FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

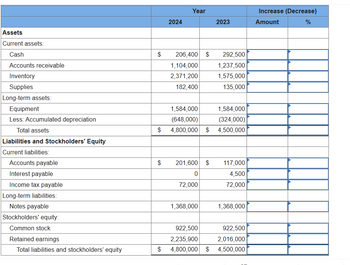

The balance sheets for Fantasy Football for 2024 and 2023 are provided below.

2. Prepare a horizontal analysis of Fantasy Football’s 2024

Transcribed Image Text:2024

Year

Increase (Decrease)

2023

Amount

Assets

Current assets:

Cash

Accounts receivable

Inventory

Supplies

$ 206,400 $ 292,500

1,104,000

1,237,500

2,371,200

1,575,000

182,400

135,000

Long-term assets:

Equipment

Less: Accumulated depreciation

Total assets

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable

Interest payable

Income tax payable

Long-term liabilities:

Notes payable

Stockholders' equity:

Common stock

1,584,000

1,584,000

(648,000)

(324,000)

$

4,800,000 $4,500,000

$

201,600 $ 117,000

0

4,500

72,000

72,000

1,368,000

1,368,000

922,500

922,500

Retained earnings

2,235,900

2,016,000

Total liabilities and stockholders' equity

$

4,800,000 $ 4,500,000

%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A 42. Subject:- accountingarrow_forwardRequired information [The following information applies to the questions displayed below.] The balance sheets for Sports Unlimited for 2024 and 2023 are provided below. 2. Prepare a horizontal analysis of Sports Unlimited's 2024 balance sheet using 2023 as the base year. (Values to be deducted and decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity SPORTS UNLIMITED Balance Sheets For the Years Ended December 31 Year $ $ $ $ 2024 211,500 $ 140,800 99,900 50,400 82,800 154,400 28,800 14,400 108,900 238,500 206,100 (76,500) 900,000 $…arrow_forwardJason Hilton, M.D., reported the following unadjusted trial balance as of September 30, 2025: View the trial balance. Calculate the debt ratio for Jason Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Average total assets Average total equity Average total liabilities Net income Total assets + Total equity Total liabilities = Debt ratio % Trial Balance Account Title Cash Jason Hilton, M.D. Unadjusted Trial Balance September 30, 2025 Accounts Receivable Supplies Land Building Office Equipment Accounts Payable Utilities Payable Unearned Revenue Notes Payable Common Stock Dividends Service Revenue Salaries Expense Utilities Expense Advertising Expense Total $ Debit Balance 39,000 7,300 2,900 28,000 100,000 25,000 56,000 23,400 800 300 282,700 $ Credit 2,400 1,100 8,666 95,000 130,000 45,534 282,700 I Xarrow_forward

- please help me understand why it was marked wrong.arrow_forwardAll answers are correct except: At what amount will Fuzzy Monkey report its investment in the December 31, 2024 balance sheet?arrow_forwardWhich of the following formulas correctly calculates the return on total assets for 2023? Hint: Remember that Excel uses the order of operations. PARENTHESES then EXPONENTS then MULTIPLICATION and DIVISION then ADDITION and SUBTRACTION. Use parentheses around any calculations in either the numerator or denominator. Multiple Choice =+B8/AVERAGE(B17:C17) =AVERAGE(B17:C17)/+B8 =+B8/SUM(B17:C17)/2 =+B8/SUM(B17:C17/2)arrow_forward

- The balance sheets for Fantasy Football for 2021 and 2020 are provided below. FANTASY FOOTBALLBalance SheetsDecember 31 2021 2020 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders’ Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders’ equity: Common stock Retained earnings Total liabilities and stockholders’ equity $ 208,000 856,000 1,900,000 124,000 1,292,000 (380,000) $ 4,000,000 $ 168,000 0 76,000 760,000 786,600 2,209,400 $ 4,000,000 $ 262,200 999,400 1,349,000 87,400 1,292,000 (190,000) $ 3,800,000 $ 129,200 3,800 76,000 760,000 786,600 2,044,400 $ 3,800,000 Required: 1. Prepare a vertical analysis of Fantasy Football’s 2021 and 2020 balance sheets. Express each amount as a percentage of total assets for that year. 2. Prepare a horizontal…arrow_forwardETYMISHTE 16598 (AIYv, i un Miyul 2. Prepare a horizontal analysis of Fantasy Football's 2024 balance sheet using 2023 as the base year. (Values to be deducted and decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Answer is complete but not entirely correct. FANTASY FOOTBALL Balance Sheets December 31 $ 2024 Year 2023 190,800 $ 284,800 748,800 835,200 1,839,600 1,094,400 158,400 92,800 1,123,200 1,123,200 (460,800) (230,400) $ 3,600,000 $ 3,200,000 $ 151,200 $ 80,000 0 3,200 86,400 86,400 950,400 950,400 Increase (Decrease) Amount % 94,000,000 86,400,000 X…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] The balance sheets for Federer Sports Apparel for 2022 and 2021 are presented below. Required: 1. Prepare a vertical analysis of the balance sheet data for 2022 and 2021. Express each amount as a percentage of total assets. (Amounts to be deducted should be indicated by a minus sign. Round your answers to 1 decimal place.) Prepare a horizontal analysis for 2022 using 2021 as the base year. (Note: If the percentage increase or decrease cannot be calculated, then leave the cell blank. Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.)arrow_forward

- H2.arrow_forwardPlease break down the forumula and where you got the information to put in EACH part of calculation. 2021: ($162,000 x 8/36 x 3/12)2022: ($153,000 x 8/36 x 9/12+($153,000-($153,000 x 8/36 x 9/12) x 7/36 x 3/12)2023: ($121,302.08 x 7/36 x 9/12+($121,302.08-($121,302.08 x 7/36 x 9/12) x 6/36 x 3/12) Step by step because it is unclear. Why is there 9/12 and 3/12. And 2021 has 8/36 in the first half.2022 has 8/36 there as well in the first half, then it in 2023, it changes to 7/36. Please explainarrow_forwarddddarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education