Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

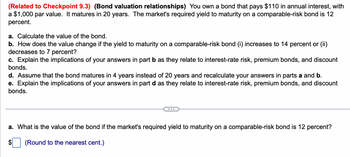

Transcribed Image Text:**Bond Valuation Relationships**

You own a bond that pays $110 in annual interest, with a $1,000 par value. It matures in 20 years. The market's required yield to maturity on a comparable-risk bond is 12 percent.

**Tasks:**

1. **Calculate the Value of the Bond.**

2. **How Does the Value Change If the Yield to Maturity on a Comparable-Risk Bond:**

- Increases to 14 percent

- Decreases to 7 percent

3. **Explain the Implications of Your Answers in Part B** as They Relate to Interest-Rate Risk, Premium Bonds, and Discount Bonds.

4. **Assume the Bond Matures in 4 Years Instead of 20 Years** and Recalculate Your Answers in Parts A and B.

5. **Explain the Implications of Your Answers in Part D** as They Relate to Interest-Rate Risk, Premium Bonds, and Discount Bonds.

---

**Calculation Task:**

- **a.** What is the value of the bond if the market's required yield to maturity on a comparable-risk bond is 12 percent?

- **Answer:** $ ___ (Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Compute the Macaulay duration under the following conditions: a. A bond with a four-year term to maturity, a 10% coupon (annual payments), and a market yield of 8%. Do not round intermediate calculations. Round your answer to two decimal places. Assume $1,000 par value. _________ years b. A bond with a four-year term to maturity, a 10% coupon (annual payments), and a market yield of 12%. Do not round intermediate calculations. Round your answer to two decimal places. Assume $1,000 par value. _________ years c. Compare your answers to Parts a and b, and discuss the implications of this for classical immunization. As a market yield increases, the Macaulay duration -(Select:declines/increases) . If the duration of the portfolio from Part a is equal to the desired investment horizon the portfolio from Part b is -(Select: no longer/still) perfectly immunized. Only typed answerarrow_forwardWhat is the market price of a bond if the face value is $1,000 and the yield to maturity is 5.7%? The bond has a 5.15% coupon rate and matures in 14 years. The bond pays interest semiannually. Please express answer as $X.XX or XX.XX and use rounding guideline included in "Course Information" module. Do not round until the final result.arrow_forwardBond A is a premium bond with a 9 percent coupon. Bond B is a 5 percent coupon bond currently selling at a discount. Both bonds make annual payments, have a YTM of 6 percent, and have five years to maturity. The face value is $1000 for both bonds. a. Why is the capital gain yield of the premium bond different from that of the discount bond? Which bond is better in terms of yields? b. What is the holding period return for each bond, if both bonds are held over the next year and sold at the year ned?arrow_forward

- A 15-year bond with a face value of $1,000 currently sells for $850. Which of the following statements is most correct? The bond's yield to maturity is greater than its coupon rate. If the yield to maturity stays constant until the bond matures, the bond's price will remain at $850. The bond's current yield is equal to the bond's coupon rate. The bond's yield to maturity is the same as capital gain yield. All of the statements above are correct. None of the above are correctarrow_forwardThe following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): Maturity (years) Price (per $100 face value) 1 $96.32 a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to maturity for each bond. The yield on the 1-year bond is %. (Round to two decimal places.) 2 $91.93 3 $87.36 4 5 $82.57 $77.42arrow_forwardA 30-year maturity bond making annual coupon payments with a coupon rate of 14.0% has duration of 11.36 years and convexity of 186.4. The bond currently sells at a yield to maturity of 8%. a. Find the price of the bond if Its yield to maturity falls to 7%. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Price of the bond b. What price would be predicted by the duration rule? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Predicted price c. What price would be predicted by the duration-with-convexity rule? (Do not round Intermediate calculations. Round your answ to 2 decimal places.) Predicted pricearrow_forward

- A bond sells for $866.09 and has a coupon rate of 6.40 percent. If the bond has 14 years until maturity, what is the yield to maturity of the bond? Assume semiannual compounding. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forward(i) Two types of risks faced by bodholders are interest rate risks and default risks? What are interest rate risks and default risks, and why might a bond exhibit more or less of these risks? (ii) You see a bond with the following characteristics: bond matures in 10 years coupon rate = 7% APR compounded semi-annually, paid semi-annually face value = $1000 bond price = $900 What is the yield to maturity (YTM) of this bond, stated as an APR with semi-annual compounding?arrow_forwarda. What is the duration of a two-year bond that pays an annual coupon of 11.5 percent and has a current yield to maturity of 13.5 percent? Use $1,000 as the face value. (Do not round intermediate calculations. Round your answer to 4 decimal places. (e.g., 32.1616)) b. What is the duration of a two-year zero-coupon bond that is yielding 11.5 percent? Use $1,000 as the face value. a. Duration b. Duration years yearsarrow_forward

- Suppose you are given the following information about four different, default-free bonds, each with a face value of $1,000. The coupon bonds have annual payments. The yield to maturity of bond A with a maturity of 1 year and a coupon rate of 0% is 2%. The yield to maturity of bond B with a maturity of 2 year and a coupon rate of 10% is 3.908%. The yield to maturity of bond C with a maturity of 3 year and a coupon rate of 6% is 5.840%. The yield to maturity of bond D with a maturity of 4 year and a coupon rate of 12% is 5.783%. Given this information, what is the four-year spot rate?arrow_forwardThere are three bonds that mature at the same time, have the same par value, and are expected to pay their first annual coupon 1 next year. The bonds are detailed in the below table. Bond A B с PV PV PV Present Value B ? ? ? PV B If ca r, then what can we say about the prices of the bonds today? (Enter >, <, or ?) PV C PV Yield to Maturity C r rb Coupon Rate ca с сarrow_forwardA bond with a 8-year duration is worth $1,074, and its yield to maturity is 7.4%. If the yield to maturity falls to 7.30%, you would predict that the new value of the bond will be approximately _________. a)$1,082.06 b)$1,075.07 c)$1,074.00 d) $1,072.93arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education