000 units

during its life.

Required:

Calculate depreciation for 2021 and 2022 using each of the following methods. Partial-year depreciation is calculated

based on the number of months the asset is in service.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- b Preview File Edit View Go Tools Window Help ♥ mgt120h-a17.pdf Page 3 of 10 a. When an individual account is written off. b. When the loss amount is known. c. For an amount that the company estimates it will not collect. Several times during the accounting period. d. a. $100,000 loss on disposal b. $40,000 loss on disposal c. $40,000 gain on disposal d. $25,000 loss on disposal D V O 6. A company sells an asset that originally cost $150,000 for $50,000 on December 31, 2016. The accumulated depreciation account had a balance of $60,000 after the current year's depreciation of $15,000 had been recorded. The company should recognize a CC 7 Search (Cª Ơ Sat Apr 15 3:05 PM 7. The average cost of a company's property and equipment is $200,000, depreciation Cost-Volume-Profit Analysis The Effect Of Prepaid Taxes On Assets Debenture Valuation And Liabili... 90 5. Under the allowance method for uncollectible accounts, Bad Debts Expense is recorded an individual account is written off For an…arrow_forwardReally stuck on these..any help would be appreciatedarrow_forwardBlossom Company sold $3,300,000, 6%, 10-year bonds on January 1, 2022. The bonds were dated January 1, 2022 and pay interest annually on January 1. Blossom Company uses the straight-line method to amortize bond premium or discount. (a)arrow_forward

- Please do not give solution in image format thankuarrow_forwardQuestion 25 Journalize Depreciation of $7,000 for the year. Edit View Insert Format Tools Table 12pt v Paragraph v BIU A O wordsarrow_forwardNonearrow_forwardhich one of the fixed asset accounts listed will not have a related contra asset account? a.Building b.Office Equipment c.Delivery Equipment d.Landarrow_forwardA v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentM... Q ☆ Tp * pter 10 HW eBook Allocating Payments and Receipts to Fixed Asset Accounts The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. a. Fee paid to attorney for title search $3,200 b. Cost of real estate acquired as a plant site: Land 335,600 Building (to be demolished) 31,900 C. Delinquent real estate taxes on property, assumed by purchaser 18,900 Cost of tearing down and removing building acquired in (b) 5,300 e. Proceeds from sale of salvage materials from old building 3,100* Special assessment paid to city for extension of water imain to the property 12,600 9. Architect's and engineer's fees for plans and supervision 46,100 h. Premium on one-year insurance policy during construction 4,400 i. Cost of filling and grading land 18,500 Money borrowed to pay building contractor 787,000* k. Cost of…arrow_forward* CengageNOWv2 | Online teachin x 2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false uTube Maps O New Tab 6 Cookie Cash 11 6,530 Accounts Receivable 12 2,100 Prepaid Expenses 13 700 Equipment 18 13,700 Accumulated Depreciation 19 1,100 Accounts Payable 21 1,900 Notes Payable 22 4,300 Bob Steely, Capital 31 12,940 Bob Steely, Drawing 32 790 Fees Earned 41 9,250 Wages Expense 51 2,500 Rent Expense 52 1,960 Utilities Expense 53 775 Depreciation Expense 54 250 Miscellaneous Expense 59 185 Totals 29,490 29.490 Determine the net income (loss) for the period. Oa Net loen in /7an items 58:05 All work saved. ere to searcharrow_forwardhelp please answer in text form with proper working and explanation for each and every part and steps with concept and introduction no ai no copy paste remember answer must be in proper format with all workingarrow_forwardgageNOwv2|Online teachin X engagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator%3D&inprogre pe Maps 6 New Tab 6 Cookie Cash 11 6,530 Accounts Receivable 12 2,100 Prepaid Expenses 13 700 Equipment 18 13,700 Accumulated Depreciation 19 1,100 Accounts Payable 21 1,900 Notes Payable 22 4,300 Bob Steely, Capital 31 12,940 Bob Steely, Drawing 32 790 Fees Earned 41 9,250 Wages Expense 51 2,500 Rent Expense 52 1,960 Utilities Expense 53 775 Depreciation Expense 54 250 Miscellaneous Expense 59 185 Totals 29,490 29,490 Determine the owner's equity ending balance. Oa, $12150 All work saved. searcharrow_forwardplem Set: Mod x * CengageNOW2| On x * Cengage Learning B Milestone Two Guidel x G module 5 problem se x+ ow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogres.. еBook Show Me How Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $44,000 in cash and giving a short-term note for $272,000. Legal fees paid were $1,780, delinquent taxes assumed were $14,700, and fees paid to remove an old building from the land were $21,700. Materials salvaged from the demolition of the building were sold for $4,700. A contractor was paid $960,600 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. Next Previous 3:20 PM Check My Work 11/28/2021 56 Farrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education