FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Presented below are the ending balances of accounts for the Kansas Instruments Corporation at December 31, 2021.

| Account Title | Debits | Credits | ||||

| Cash | $ | 31,000 | ||||

| 152,000 | ||||||

| Raw materials | 35,000 | |||||

| Notes receivable | 111,000 | |||||

| Interest receivable | 14,000 | |||||

| Interest payable | $ | 16,000 | ||||

| Investment in debt securities | 43,000 | |||||

| Land | 61,000 | |||||

| Buildings | 1,520,000 | |||||

| 631,000 | ||||||

| Work in process | 53,000 | |||||

| Finished goods | 100,000 | |||||

| Equipment | 322,000 | |||||

| Accumulated depreciation—equipment | 141,000 | |||||

| Patent (net) | 131,000 | |||||

| Prepaid rent (for the next two years) | 71,000 | |||||

| Deferred revenue | 47,000 | |||||

| Accounts payable | 191,000 | |||||

| Notes payable | 510,000 | |||||

| Restricted cash (for payment of notes payable) | 91,000 | |||||

| Allowance for uncollectible accounts | 24,000 | |||||

| Sales revenue | 1,020,000 | |||||

| Cost of goods sold | 461,000 | |||||

| Rent expense | 39,000 | |||||

Additional Information:

- The notes receivable, along with any accrued interest, are due on November 22, 2022.

- The notes payable are due in 2025. Interest is payable annually.

- The investment in debt securities consist of treasury bills, all of which mature next year.

- Deferred revenue will be recognized as revenue equally over the next two years.

Show work

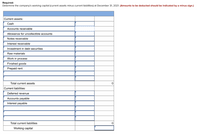

Transcribed Image Text:Required:

Determine the company's working capital (current assets minus current liabilities) at December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.)

Current assets:

Cash

Accounts receivable

Allowance for uncollectible accounts

Notes receivable

Interest receivable

Investment in debt securities

Raw materials

Work in process

Finished goods

Prepaid rent

Total current assets

Current liabilities:

Deferred revenue

Accounts payable

Interest payable

Total current liabilities

Working capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following information: Beginning cash balance on March 1, $75,000. Cash receipts from sales, $302,000. Cash payments for direct materials, $134,000. Cash payments for direct labor, $70,000. Cash payments for overhead, $36,000. Cash payments for sales commissions, $8,000 Cash payments for interest, $180 (1% of beginning loan balance of $18,000) Cash repayment of loan, $18,000. Prepare a cash budget for March for Gado Company.arrow_forwardCulver Limited reports the following selected information at December 31, 2024: Accounts receivable $299,000 Interest income $12,200 Advances to employees 10,000 Interest receivable 8,000 Allow. for expected credit losses 15,000 Inventory 224,000 Credit losses 19,000 Notes receivable (due in 120 days) 50,000 Cost of goods sold 2,330,000 Notes receivable (due in 4 years) 152,000 Depreciation expense 100,000 Salaries expense 804,000 Income tax expense 152,000 Sales 4,200,000 Income tax receivable 14,900 Sales tax recoverable 5,000 Prepare a partial statement of financial position for Culver Ltd. (List current assets in order of liquidity.)arrow_forwardUsing the following information: a. Beginning cash balance on March 1, $80,00. b. Cash receipts from sales, $306,000. c. Cash payments for direct materials, $135,000. d. Cash payments for direct labor, $73,000. e. Cash payments for overhead, $41,000. f. Cash payments for sales commissions, $7,000 g. Cash payments for interest, $110 (1% of beginning loan balance of $11,000) h. Cash repayment of loan, $11,000. Prepare a cash budget for March for Gado Company. GADO COMPANY Cash Budget March Total cash available Less: Cash payments for Total cash payments Loan activity Loan balance, end of month D-pptx A Presentation3.pptx 1 Jarvis CST 141.00...pptx A Musical Theatre Hi...ppt re to searcharrow_forward

- Yogesharrow_forwardCalculate the Gross and the Net Operating Cycle for Vishal & Co. Ltd. using the following information. (Assume 360 days in a year). Amt. in Rs. Opening Balances Raw Material 200,000 WIP 60,000 Finished Goods 600,000 Debtors 250,000 Creditors 550,000 Closing Balances Raw Material 300,000 WIP 65,000 Finished Goods 725,000 Debtors 215,000 Creditors 575,000 Annual Purchase of Raw Material 3, 200,000 Manufacturing Expenses 550,000 Selling & Distribution Costs 300,000 Sales 4,480,000arrow_forwardDuke Company’s records show the following account balances at December 31, 2021: Sales revenue $ 17,600,000 Cost of goods sold 10,300,000 General and administrative expense 1,130,000 Selling expense 630,000 Interest expense 830,000 Income tax expense has not yet been determined. The following events also occurred during 2021. All transactions are material in amount. $430,000 in restructuring costs were incurred in connection with plant closings. Inventory costing $530,000 was written off as obsolete. Material losses of this type are considered to be unusual. It was discovered that depreciation expense for 2020 was understated by $63,000 due to a mathematical error. The company experienced a negative foreign currency translation adjustment of $330,000 and had an unrealized gain on debt securities of $310,000. Required:Prepare a single, continuous multiple-step statement of comprehensive income for 2021. The company’s effective tax rate on all…arrow_forward

