FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

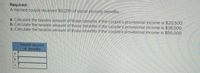

Transcribed Image Text:Required:

A married couple received $9,200 of social security benefits.

a. Calculate the taxable amount of those benefits if the couple's provisional income is $20,500.

b. Calculate the taxable amount of those benefits if the couple's provisional income is $38,000.

c. Calculate the taxable amount of those benefits if the couple's provisional income is $56,000.

Taxable amount

of benefits

a.

b.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise 12-25 (Algorithmic) (LO. 7) Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario, who is single, earns wages of $490,200. His additional Medicare tax is $ b. George and Shirley are married and file a joint return. During the year, George earns wages of $298,100, and Shirley earns wages of $447,150. Their additional Medicare tax is $ c. Simon has net investment income of $56,880 and MAGI of $284,400 and files as a single taxpayer. Simon's additional Medicare tax is $arrow_forwardPlease explain every step. Thank youarrow_forwardFor the current year, the maximum percentage of social security benefits which might be included In a taxpayer's gross income is? A, 50% 85% 0% 65% 100%arrow_forward

- Begin by computing taxable income for each couple. (Complete all input fields. Enter "0" for accounts with a zero balance.) Williams Denbergs Salary $50,000 $145,000 Taxable interest income 50 600 Gross income $50,050 $145,600 Minus: IRA contribution 0 (6,000) Adjusted gross income $50,050 $139,600 Minus: Greater of standard deduction or itemized deductions (24,400) (24,400) Taxable income $25,650 $115,200 Now calculate the 2019 tax due or refund due for each couple. (Use the 2019 tax rate schedule for all tax calculations. Do not round intermediary calculations. Only round the amount you enter in the input field to the nearest dollar. Use a minus sign or parentheses for a net tax refund.) Williams Denbergs Gross tax Minus: Withholding 500 8900 Tax due (refund) Begin by computing taxable income for each…arrow_forwardExercise 4 - 26 (Algorithmic) (LO. 4) Determine the taxable amount of Social Security benefits for the following situations. If required, round your answers to the nearest dollar. If an amount is zero, enter "0". a. Tyler and Candice are married and file a joint tax return. They have adjusted gross income of $38, 200 before considering their Social Security benefits, no tax-exempt interest, and $ 13,370 of Social Security benefits. As a result, $fill in the blank 1 of the Social Security benefits are taxable. b. Assume Tyler and Candice have adjusted gross income of $16, 200 before considering their Social Security benefits, no tax-exempt interest, and $17,820 of Social Security benefits. As a result, $fill in the blank 2 of the Social Security benefits are taxable. c. Assume Tyler and Candice have adjusted gross income of $113, 500 before considering their Social Security benefits, no tax - exempt interest, and $17,025 of Social Security benefits. As a result, $fill in the blank 3 of…arrow_forwardFind the net pay for each of the following employees after FICA, Medicare, federal withholding tax, state disability insurance, and other deductions have been taken out. Assume that none has earned over $115,000 so far this year. Assume a FICA rate of 6.2%, Medicare rate of 1.45%, and a state disability insurance rate of 1%. Use the percentage method of withholding. 13. Clarissa Karsten: $492.58 weekly earnings, 1 withholding 13. allowance, single, $25 in other deductionsarrow_forward

- Determine the maximum contribution that can be made to a Keogh plan in each of the following cases. In all instances, the individual is self-employed, and the self-employment tax reduction has already been taken. Required: a. Self-employment income of $61,800. b. Self-employment income of $61,800 and wage income of $32,000. c. Self-employment income of $125,000. d. Self-employment income of $319,000. Mc Graw Hill 22 é a. Maximum Keogh plan contribution b. Maximum Keogh plan contribution c. Maximum Keogh plan contribution d. Maximum Keogh plan contribution F2 Answer is complete but not entirely correct. Z 3 80 F3 E 4 F6 7 ወ F7 .— 8 Y U DII F8 9 F9arrow_forwardAnswer last two subpart onlyarrow_forwardDetermine the retirement savings contributions credit in each of the following independent cases. Use Table 9-2. a. A married couple filing jointly with modified AGI of $37,500 and an IRA contribution of $1,800. b. A married couple filing jointly with modified AGI of $58,000 and an IRA contribution of $1,900. c. A head of household taxpayer with modified AGI of $33,000 and Roth IRA contribution of $1,990. d. A single taxpayer with modified AGI of $12,000 and an IRA contribution of $2,800. Retirement Savings Contributions Creditarrow_forward

- Julie's gross salary is 950,000; mandatory contributions is 50,000. Compute for the following: a. gross compensation? b. exclusions from gross income c.taxable compensationarrow_forwardDetermine the maximum contribution that can be made to a Keogh plan in each of the following cases. In all instances, the individual is self-employed, and the self-employment tax reduction has already been taken. Required: a. Self-employment income of $71,000. b. Self-employment income of $71,000 and wage income of $38,500. c. Self-employment income of $190,000. d. Self-employment income of $307,000. a. Maximum Keogh plan contribution b. Maximum Keogh plan contribution c. Maximum Keogh plan contribution d. Maximum Keogh plan contribution $ $ Amount $ 614 142 142 380arrow_forwardVishnuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education