FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

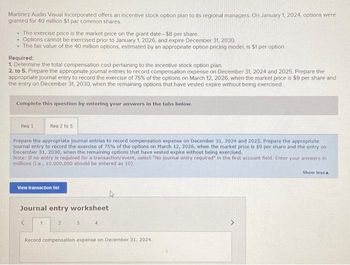

Transcribed Image Text:Martinez Audio Visual Incorporated offers an incentive stock option plan to its regional managers. On January 1, 2024, options were

granted for 40 million $1 par common shares.

• The exercise price is the market price on the grant date-$8 per share.

.

Options cannot be exercised prior to January 1, 2026, and expire December 31, 2030.

. The fair value of the 40 million options, estimated by an appropriate option pricing model, is $1 per option

Required:

1. Determine the total compensation cost pertaining to the incentive stock option plan.

2. to 5. Prepare the appropriate journal entries to record compensation expense on December 31, 2024 and 2025. Prepare the

appropriate journal entry to record the exercise of 75% of the options on March 12, 2026, when the market price is $9 per share and

the entry on December 31, 2030, when the remaining options that have vested expire without being exercised

Complete this question by entering your answers in the tabs below.

Req 1

Reg 2 to 5

Prepare the appropriate journal entries to record compensation expense on December 31, 2024 and 2025, Prepare the appropriate

journal entry to record the exercise of 75% of the options on March 12, 2026, when the market price is $9 per share and the entry on

December 31, 2030, when the remaining options that have vested expire without being exercised.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in

millions (i... 10,000,000 should be entered as 10).

View transaction list

Journal entry worksheet

1

2

3

4

Record compensation expense on December 31, 2024.

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the following Put Option: May 50 trading at $3.15/share May is the expiration 50 is the Strike Price$3.15 is the PremiumIf, at expiration, the stock price is $40, the Buyer (to Open) would have a TOTAL gain or loss of.....(not per share) if a loss use the '-' signarrow_forwardYou are given the daily closing prices of a stock from Jan 1, 2018 to Jan 5, 2018: Date Stock price Jan 1 Jan 2 Jan 3 Jan 4 Jan 5 A 5.00 B 5.50 C 6.00 At the end of Jan 1, 2018, Jie purchased the following options that expire on Jan 5, 2018: (a) Arithmetic average strike Asian call option. (b) Up-and-in call option with a barrier of 110 and strike of 105. For both options, the underlying asset is the stock and the payoff is determined using the last 4 daily closing prices. Determine Jie's total payoff on Jan 5, 2018. D Possible Answers E 105 6.50 109 7.00 112 110 111arrow_forwardCalculate the price weighted index value for 31 Dec 2020, prior to the splits. Shares W and X had 2 for 1 splits after the close on 31 Dec 2020. The pre-split divisor was 4. Share W X Y Z Select one: O A. 121.25 O B. 72.5 O C. 81.69 O D. 100.0 31-Dec-20 Closing Price $ 75.00 $ 150.00 $ 25.00 $ 40.00 31-Dec-20 Shares 10,000 5,000 20,000 25,000 31-Dec-21 Closing Price $50.00 $65.00 $35.00 $50.00 31-Dec-21 Shares 20,000 10,000 20,000 25,000arrow_forward

- Demonstrate the impact of different values on a market value weighted stock index with a hypothetical example considering three stocks (stock A, B and C), no. of shares and price for base year 2020 and for the year 2021 with two different cases Case A and Case B ( base year index value as 100)arrow_forwardThe following three defense stocks are to be combined into a stock index in January 2019 (perhaps a portfolio manager believes these stocks are an appropriate benchmark for his or her performance). Suppose that Douglas McDonnell shareholders approve a 2-for-1 stock split on January 1, 2020. Douglas McDonnell Dynamics General International Rockwell New divisor Shares (millions) 180 325 370 Rate of return 1/1/19 $ 60 68 97 Price 1/1/20 $ 64 64 86 a. What is the new divisor for the index? (Do not round intermediate calculations. Round your answer to 3 decimal places.) 1/1/21 $77 78 100 b. Calculate the rate of return on the index for the year ending December 31, 2020, if Douglas McDonnell's share price on January 1, 2021, is $23.42 per share. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardThe database is mentioned in the attachment:Ques) Draw a profit diagram for an investor in a call option with an exercise price of 64 that expires in March and explain the diagram. Undertake the same analysis for the writer of the call. Comment on the contention that options are a zero sum game for the writer and investor in options.arrow_forward

