FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

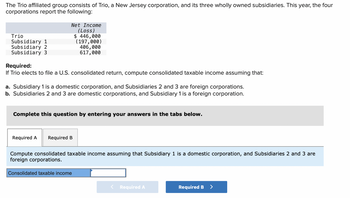

Transcribed Image Text:The Trio affiliated group consists of Trio, a New Jersey corporation, and its three wholly owned subsidiaries. This year, the four corporations report the following:

| Corporation | Net Income (Loss) |

|---------------|-------------------|

| Trio | $446,000 |

| Subsidiary 1 | (197,000) |

| Subsidiary 2 | 406,000 |

| Subsidiary 3 | 617,000 |

**Required:**

If Trio elects to file a U.S. consolidated return, compute consolidated taxable income assuming that:

a. Subsidiary 1 is a domestic corporation, and Subsidiaries 2 and 3 are foreign corporations.

b. Subsidiaries 2 and 3 are domestic corporations, and Subsidiary 1 is a foreign corporation.

**Instructions:**

Complete this question by entering your answers in the tabs below.

- **Compute consolidated taxable income assuming that Subsidiary 1 is a domestic corporation, and Subsidiaries 2 and 3 are foreign corporations.**

- A text box is provided for entering the consolidated taxable income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Partnerships: a.Are not taxable entities. b.Are taxed in the same manner as individuals. c.File tax returns on Form 1041. d.File tax returns on Form 1120.arrow_forwardUnless a “check the box” election is made on Form 8832, a Limited Liability Company (LLC) formed in the United States with a single member is disregarded as a separate entity for US Income Tax purposes. (TRUE or FALSE)arrow_forwardWhich of the following statements in relation to the taxation treatment of unfranked distributions from Australian shares is most correct? A.Unfranked dividends are taxed as normal income and no imputation credits apply B.Unfranked dividends have tax paid at the company rate prior to their distribution to individual shareholders C.Unfranked dividends are tax-free to the investor D.The taxpayer receives the value of franking credits whether they receive the dividends as cash or as extra shares through a dividend re-investment parrow_forward

- Choose the correct. Which of the following is not a reason for two companies to file separate tax returns?a. The parent owns 68 percent of the subsidiary.b. They have no intra-entity transactions.c. Intra-entity dividends are tax-free only on separate returns.d. Neither company historically has had an operating tax loss.arrow_forwardThe Parent consolidated group reports the following results for the tax year. Entity Income or Loss Parent $16,200 Sub1 (1,620) Sub2 6,480 Sub3 3,240 Do not round any division in your computations. If required, round your answers to nearest whole dollar. If an amount is zero, enter "0". a. What is the group's consolidated taxable income and consolidated tax liability? If the relative taxable income method, the consolidated taxable income is $24,300 and the total consolidated tax liability is $5103. b. If the Parent group has consented to the relative taxable income method, how will the consolidated tax liability be allocated among the Parent and Subsidiaries 1, 2, and 3?arrow_forwardPlease do not give solution in image format ?arrow_forward

- True or False: An S Corporation recognizes gain on the distribution of appreciated property to its shareholders which is then reported to its shareholders on Schedule K-1.arrow_forwardWhich of the following dividends received by lon Corp. would NOT be subject to Part IV tax? O A. Dividends received from a wholly owned subsidiary of lon Corp. and, as a result of distributing this dividend, the wholly owned subsidiary received a dividend refund of $5,000. O B. Dividends received from lon Corp.'s portfolio of investments that are deductible in the calculation of taxable income for lon Corp. O C. Dividends received from an unconnected company that is deductible in the calculation of taxable income for lon Corp. O D. Dividends received from a wholly owned subsidiary of lon Corp. and the wholly owned subsidiary did not receive a dividend refund in the current year.arrow_forward1. Establishes the tax differences between individuals and corporations in the United States. 2. Explains Form M-1 and what it is used for. 3. Explains Form 1125-A and what it is used for.arrow_forward

- rrrrrrrarrow_forwardWhich of the following statements is true related to the conversion of a regular corporation to a limited liability company taxed as a partnership? A. In the conversion of a C corporation to an LLC taxed as a partnership, the transfer of appreciated assets from the liquidating corporations is not taxed at the corporate level. B. The corporation can contribute it's assets and liabilities into the new LLC in exchange for ownership interests. The corporation then distributes the LLC interests to it's shareholders in liquidation of the shareholders corporate stock. C. If the corporation distributes it's assets and liabilities to it's shareholders in liquidation of the new corporation, the shareholders are restricted from contributing these assets into the new partnership. D. The existence of substantially appreciated intangibles and goodwill with little or no tax basis has no consequences when converting a C corporation to an LLCarrow_forward18. Current Attempt in Progress Taxable income of a corporation differs from pretax financial income because of PermanentDifferences TemporaryDifferences Yes No Yes Yes No No No Yesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education