FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Refer to the income statements in requirement 1 above. For both current operations and the proposed new operations, compute (a) the degree of operating leverage, (b) the break-even point in dollars, and (c) the margin of safety in both dollar and percentage terms.

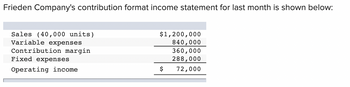

Transcribed Image Text:Frieden Company's contribution format income statement for last month is shown below:

$1,200,000

840,000

Sales (40,000 units)

Variable expenses

Contribution margin

Fixed expenses

360,000

288,000

Operating income

72,000

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A decrease in accounts payable constitutes a/an _________ in net working capital and is considered a/an __________ to a project. Select one: a. increase; cash inflow b. increase; cash outflow c. decrease; cash inflow d. decrease; cash outflow e. increase; opportunity costarrow_forwardResidual income is the excess of operating income over the cost of capital associated with the deployed assets. Following is information for four segments. Experiment with alternative rates of the cost of capital by using the pick list choices associated with the boxed area. Note how the relative residual income changes between the units based on the interest rate assumption! What do you wish to assume for the interest rate? >>>> Operating income Operating assets Assumed interest rate Cost of Capital Residual income Segment A 1,200,000 8,000,000 X 0 1,200,000 Segment B 1,000,000 4,000,000 X 0 1,000,000 Segment C 750,000 2,000,000 X 0 750,000 0% Segment D 500,000 600,000 X 0 500,000arrow_forwardThe simple model of finacnial planning assumes which of thr following: Only assest are expected to increase the same rate as the sales projection The sales projextion is the inly thing expected to increase Assets liabilities equity and expenses are projected to increase at the same rate as the sales projectionsarrow_forward

- Formula for Weighted Average cost of capital is WACC wdT(rdT) + wrP(rP) + wr$(rS) WACC wd(rdT) + wPS(rPS) + w$(rS) WACC = wdS(rdS) + wPS(rPS) + WS(rS) WACC = wdP(rdP) + wPS(rPS) + w$(rS) Clear my selectionarrow_forwardYes, because operating income increases.arrow_forwardChapter 24 discusses various methods of analyzing financial statements in terms of calculating ratios. Specifically, Return on Assets (ROA) is a very simple calculation: ROA= Net Income/Average Total Assets. Another method at arriving at this ratio is the DuPont Equation that was discussed in your textbook. In looking at the DuPont Equation, what benefits are derived by using this method rather than the most typical method that I have described above?arrow_forward

- Indicate one ratio from each of the three categories (profitability, liquidity, and solvency) that you believe to be most indicative of future performance.arrow_forwardAll of the following are the tools for Financial Analysis except: 1.Trend Analysis 2.Funds Flow Statements 3.Standard Costing 4.Ratio Analysisarrow_forwardIdentify two ratios to use to analyze a firm’s liquidity position, andwrite out their equations.arrow_forward

- Which term is used to represent the sales level that results in a project's net income exactly equalling zero? Group of answer choices Cash breakeven Operational breakeven Present value breakeven Financial breakeven Accounting profit breakevenarrow_forwardThe average accounting rate of return (AAR): is the primary methodology used in analyzing independent projects. O O O O O is the best method of financially analyzing mutually exclusive projects. is similar to the return on assets ratio. considers the time value of money. measures net income as a percentage of the sales generated by a project.arrow_forwardWhich of the following statements are true about the interest-burden ratio? Check all that apply: It can be expressed as EBIT/Interest Expense. If the company has no financial leverage, the interest-burden ratio will be equal to 0. A company with higher financial leverage will have a lower interest-burden ratio. If the company has no financial leverage, the interest-burden ratio will be equal to 1. It can be expressed as Net profits/Pretax profits.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education