FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

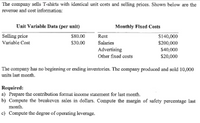

Transcribed Image Text:The company sells T-shirts with identical unit costs and selling prices. Shown below are the

revenue and cost information:

Unit Variable Data (per unit)

Monthly Fixed Costs

Selling price

$80.00

Rent

$140,000

$200,000

$40,000

Variable Cost

$30.00

Salaries

Advertising

Other fixed costs

$20,000

The company has no beginning or ending inventories. The company produced and sold 10,000

units last month.

Required:

a) Prepare the contribution format income statement for last month.

b) Compute the breakeven sales in dollars. Compute the margin of safety percentage last

month.

c) Compute the degree of operating leverage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Variable Costs, Contribution Margin, Contribution Margin Ratio Super-Tees Company plans to sell 20,000 T-shirts at $19 each in the coming year. Product costs include: Direct materials per T-shirt $6.65 $1.33 Direct labor per T-shirt Variable overhead per T-shirt $0.57 Total fixed factory overhead $43,000 Variable selling expense is the redemption of a coupon, which averages $0.95 per T-shirt; fixed selling and administrative expenses total $13,000.arrow_forwardManjiarrow_forwardNeed help with this questionarrow_forward

- Compute (a) the margin of safety in dollars and (b) the margin of safety ratio with the given details below: Aactual sales for the product= 1,000,000 Break-even sales = 840,000.arrow_forward[The following information applies to the questions displayed below.] Alden Company's monthly data for the past year follow. Management wants to use these data to predict future variable and fixed costs. Month Units Sold Total Cost Month Units Sold Total Cost 1 324,500 $ 162,000 7 355,500 $ 245,564 2 169,500 105,750 8 274,500 156,250 3 269,500 210,100 9 75,100 60,500 4 209,500 104,500 10 154,500 135,125 5 294,500 206,000 11 6 194,500 116,500 12 98,500 104,500 98,500 77,150 Problem 18-1A (Algo) Part 1 1. Estimate both the variable costs per unit and the total monthly fixed costs using the high-low method. (Do not round intermediate calculations.) High-Low method - Calculation of variable cost per unit Total cost at the high point Variable costs at the high point: Volume at the high point: Variable cost per unit Total variable costs at the high point Total fixed costs High-Low method - Calculation of fixed costs Total cost at the low point Variable costs at the low point: Volume at the…arrow_forwardValaarrow_forward

- If a company had a contribution margin of $21,000 and a contribution margin ratio of 70%, total variable costs must have been …arrow_forwardThe Carlsbad Corporation produces and markets two types of electronic calculators: Model 4A and Model 5A. The following data were gathered on activities during the third quarter: Sales in units Sales price per unit Variable production costs per unit Traceable fixed production costs Variable selling expenses per unit Traceable fixed selling expenses Allocated portion of corporate expenses Sales Variable expenses Contribution margin Traceable fixed production costs Traceable fixed expenses Segment margin Common fixed expenses Net operating income (loss) Required: Prepare a segmented income statement for last quarter. The statement should provide sufficient detail to allow the company to evaluate the performance of the manager of each product line. X Answer is complete but not entirely correct. Model 4A 876,000 240,000 X 636,000 $ $ Model 4A 6,000 $ 146 $ 40 $ 210,000 $20 $ 15,000 $ 136,000 $ Total Company 1,926,000 485,000 X 1,441,000 520,000 35,000 886,000 276,000 610,000 $ 210,000…arrow_forwardSolve this attachment.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education