ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

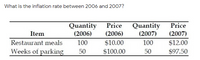

Transcribed Image Text:What is the inflation rate between 2006 and 2007?

Quantity

(2006)

Price

Quantity

Price

Item

(2006)

(2007)

(2007)

Restaurant meals

100

$10.00

100

$12.00

Weeks of parking

$100.00

$97.50

50

50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward2arrow_forwardUsing 1913 as the base year with a value of 100,the ENR construction cost index (CCI) for October2005 was 7562.50. For October 2006, the CCIvalue was 7882.53. (a) What was the inflation ratefor construction for that one-year period? (b) Theindex value for January 2007 was 7879.58. Whatwas the inflation rate over the period October2006 and January 2007?arrow_forward

- Find the real amounts (with today as the base year) corresponding to the current amounts shown below for a 4% inflation rate. (a) $400 three years from now (b) $400 three years ago (c) $10 next year (d) $350983 in 10 years from nowarrow_forwarded Question 10 Inflation Rate (n) 15.0% 14.0% 13.0% 12.0% 11.0% 10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 1,000 2,000 3,000 000't 4,000 000 5 5,000 0003 6,000 7,000 8,000 000'60 10,000 LRAS Real GDP (Y) This policy causes the inflation rate to drop to AD 12,000 3 11,000 13,000 14,000 15,000 SRAS 16,000 Consider the graph above. It is also in the files folder under the name Short Run and the Long Run. The graph pertains to a hypothetical country. The central bank in this country (also called the Fed) follows an inflation targeting policy. The current target inflation rate in 8 percent. The natural rate of unemployment is 5 percent and Okun's alpha is 8. 17,000 18,000 9,000 20,000 Finally, the president of the country appoints a new chairperson for the central band and the chair decides to bring the runaway inflation under control (as the U.S. FED did in 1980). The new chair realizes that 8 percent inflation target is way too high. So, s/he decides to reduce the long-term…arrow_forward3 eBook Hint Print References Problem 14.030: Compare alternatives by calculating their capitalized cost Compare the alternatives below on the basis of their capitalized costs with adjustments made for inflation. Use / -9% per year and f= 3.5% per year. Alternative First cost, $ AOC. $ per year Salvage value, $ Life, years X -15,500,000 -25,000 105,000 00 The capitalized cost for alternative X is $[ The capitalized cost for alternative Y is $[ Select alternative X Y -12,500,000 -10,000 82,000 10arrow_forward

- Question 7 15.0% 14.0% 13.0% 12.0% 11.0% .10.0% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Inflation Rate (n) down to 0 decreases to 5.04 1,000 2,000 10.04 3,000 4,000 5,000 Consider the graph above. It is also in the files folder under the name Short Run and the Long Run. The graph pertains to a hypothetical country. The central bank in this country (also called the Fed) follows an inflation targeting policy. The current target inflation rate in 8 percent (I know, it is too high. We will deal with this problem later after appointing a new chairperson for the Fed). The natural rate of unemployment is 5 percent and Okun's alpha is 8. 7000.00 LRAS Suppose that consumer confidence in the economy declines and as a result AD decreases by 3,000 units. This reduction in demand causes the inflation rate to slow 7.00 percent in the short run. In the short run, the real GDP percent. AD Real GDP (Y) SRAS 6,000 7,000 8,000 9,000 10,000 3 11,000 12,000 13,000 14,000 15,000 16.000 17,000…arrow_forwardIf you invest S1000 now, what is the future dollars for 10 years, when IR is 6% and inflation rate is 4%. "Type the final answer in the box without the currency sign"arrow_forward(i) (ii) (iii) Given a consumer price index of 154.5 in the year 2019 and 165.3 in 2020, calculate the rate of inflation in 2020. The average price of a car was £35,650 in 2019. Calculate the revised price in 2020 based on the rate of inflation calculated in part (i). Assume that in 2019 Robert has invested £2000 in a bank account, which pays an annual interest rate of 6%. After a year has passed, he is paid £120 in interest. Explain whether Robert is now better off than he was the year before based on your answer in part (i).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education