CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

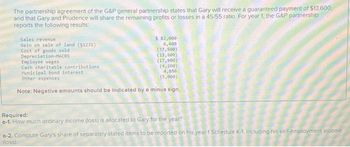

Transcribed Image Text:The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $13,600,

and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership

reports the following results:

Sales revenue

Gain on sale of land (51231)

Cost of goods sold

Depreciation-MACRS

$ 82,000

6,400

(37,500)

(13,800)

(17,900)

Employee wages

(4,200)

Cash charitable contributions

Municipal bond interest

Other expenses

4,050

(5.000)

Note: Negative amounts should be indicated by a minus sign.

Required:

a-1. How much ordinary income (loss) is allocated to Gary for the year?

a-2. Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employment income

(loss).

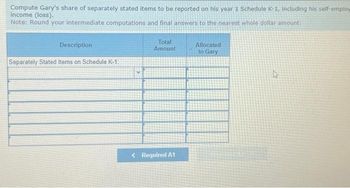

Transcribed Image Text:Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employ

income (loss).

Note: Round your intermediate computations and final answers to the nearest whole dollar amount.

Description

Separately Stated Items on Schedule K-1:

Total

Amount

Required A1

Allocated

to Gary

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $19,000, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue $ 83,200 Gain on sale of land (§1231) 6,300 Cost of goods sold (40,700) Depreciation—MACRS (16,600) Employee wages (16,600) Cash charitable contributions (3,400) Municipal bond interest 5,600 Other expenses (4,800) Note: Negative amounts should be indicated by a minus sign. Required: a-1. How much ordinary income (loss) is allocated to Gary for the year? a-2. Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employment income (loss). b. Compute Gary's share of self-employment income (loss) to be reported on his year 1 Schedule K-1, assuming G&P is a limited partnership and Gary is a limited partner. PLEASE…arrow_forwardThe partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $14,100, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 91,500 7,500 (53,500) (15,600) (11,100) (5,300) 5,450 (5,100) Note: Negative amounts should be indicated by a minus sign. Required: a-1. How much ordinary income (loss) is allocated to Gary for the year? a-2. Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employment income (loss). Complete this question by entering your answers in the tabs below. Required A1 Required A2 How much ordinary income (loss) is allocated to Gary for the year? Note: Round your intermediate computations to the nearest…arrow_forwardThe partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $13,000, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 70,000 $ 8,000 $ (38,000) $ (9,000) $ (14,000) $ (3,000) $ 2,000 $ (2,000) (Negative amounts should be indicated by a minus sign.) b. Compute Gary's share of self-employment income (loss) to be reported on his year 1 Schedule K-1, assuming G&P is a limited partnership and Gary is a limited partner. Self-employment income (loss)arrow_forward

- The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $14,500, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land ($1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses (Negative amounts should be indicated by a minus sign.) Problem 20-61 Part a (Algo) a-1. How much ordinary income (loss) is allocated to Gary for the year? a-2. Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employment income (loss). Req A1 Complete this question by entering your answers in the tabs below. Req A2 $ 80,700 6,900 (28,200) (18,100) (17,200) (4,600) Description Separately Stated Items on Schedule K-1: §1231 gains Cash charitable contributions Compute Gary's share of separately stated…arrow_forwardThe partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $14,100. and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land ($1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses Note: Negative amounts should be indicated by a minus sign. Required: a-1. How much ordinary income (loss) is allocated to Gary for the year? $91,500 7,500 (53,500) (15,600) (11,100) (5,300) 5,450 (5,100) a-2. Compute Gary's share of separately stated items to be reported on his year 1 Schedule K-1, including his self-employment income (loss). How much ordinary income (loss) is allocated to Gary for the year? Note: Round your intermediate computations to the nearest whole dollar amount. Ordinary income (loss) Description Required At Separately Stated Items…arrow_forwardi need the answer quicklyarrow_forward

- Required information [The following information applies to the questions displayed below.] The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $13,000, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 70,000 8,000 (38,000) (9,000) (14,000) (3,000) 2,000 (2,000) Note: Negative amounts should be indicated by a minus sign. c. What do you believe Gary's share of self-employment income (loss) to be reported on his year 1 Schedule K-1 should be, assuming G&P is an LLC and Gary spends 2,000 hours per year working there full time? Self-employment income (loss)arrow_forwardGive me correct answer with explanation.farrow_forwardVikram Bhaiarrow_forward

- ! Required information [The following information applies to the questions displayed below.] The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $18,700, and that Gary and Prudence will share the remaining profits or losses in a 45/55 ratio. For year 1, the G&P partnership reports the following results: Sales revenue Gain on sale of land (§1231) Cost of goods sold Depreciation-MACRS Employee wages Cash charitable contributions Municipal bond interest Other expenses $ 85,000 6,350 (33,500) (16,800) (12,100) (5,000) 5,000 (5,100) Note: Negative amounts should be indicated by a minus sign. b. Compute Gary's share of self-employment income (loss) to be reported on his year 1 Schedule K-1, assuming G&P is a limited partnership and Gary is a limited partner. Self-employment income (loss)arrow_forwardDo not give solution in imagearrow_forwardThe partnership agreement of AAA, BBB and CCC provides for the year-end allocation of net income in the following order: • First, AAA is to receive 10% of net income up to P100,000 and 20% over P100,000 Second, BBB and CCC each are to receive 5% of the remaining income over P150,000 • The balance of income is to be allocated equally among the three partners The partnership's 2009 net income was P250,000 before any allocations to partners. What amount should be allocated to BBB?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,