ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

refer to figure 23.6. if aggregate income is $1,000, aggregate consumption is

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

Transcribed Image Text:QUESTION 2

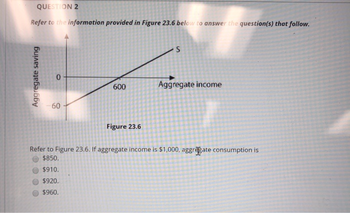

Refer to the information provided in Figure 23.6 below to answer the question(s) that follow.

Aggregate saving

0

60

600

Figure 23.6

S

Aggregate income

Refer to Figure 23.6. If aggregate income is $1,000, aggregate consumption is

$850.

$910.

$920.

$960.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Show full answers to the questions and steps to this exercisearrow_forwardNonearrow_forwardax policy is one used not only for economic purposes but also for political purposes. It is the opinion of some economists and politicians that the rich should pay more of their income in taxes, and that the resulting fairness from this rise in taxes will lead to more economic growth and a rise in employment. Using the simple expenditure model (Y and Ep, not IS-LM) answer these two questions: One, would a lump-sum tax increase on many high-income households cause GDP to rise in the short run as predicted by the politicians? Why or why not? And two, are there macroeconomic conditions in the simple model under which such a tax increase would be fully warranted? Draw the graphs and explain the outcomes for both cases.arrow_forward

- Assume the following model of the expenditure sector: S=C+I+G+Nx TR=100 C=420+(4/5)YD I=160 G=180 Nx=-40 YD=Y+TR-TA TA=(1/6)Y Assume you increase both government purchases (G) and taxes (TA) by the same lump sum of deltaG=deltaTA=+300. Would this be sufficent to reach the full employment level of output at Y*=2700? Why or why not?arrow_forwardA media company wants to know how much consumers spend in a closed economy. The answer is not readily available, but we know the following: Consumption: C = 50 + 0.6(Y - T) • Investment: 1 = 40-500 i • Taxes: T = 2C . Government spending: G = 20 where Y is GDP and i is the interest rate. At the time of the analysis, the central bank made sure that the interest rate. was 4% What is the level of consumption C? Select one: a 155 b. 170 c. 195 d. 220arrow_forwardGiven the scatter diagram in Figure 8-1, what is the MPC (your best estimate)? a. 1 b. 2/3 c. 1/2 d. 1/3 I know the answer of this question answer is 2/3 but can you please give the explanation how 2/3 is the answer of the problemarrow_forward

- If the increase in government spending is $500 and the marginal propensity to consume is .75 then the change in real gross domestic domestic product will be ___arrow_forwardOne last time, please consider a closed economy with the following information: • Economic investment = $4500 • Private savings = $3000 Output (income) = $16,000 Consumption = $11,000 This economy has no transfer payments; in other words, total taxes and "net taxes" are the same thing. Carefully following all numeric instructions, calculate this economy's taxes (T). Note that there are no transfer payments.arrow_forwardeconomicsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education