ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

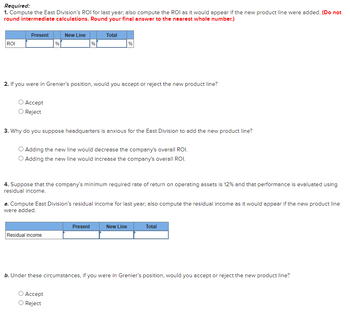

Transcribed Image Text:Required:

1. Compute the East Division's ROI for last year; also compute the ROI as it would appear if the new product line were added. (Do not

round intermediate calculations. Round your final answer to the nearest whole number.)

ROI

Present

O Accept

Reject

%

New Line

2. If you were in Grenier's position, would you accept or reject the new product line?

%

Residual income

Total

3. Why do you suppose headquarters is anxious for the East Division to add the new product line?

Adding the new line would decrease the company's overall ROI.

Adding the new line would increase the company's overall ROI.

Accept

Reject

%

4. Suppose that the company's minimum required rate of return on operating assets is 12% and that performance is evaluated using

residual income.

a. Compute East Division's residual income for last year, also compute the residual income as it would appear if the new product line

were added.

Present

New Line

Total

b. Under these circumstances, if you were in Grenier's position, would you accept or reject the new product line?

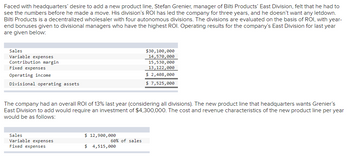

Transcribed Image Text:Faced with headquarters' desire to add a new product line, Stefan Grenier, manager of Bilti Products' East Division, felt that he had to

see the numbers before he made a move. His division's ROI has led the company for three years, and he doesn't want any letdown.

Bilti Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with year-

end bonuses given to divisional managers who have the highest ROI. Operating results for the company's East Division for last year

are given below:

Sales

Variable expenses

Contribution margin

Fixed expenses

Operating income

Divisional operating assets

The company had an overall ROI of 13% last year (considering all divisions). The new product line that headquarters wants Grenier's

East Division to add would require an investment of $4,300,000. The cost and revenue characteristics of the new product line per year

would be as follows:

Sales

Variable expenses

Fixed expenses

$ 12,900,000

60% of sales

$30,100,000

14,570,000

15,530,000

13,122,000

$ 2,408,000

$ 7,525,000

$ 4,515,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- kk.2arrow_forwardPls help with what you can really appreciatedarrow_forward7 8 Part 3: Economic Ordering Quantity 9 1. Calculate the company's EOQ for Engine Valve A1100 (make sure to link values to the other tabs): 10 11 Estimated Annual Sales this year: 12 Ordering cost for each order: 13 Carrying Cost per unit 14 15 EOQ: 16 units units 17 2. Complete the table below by linking to the appropriate cells in the other tabs: 18 19 Order Size Total Total Carrying Cost Ordering Cost 24 20 21 28 29 30 22222222223 25 26 5 10 20 50 100 27 3. Create a graph of both the Carrying and Ordering cost. Make sure your EOQ ties to where the two lines cross. Rename your Chart to: Cost of Ordering & Carrying Inventory Larrow_forward

- Q1.b. In response to a request from your immediate supervisor, you have prepared a CVP graph portraying the cost and revenue characteristics of your company's product and operations. Explain how the lines on the graph and the break-even points would change if (1) the selling price per unit decrease, (2) fixed cost increased throughout the entire range of activity portrayed on the graph, and (3) variable cost per unit increased. S18000 $1.000 52000 $100.000 $15.00 $50,00 525.000 50 la T S speakers nakarrow_forwardA large company operated in several businesses, including computers, disk drives, financial services, and defense satellites. Each business operated as a self-contained division. However, due to an economic downturn and changing market conditions, the company sold its noncore businesses of financial services and defense satellites in order to focus only on computer-related products. However, after making these sales, its costs were still high. a. What was the root cause of the problem? b. What structural changes needs to be made to resolve it? Justifyarrow_forward1arrow_forward

- (Table) According to the table, marginal revenue for the first unit is: QP 0 20 1 2 18 16 3 13 4 10 5 7 6 4 $0. $18. $20. $16. 30arrow_forwarda) The owners of firms in the real world would generally expect (in the long run at least) to have some positive of profits on their accounting statements. However, in economic models we usually assume that firms will be willing to operate for zero economic profits even for the long term. Explain why this is the case.arrow_forward[The following information applies to the questions displayed below.] Pete’s Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August. Pete’s Tennis Shop uses a periodic inventory system. Date Transactions Units Unit Cost Total Cost August 1 Beginning inventory 8 $ 160 $ 1,280 August 4 Sale ($225 each) 5 August 11 Purchase 10 150 1,500 August 13 Sale ($240 each) 8 August 20 Purchase 10 140 1,400 August 26 Sale ($250 each) 11 August 29 Purchase 11 130 1,430 $ 5,610 For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. 3. Using LIFO, calculate ending inventory and cost of goods sold at August 31.arrow_forward

- 4. Last year Wei Guan Inc. had $350 million of sales, and it had $270 million of fixed assets that were used at 63% of capacity. In millions, by how much could Wei Guan's sales increase before it is required to increase its fixed assets? Please TYPEarrow_forward3514e77ebfcb001ff309cb?start=true Chapter 7 - Production, Cost and Industry Structure OPEN Practice similar What is the Smith Co's Total Revenue? $ Submit answer Suppose that the firm Smith Co sells 10 gowns for $115.00 per gown. Each gown costs $74.00 to produce, and Smith Co could rent out their factory space for $330.00 per month. Answers (in progress) O E Answer hp I # $ 9 4 Score -/1 2 ☆ 68°F 6 I am finished 11:12 PM 9/28/2022 LINE 4461arrow_forwardQuestion 34 A cell phone factory has a total production cost of Cx) - 150x+10000 and a revenue function R(x) - 200x, where x represents the number of cell phones made or sold. Determine the break-even point for this factory. Break-even point: (20,220) Break-even point: (200,40000) Break-even point: (40000,200) Break-even point: (220,20)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education