- With formulas, no tables Exploring six-month call and put options for a stock with an exercise price of $20 and a call premium of $4 per contract, your consideration involves the potential purchase of 20 call options. Let's analyze the following scenarios: a) In the context of contemplating the acquisition of 20 call options, visualize the profit and losses at the expiration date of your position, disregarding any transaction costs. Calculate the potential gain if the stock price stands at $20 in six months. Determine the break-even point and assess the potential gain if the stock price rises to $27 in six months. b) Examine the profit and losses for the writer (seller) of the call option. What constitutes the maximum profit for the call writer, and what represents the maximum loss for the call writer? c) Shift attention to a put option for the same stock, sharing the same strike price and maturity, traded on the market at a price of $3. Present the profit and losses at the expiration…arrow_forwardThe following table lists prices of Amazon options in January 2018 when Amazon stock was selling for $1,200. Exercise Price Expiration Date April 2018 Call Price Put Price $ 31.10 $1,200 1,300 1,400 $1,200 1,300 1,400 $1,200 1,300 1,400 $132.70 73.20 70.10 134.20 $ 53.55 96.00 33.00 July 2018 $161.70 104.00 62.55 156.05 January 2019 $210.00 $ 88.05 155.35 133.25 112.00 190.00 Suppose that by January 2019, the price of Amazon could either rise from its January 2018 level to $1,200 × 1.25 = $1,500.00 or fall to $1,200/1.25 = $960.00. a. What would be your percentage return on a January expiration call option with an exercise price of $1,200 if the stock price rose? (Round your answer to 2 decimal places.) b. What would be your percentage return if the stock price fell? (Negative value should be indicated by a minus sign.) c. Which is riskier: the stock or the option? a. Percentage return b. Percentage return Which is riskier: the stock or the option? % (100) % Option C.arrow_forwardThe following table lists the options on Amazon shares in January 2018 when Amazon stock was selling for $1,210. Exercise Price $1,210 1,310 1,410 Expiration Date July 2018 Call Price $161.90 104.10 62.65 a. Call option with exercise price of $1,210 b. Put option with exercise price of $1,210 C. Call option with exercise price of $1,310 d. Put option with exercise price of $1,310 e. Call option with exercise price of $1,410 f. Put option with exercise price of $1,410 Use the data in the table to calculate the payoff and the profits for investments in each of the following July maturity options, assuming that the stock price on the expiration date is $1,305. (Negative amounts should be indicated by a minus sign. Round your "Profit" answers to 2 decimal places.) Put Price $53.56 96.10 156.15 Payoff Profitarrow_forward

- Walters Audio Visual, Inc., offers a stock option plan to its regional managers. On January 1, 2021, 40 million options were granted for 40 million $1 par common shares. The exercise price is the market price on the grant date, $8 per share. Options cannot be exercised prior to January 1, 2023, and expire December 31, 2027. The fair value of the options, estimated by an appropriate option pricing model, is $2 per option. Because the plan does not qualify as an incentive plan, Walters will receive a tax deduction upon exercise of the options equal to the excess of the market price at exercise over the exercise price. The income tax rate is 25%. 4. Record the exercise of the options and their tax effect if all of the options are exercised on March 20, 2026, when the market price is $12 per share.5. Assume the option plan qualifies as an incentive plan. Prepare the appropriate journal entries to record compensation expense and its tax effect on December 31, 2021.6. Assuming the option…arrow_forwardYou purchased two contracts of "ABA December 11 2015 72.00 Put" at $4.20 per option and exercise it when the underlying stock price was $65.50. What is your profit and return on the investment, excluding the commissions?arrow_forwardQuestion 3?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education