FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

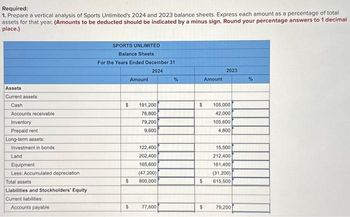

Transcribed Image Text:Required:

1. Prepare a vertical analysis of Sports Unlimited's 2024 and 2023 balance sheets. Express each amount as a percentage of total

assets for that year. (Amounts to be deducted should be indicated by a minus sign. Round your percentage answers to 1 decimal

place.)

Assets

Current assets:

Cash

Accounts receivable

Inventory

Prepaid rent

Long-term assets:

Investment in bonds

Land

Equipment

Less: Accumulated depreciation

Total assets

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable

SPORTS UNLIMITED

Balance Sheets

For the Years Ended December 31

2024

$

$

$

Amount

191,200

76,800

79,200

9,600

122,400

202,400

165,600

(47,200)

800,000

77,600

%

Amount

2023

$ 105,000

42,000

105,600

4,800

15,500

212,400

161,400

(31,200)

$ 615,500

$ 79,200

%

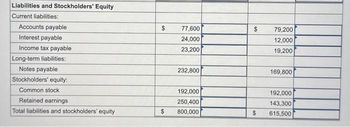

Transcribed Image Text:Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable

Interest payable

Income tax payable

Long-term liabilities:

Notes payable

Stockholders' equity:

Common stock

Retained earnings

Total liabilities and stockholders' equity

$

$

77,600

24,000

23,200

232,800

192,000

250,400

800,000

$

$

79,200

12,000

19,200

169,800

192,000

143,300

615,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Don't provide answers in image formatarrow_forwardA 42. Subject:- accountingarrow_forwardRequired information [The following information applies to the questions displayed below.] The balance sheets for Sports Unlimited for 2024 and 2023 are provided below. 2. Prepare a horizontal analysis of Sports Unlimited's 2024 balance sheet using 2023 as the base year. (Values to be deducted and decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity SPORTS UNLIMITED Balance Sheets For the Years Ended December 31 Year $ $ $ $ 2024 211,500 $ 140,800 99,900 50,400 82,800 154,400 28,800 14,400 108,900 238,500 206,100 (76,500) 900,000 $…arrow_forward

- Use the following data to determine the total dollar amount of assets to be classified as current assets. Metlock, Inc. Balance Sheet December 31, 2022 Cash $188000 Accounts payable $205000 Accounts receivable 151000 Salaries and wages payable 28000 Inventory 171000 Mortgage payable 232000 Prepaid insurance 91900 Total liabilities $465000 Stock investments (long-term) 251000 Land 260000 Buildings $308000 Common stock $377900 Less: Accumulated (62500) 245500 Retained earnings 732500 depreciation Total stockholders' Goodwill 217000 $1110400 equity Total liabilities and Total assets $1575400 $1575400 stockholders' equity O $430900 O $852900 O $601900 O $510000arrow_forwardPrepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Lishilitinn WALTON COMPANY Vertical Analysis of Balance Sheets Year 4 $ Amount 17,800 21,300 55,100 136,900 25,700 256,800 27,600 270,600 30,300 328,500 585,300 Percentage of Total % $ $ Amount Year 3 13,700 6,800 47,500 144,700 10,500 223,200 21,100 256,000 24,900 302,000 525,200 Percentage of Total %arrow_forwardleft numbers are 2025 right column is 2024. i need to figure out B. asset turnover C return on assets D. return on common stockholder equity.arrow_forward

- Required information [The following information applies to the questions displayed below.] The balance sheets for Sports Unlimited for 2024 and 2023 are provided below. Required: 1. Prepare a vertical analysis of Sports Unlimited's 2024 and 2023 balance sheets. Express each amount as a percentage of total assets for that year. (Amounts to be deducted should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity SPORTS UNLIMITED Balance Sheets For the Years Ended December 31 2024 $ $ $ $ Amount 211,500 99,900 82,800 28,800 108,900 238,500 206,100 (76,500)…arrow_forwardDo not give image formatarrow_forwardPerform a horizontal analysis for the balance sheet entry "Cash" given below. That is, find the amount of increase or decrease (in $) and the associated percent (rounded to the nearest tenth).arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardThe balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional Information for 2024: 1. Net Income is $150,600. 2. Sales on account are $1,215,500. (All sales are credit sales.) 3. Cost of goods sold is $973,400. Complete this question by entering your answers in the tabs below. a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity 2024 19.9 % 13.9 % %6 $208,600 60,000 86,000 3,100 times %6 390,000 390,000 700,000 580,000 (338,000) (178,000)…arrow_forwardThe balance sheets for Fantasy Football for 2024 and 2023 are provided below. 2. Prepare a horizontal analysis of Fantasy Football’s 2024 balance sheet using 2023 as the base year. (Values to be deducted and decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education