Concept explainers

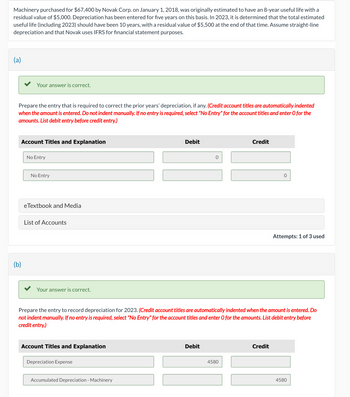

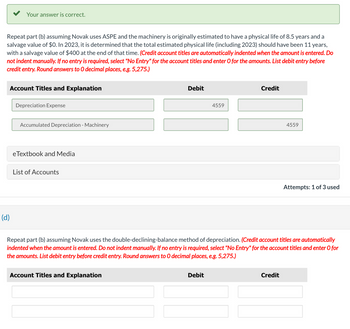

Please answer the following question

Must choose from the following LIST OF ACCOUNTS:

Accumulated Depletion

Accumulated Depreciation - Buildings

Accumulated Depreciation - Equipment

Accumulated Depreciation - Furniture and Fixtures

Accumulated Depreciation - Machinery

Accumulated Depreciation - Vehicles

Accumulated Impairment Losses - Building

Accumulated Impairment Losses - Equipment

Accumulated Impairment Losses - Land

Accumulated Impairment Losses - Machinery

Accumulated Impairment Losses - Mine

Accumulated Impairment Losses - Patents

Accumulated Impairment Losses - Tools and Dies

Accumulated Impairment Losses - Vehicles

Asset Retirement Obligation

Buildings

Cash

Common Shares

Contribution Expense

Cost of Goods Sold

Deferred Revenue - Government Grants

Depreciation Expense

Equipment

Furniture and Fixtures

Gain on Disposal of Automobiles

Gain on Disposal of Building

Gain on Disposal of Equipment

Gain on Disposal of Furniture and Fixtures

Gain on Disposal of Machinery

Gain on Disposal of Vehicles

Gain on Sale of Land

Interest Expense

Interest Pavable

Inventory

Investment Property

Land

Liability for Site Restoration

Loss on Disposal of Automobiles

Loss on Disposal of Building

Loss on Disposal of Equipment

Loss on Disposal of Machinery

Loss on Disposal of Vehicles

Loss on Expropriation

Loss on Impairment

Loss on Sale of Land

Machinery

Mineral Resources

No Entry

Notes Payable

Oil Property

Recovery of Loss from Impairment

Repairs and Maintenance Expense

Revaluation Surplus (OCI)

Revenue - Government Grants

Royalty Expense

Vehicles

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- LIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures Gain on Disposal of Machinery Gain on Disposal of Vehicles Gain on Sale…arrow_forwardLIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures Gain on Disposal of Machinery Gain on Disposal of Vehicles Gain on Sale of…arrow_forwardPlease answer the following question Must choose from the following LIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures…arrow_forward

- Paresarrow_forwardExplain the appropriate accounting treatment required when a change is made in the service life or residual value of property, plant, and equipment and intangible assets.arrow_forwardplease choose from the following accounts: Accounts Payable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Leasehold Improvements Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicle Overhaul Accumulated Depreciation - Vehicles Advertising Expense Asset Retirement Obligation Buildings Cash Common Shares Contributed Surplus - Donated Capital Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Donation Revenue Equipment Finance Expense Gain on Disposal of Buildings Gain on Disposal of Equipment Gain on Disposal of Machinery Gain on Disposal of Vehicles Gain on Vehicle Overhaul Gain or Loss in Value of Investment Property GST Receivable Interest Expense Interest Payable Inventory Investment Property Land Land Improvements Legal Expense Loss on Disposal of Buildings Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Vehicles Loss on Vehicle Overhaul Machinery…arrow_forward

- Please answer the following question Must choose from the following LIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures…arrow_forwardPlease answer the following question Must choose from the following LIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures…arrow_forwardQ: Accumulated depreciation represents: Select one: O a. The depreciation taken on fixed assets for one year O b. The decline in value on Property, Plant, and Equipment O c. The depreciation taken since the asset was purchased O d. The loss from damage on an assetarrow_forward

- please answser the following LIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures Gain on Disposal of Machinery Gain on…arrow_forwardplease answser the following LIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures Gain on Disposal of Machinery Gain on…arrow_forwardplease answser the following LIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures Gain on Disposal of Machinery Gain on…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education