ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

nn4

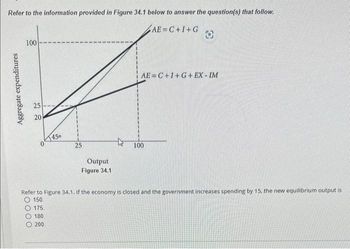

Transcribed Image Text:Refer to the information provided in Figure 34.1 below to answer the question(s) that follow.

AE=C+I+G

Aggregate expenditures

100

25

20

00

175.

180

450

200.

Output

Figure 34.1

Refer to Figure 34.1. If the economy is closed and the government increases spending by 15, the new equilibrium output is

O150.

3-D

AE=C+I+G+EX - IM

100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Given cE = p(aE - bE2), Solve for E.arrow_forwardYour savings account balance at the end of May was $500. You made a $200 deposit on June 4 and withdrew $100 on June 25. Calculate your average (mean) daily balance for June.arrow_forwardWelfare and Efficiency - End of Chapter Problem A study by University of Minnesota economist, Joel Waldfogel, estimated the difference in the actual monetary value of gifts received and how much the recipients would have been willing to pay to buy them on their own. The study suggested that the average recipient's valuation was approximately 90% of the actual purchase price. a. In 2019, it was estimated that the average amount spent on winter holiday gifts in Canada was $692. Based on the estimate from the Waldfogel study, how much of this would be deadweight loss? Enter your answer to the cent. b. In 2019, approximately 30 million people in Canada above the age of 18. Assuming that each individual purchased $692 worth of gifts, what was the total deadweight loss associated with gift giving in Canada? Round your answer to the nearest million dollars. millionarrow_forward

- It is conceivable that the APC, APS, MPC, and MPS could simultaneously be A. APC 1.0; APS= 0; MPC= 0.15; MPS= 0.15. OB. APC= 1.0; APS= 0.1; MPC = 0.85; MPS = 0.25. OC. APC= 1.3; APS - 0.3; MPC = 0.8; MPS = 0.2. OD. APC 0.8; APS= 0.2; MPC = 1.1; MPS = 0.1.arrow_forward33. Consider an expected utility maximizer whose utility function is U(w), where w denotes wealth, expressed in dollars. Suppose that U(0) = 0 and U(1,000, 000) = 1. Further suppose that the individual is indifferent between having w = 200, 000 for sure or a gamble in which w = 0 with probability .4 and w = 1,000, 000 with probability .6. For this individual, U(200, 000) is %3Darrow_forwardSuppose that you work for a U.S. senator who is contemplating writing a bill that would put a national sales tax in place. Because the tax would be levied on the sales revenue of retail stores, the senator has asked you to prepare a forecast of retail store sales for year 8, based on data from year 1 through year 7. The data are: (c1p2) Year Retail Store Sales 1 $1,225 2 1,285 3 1,359 4 1,392 5 1,443 6 1,474 7 1,467 54 Chapter One a. Use the first naive forecasting model presented in this chapter to prepare a forecast of retail store sales for each year from 2 through 8. b. Prepare a time-series graph of the actual and forecast values of retail store sales for the entire period. (You will not have a forecast for year 1 or an actual value for year 8.) c. Calculate the root-mean-squared error for your forecast series using the values for year 2 through year 7. 3. Use the second naive forecasting model presented in this chapter to answer parts (a) through (c) of Exercise 2. Use P 0.2 in…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education