FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

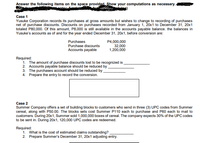

Transcribed Image Text:Answer the following items on the space provided. Show your computations as necessary..

Case 1

Yusuke Corporation records its purchases at gross amounts but wishes to change to recording of purchases

net of purchase discounts. Discounts on purchases recorded from January 1, 20x1 to December 31, 20x1

totaled P80,000. Of this amount, P8,000 is still available in the accounts payable balance. the balances in

Yusuke's accounts as of and for the year ended December 31, 20x1, before conversion are:

Purchases

P4,000,000

32,000

1,200,000

Purchase discounts

Accounts payable

Required:

1. The amount of purchase discounts lost to be recognized is

2. Accounts payable balance should be reduced by

3. The purchases account should be reduced by

4. Prepare the entry to record the conversion.

Case 2

Summer Company offers a set of building blocks to customers who send in three (3) UPC codes from Summer

cereal, along with P50.00. The blocks sets cost Summer P110 each to purchase and P60 each to mail to

customers. During 20x1, Summer sold 1,000,000 boxes of cereal. The company expects 30% of the UPC codes

to be sent in. During 20x1, 120,000 UPC codes are redeemed.

Required:

1. What is the cost of estimated claims outstanding?

2. Prepare Summer's December 31, 20x1 adjusting entry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which accounting principle requires that bad debts expense be recognized in the same period as the sale? A) Measurement principle B) Expense Recognition (Matching) principle C) Revenue Recognition principle D) Historical Cost principle Please answer ASAP, I will upvotearrow_forwardThe internal control questionnaire for purchases and accounts payable includes the following questions. Next to each of the questions, indicate the letter of the related transaction assertion.A. OccurrenceB. CompletenessC. AccuracyD. ClassificationE. Cutoff_______ 1. Are vendor's monthly statements reconciled with individual accounts payable accounts?_______ 2. Are all purchases made only on the basis of approved purchase requisitions?_______ 3. Are vendors' invoices listed immediately upon receipt?_______ 4. Are vendors' invoices matched against purchase orders and receiving reports before a liability is recorded?_______ 5. Is the accounts payable customer ledger balanced periodically with the general ledger control account?_______ 6. Does the accounting manual give instructions to date purchase entries on the date of receipt of goods?_______ 7. Are shipping documents authorized and prepared for goods returned to vendors?_______ 8. Is the accounts payable department notified of goods…arrow_forwardwhat is the interim report of a company?arrow_forward

- To increase Supplies Expense a debit entry is needed. Select one: O True O Falsearrow_forwardWhich following statement is a correct statement about the direct write-off method for calculating credit loss expense? A. It is in accordance with GAAP. B. It uses an allowance for credit losses account. C. It tends to understate accounts receivable on the balance sheet. D. It recognizes credit loss expense when a specific account is determined to be uncollectible.arrow_forwardA receiving report is filled out when we receive: An inventory shipment from a vendor. Items that a customer is authorized to return from a previous sale. A payment on a customer's account. a and b only. Answer is not the First option!arrow_forward

- Which of the following accounts are characterized as a "contra" account? (Select ALL that apply) O Equipment O Deferred Revenue OAccumulated Depreciation O Accounts Payable O Depreciation Expense O Sales Allowances O Sales return O Allowance for Uncollectible A/R O Bad Debt Expense O Accounts Receivable O Notes Payable O Cost of Goods Sold ASUSarrow_forwardFrom page 5-2 of the VLN, which of the following accounts are subtracted from sales to compute Net sales? Allowance for uncollectible accounts Deferred revenue Sales discounts Sales returns and sales allowances Accumulated depreciation Trade discountarrow_forwardA ____ will cause Deferred Revenue to decrease. A. Debit B. Creditarrow_forward

- Don't use ai i will report you answer solve it as soon as possible with proper explanationarrow_forwardMatch the statements below with the accounting assumption, characteristic, or principle to which the statement relates. Assumptions/characteristics/principles may be used once, more than once, or not at all. Recorded when the performance obligation is satisfied. a. Revenue recognition principle V The reason for recording accruals and deferrals in adjusting entries. b. Matching principle Valuing assets at amounts originally paid for them. C. Historical cost principle Entity assumed to have a long life d. Going concern assumption Description of significant accounting policies and unusual events. e. Full disclosure principle v Information has predictive and confirmatory value. T. Relevance characteristic 8. Consistency characteristicarrow_forwardIdentify the correct pair of formula from the following column I and II: (Choose the correct alternative) Column I Column II A Current Account Surplus i. Receipts Payments C Balance Current Account i. Receipts + Payments D Current Account Deficit iv. Receipts < Payments Alternatives: а) А -i b) В - ii c) C - ii d) D - ivarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education