- 19. A listing of the estimated balances in the company's ledger accounts as of December 31, 2023 is given below (as well as in your Excel template): Cash Accounts receivable Inventory-raw materials Inventory-finished goods Capital assets (net) Assets $ 83,365 1,122,900 10,000 9,125 724,000 $1,949,390 Total assets Liabilities and Shareholders' Equity Accounts payable $ 231,563 Capital stock 1,000,000 Retained Earnings Total liabilities and shareholders' equity 717,828 $1,949,390 Required: 1. Prepare a monthly master budget for ToyWorks for the year ended December 31, 2024, including the following schedules (Use the Excel template provided!): Sales Budget & Schedule of Cash Receipts Production Budget & Manufacturing Overhead Budget Direct Materials Budget & Schedule of Cash Disbursements Direct Labour Budget Selling and Administrative Expense Budget Ending Finished Goods Inventory Budget Cash Budget 2. Prepare budgeted financial statements at December 31, 2024, using absorption costing.arrow_forwardDuke Company’s records show the following account balances at December 31, 2021: Sales revenue $ 18,600,000 Cost of goods sold 10,800,000 General and administrative expense 1,180,000 Selling expense 680,000 Interest expense 880,000 Income tax expense has not yet been determined. The following events also occurred during 2021. All transactions are material in amount. $480,000 in restructuring costs were incurred in connection with plant closings. Inventory costing $580,000 was written off as obsolete. Material losses of this type are considered to be unusual. It was discovered that depreciation expense for 2020 was understated by $68,000 due to a mathematical error. The company experienced a negative foreign currency translation adjustment of $380,000 and had an unrealized gain on debt securities of $360,000. Required:Prepare a single, continuous multiple-step statement of comprehensive income for 2021. The company’s effective tax rate on all…arrow_forwardUsing the following information: a. Beginning cash balance on March 1, $81,000. b. Cash receipts from sales, $309,000. c. Cash payments for direct materials, $134,000. d. Cash payments for direct labor, $73,000. e. Cash payments for overhead, $43,000. f. Cash payments for sales commissions, $8,000 g. Cash payments for interest, $130 (1% of beginning loan balance of $13,000) h. Cash repayment of loan, $13,000. Prepare a cash budget for March for Gado Company. GADO COMPANY Cash Budget March Beginning cash balance Add: Cash receipts from sales Total cash available Less: Cash payments for 81,000 309,000 390,000 Direct materials 134,000 Direct labor 73,000 Overhead 43,000 Sales commissions 8,000 Interest on loan 130 Total cash payments 258,130 Ending cash balance $ 131,870 Loan activity Beginning cash balance 13,000 Repayment of Bank loan 118,870 Loan balance, end of month %24arrow_forward

- During 2021, its first year of operations, Pave Construction provides services on account of $160,000. By the end of 2021, cash collections on these accounts total $110,000. Pave estimates that 25% of the uncollected accounts will be uncollectible. In 2022, the company writes off uncollectible accounts of $10,000.Required:1. Record the adjustment for uncollectible accounts on December 31, 2021.2. Record the write-off of accounts receivable in 2022 and calculate the balance of Allowance for Uncollectible Accounts at the end of 2022 (before adjustment in 2022).3. Assume the same facts as above but assume actual write-offs in 2022 were $15,000. Record the write-off of accounts receivable in 2022 and calculate the balance of Allowance for Uncollectible Accounts at the end of 2022 (before adjustment in 2022).arrow_forwardThe following comparative balance sheet is given for Estern Co.: Assets Dec 31, 2021 Dec 31, 2020 Cash $58,500 $351,000 72,000 Notes Receivable 63,000 Supplies & Inventory 81,000 121,500 Prepaid expense 31,500 54,000 Long-term investments 0 81,000 Machines and tools 166,500 144,000 Accumulated depreciation-equipment (63.000) (45,000) Total Assets $639,000 $477.000 Liabilities & Stockholders' Equity Accounts payable $ 76,500 $ 31,500 Bonds payable (long-term) 166,500 211,500 Common Stock 180,000 103,500 Retained Earnings 216.000 130.500 Total Liabilities & Stockholders' Equity $639.000 $477,000 Income Statement Information (2021): 1. Net income for the year ending December 31, 2021 is $130,500. 2. Depreciation expense is $18,000. 3. There is a loss of $9,000 resulted from the sale of long-term investment. Additional information (2021): 1. All sales and purchases of inventory are on account (or credit). 2. Received cash for the sale of long-term investments that had a cost of $81,000,…arrow_forwardThe following December 31, 2021, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents $ 5,000Accounts receivable (net) 20,000Inventory 60,000Property, plant, and equipment (net) 120,000Accounts payable 44,000Salaries payable 15,000Paid-in capital 100,000 The only asset not listed is short-term investments. The only liabilities not listed are $30,000 notes payable due in two years and related accrued interest of $1,000 due in four months. The current ratio at year-end is 1.5:1.Required:Determine the following…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education