Concept explainers

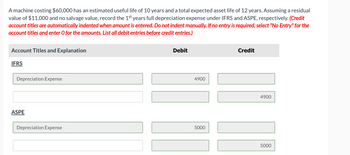

please answser the following

LIST OF ACCOUNTS:

Accumulated Depletion

Accumulated Depreciation - Buildings

Accumulated Depreciation - Equipment

Accumulated Depreciation - Furniture and Fixtures

Accumulated Depreciation - Machinery

Accumulated Depreciation - Vehicles

Accumulated Impairment Losses - Building

Accumulated Impairment Losses - Equipment

Accumulated Impairment Losses - Land

Accumulated Impairment Losses - Machinery

Accumulated Impairment Losses - Mine

Accumulated Impairment Losses - Patents

Accumulated Impairment Losses - Tools and Dies

Accumulated Impairment Losses - Vehicles

Asset Retirement Obligation

Buildings

Cash

Common Shares

Contribution Expense

Cost of Goods Sold

Deferred Revenue - Government Grants

Depreciation Expense

Equipment

Furniture and Fixtures

Gain on Disposal of Automobiles

Gain on Disposal of Building

Gain on Disposal of Equipment

Gain on Disposal of Furniture and Fixtures

Gain on Disposal of Machinery

Gain on Disposal of Vehicles

Gain on Sale of Land

Interest Expense

Interest Pavable

Inventory

Investment Property

Land

Liability for Site Restoration

Loss on Disposal of Automobiles

Loss on Disposal of Building

Loss on Disposal of Equipment

Loss on Disposal of Machinery

Loss on Disposal of Vehicles

Loss on Expropriation

Loss on Impairment

Loss on Sale of Land

Machinery

Mineral Resources

No Entry

Notes Payable

Oil Property

Recovery of Loss from Impairment

Repairs and Maintenance Expense

Revaluation Surplus (OCI)

Revenue - Government Grants

Royalty Expense

Vehicles

Step by stepSolved in 3 steps with 1 images

- 4. Depletion expense a. is usually part of cost of goods sold b. includes tangible equipment in the depletable amount c. exclude intangible development costs from depletable amount d. exclude restoration cost from depletable amountarrow_forwardA plant asset's book value equals its estimated salvage value: A. On the date of the asset's disposal B. At the end of the asset's useful life C. On each date the asset's depreciation is brought up to date. D. At any time throughout the asset's useful life E. None of these.arrow_forwardOn January 1, 2021, Culver Company purchased on credit machinery costing $180,000 and incurred $6,145 in installation costs. The machinery has an estimated useful life of 15 years and a residual value of $11,440. The company uses the straight-line method of depreciation. At the end of 2022, Culver recorded depreciation and assessed the asset, determining a recoverable amount of $150,800. Culver sold the equipment to Voilex Corporation on June 30, 2023, for $148,300. Prepare the necessary entries assuming Culver has a December 31 year-end. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. List all debit entries before credit entries. Round answers to O decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Account Titles and Explanation Date (To record depreciation expense) Debit Creditarrow_forward

- Accounts Payable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Leasehold Improvements Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicle Overhaul Accumulated Depreciation - Vehicles Advertising Expense Asset Retirement Obligation Buildings Cash Common Shares Contributed Surplus - Donated Capital Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Donation Revenue Equipment Finance Expense Gain on Disposal of Buildings Gain on Disposal of Equipment Gain on Disposal of Machinery Gain on Disposal of Vehicles Gain on Vehicle Overhaul Gain or Loss in Value of Investment Property GST Receivable Interest Expense Interest Payable Inventory Investment Property Land Land Improvements Legal Expense Loss on Disposal of Buildings Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Vehicles Loss on Vehicle Overhaul Machinery Mineral Resources Mortgage Payable No Entry…arrow_forwardLIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures Gain on Disposal of Machinery Gain on Disposal of Vehicles Gain on Sale…arrow_forwardLIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures Gain on Disposal of Machinery Gain on Disposal of Vehicles Gain on Sale of…arrow_forward

- Please answer the following question Must choose from the following LIST OF ACCOUNTS: Accumulated Depletion Accumulated Depreciation - Automobiles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery Accumulated Depreciation - Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Tools and Dies Accumulated Impairment Losses - Vehicles Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Furniture and Fixtures Gain on Disposal of Automobiles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture and Fixtures…arrow_forwardEquipment that cost 412000 and on which 191000 of accumulated depreciation has been recorded was disposed of for 181000 cash. The entry to record this event would include a ? Equipment that cost $412000 and on which $191000 of accumulated depreciation has been recorded was disposed of for $181000 cash. The entry to record this event would include a O credit to Accumulated Depreciation for $191000. Ogain of $40000. credit to the Equipment account for $221000. loss of $40000.arrow_forwardDepreciation of property, plant and equipment is the process of asset valuation for statement of financial position purposes asset valuation based on current replacement cost data allocation of the asset's cost over its useful life fund accumulation for the replacement of the assetarrow_forward

- 1. What are the two main characteristics of intangible assets? 2. Why does the accounting profession make a distinction between internally created intangibles and purchased intangibles? 3. What are the factors to be considered in estimating the useful life of an intangible asset? 4. What is the nature of research and development cost? 5. Indicate the proper accounting form the following items. Organization Cost Advertising Cost Operating Lossesarrow_forwardParesarrow_forwardPlease use your own words to restate the ''total inventory'' and ''property/ plant/ equipment''. Should be the same length as the original one.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education