ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

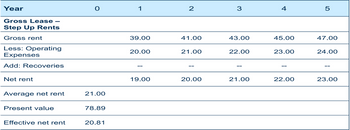

Rent is $39/sq ft and increases by $2/sq ft each year thereafter. Operating expenses are $20/sq ft, increasing by $1/year.

Question:

Rent is $39/sq ft and increases by

Transcribed Image Text:Year

Gross Lease -

Step Up Rents

Gross rent

Less: Operating

Expenses

Add: Recoveries

Net rent

Average net rent

Present value

Effective net rent

O

21.00

78.89

20.81

1

39.00

20.00

19.00

2

41.00

21.00

20.00

3

43.00

22.00

21.00

4

45.00

23.00

22.00

5

47.00

24.00

23.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 5. Funding the nest egg shortfall Determining Retirement Shortfall Yuan and Alex have 40 years to retirement. They are taking a personal finance course and have calculated their projected retirement income and investment needs. Based on their calculations and taking into account their Social Security and pension incomes, they have a projected shortfall of $6,750.00 per year. Use the following tables to answer the questions about future value interest factors. Interest Factors-Future Value Interest Factors-Future Value of an Annuity Periods 3.00% 5.00% 6.00% 8.00% 9.00% 5.600 1.810 2.090 3.386 4.290 2.653 3.210 4.661 6.848 8.620 2.420 4.322 5.740 10.062 13.260 20.410 2.810 5.516 7.690 14.785 20 25 30 35 40 3.260 7.040 10 280 21 724 31 410 = The impact of the inflation factor Continuing their worksheet, they consult a friend, economics professor Dr. Wu, who believes that they can expect the average annual inflation rate to be 5%, possibly 6% tops. Complete the following table by…arrow_forwardBeth bought some residential development property for 200,000 five years ago. She sold the property this year for $1,200,000 and spent $250,000 for infrastructure development in year 5, the year in which the property was sold. If the inflation rate for the past 5 years has been steady at 5% annually, compute the after-tax real rate of return on this investment. Assume a capital gain tax of 15%. Group of answer choices 33.17% 28.13% 26.83% 31.84%arrow_forwardwrite on paper 1- The current gasoline price is $4.50 per gallon, and it is projected to increase by 5% the next year, 7% the following year, and 8% the third year. What is the average inflation rate for the projected gasoline price for the next three years?arrow_forward

- 5 On March 7, 2018, you could read in The New York Times that the Governor of West Virginia offered the state's teachers "a 1 percent a year raise for the next five years." The article noted that "if inflation averages 2 percent a year for that period, this translates into an effective 5 percent pay cut." [R170] Is the “5 percent pay cut” claim correctarrow_forwardWhat is the value of the CPI in the base period? The value of the CPI in the base period O A. can be greater than, equal to, or less than 100 O B. is 100 no matter what reference base period is chosen C. changes when the reference base period changes D. is relevant only if the base period is within the last 10 yearsarrow_forwardIn the market the real interest rate is 3% and nominal interest rate is 6.6% Find inflation rate.arrow_forward

- 16. David Rosner makes $49,200 per year as an editor. He was notified of a 4% raise in a year in which the CPI index increased by 2.8%. Find the gain or loss in his purchasing power.arrow_forwardAssume that the economy has an annual inflation rate of 5 percent. Are the following investments profitable in real terms? You do not need to explain your answer. (a) A$1,000 face-value bond, which you purchase at a 30% discount, that pays a monthly coupon of$4. (b) A$1 million house the increases in price by$45,000 per year. You do not rent out the house, nor do you undertake renovations. (c) A$1 million house that you renovate for$45,000 over the course of a year, causing the price to increase to$1.1 million. (d) The spot price of silver is$31 per ounce. You purchase 50 ounces of silver for$1,600, in order to compensate the merchant. Over the year, the spot price of silver rises to$34per ounce, and you are able to sell the silver you have at the spot price. (e) You purchase a Non-Fungible Token (NFT) for$98 million. The following year, you are able to sell it for$102.5 millionarrow_forwardHenrique is a baseball fan and attends several games per season. His expenses per season are listed in the table below: |Year 1 |Year 2 5 Baseball Tickets Jersey Food Transport $500 $600 |$100 $150 $50 |$120 $150 $80 Calculate the inflation rate for Henrique's baseball season between year 1 and 2. 18.5% O0.18% 15.8% O1.6%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education