ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

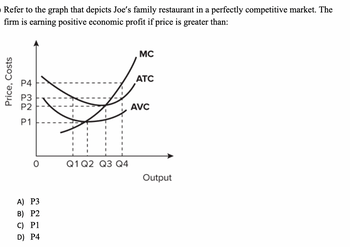

Transcribed Image Text:Refer to the graph that depicts Joe's family restaurant in a perfectly competitive market. The

firm is earning positive economic profit if price is greater than:

Price, Costs

1 22 2

P4

P3

P2

P1

A) P3

B) P2

C) P1

D) P4

G

1

I

I

I

Q1 Q2 Q3 Q4

MC

ATC

AVC

Output

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the following graphs for a representative firm and the overall market in a perfectly competitive market for good X. In the short-run firms will [Select] and in the long-run firms will [Select] P1 Firm MC ATC Q P1 Market 01 D 0arrow_forwardQuantity 10 20 30 40 Fixed Cost 200 200 200 200 Variable Cost 50 100 300 800 Total Cost 250 300 500 1000 Based on the aforementioned chart for a company that is perfectly competitive: A) Calculate the marginal cost using X B) Determine the quantity that will maximize profits if the equilibrium price is $20. C) What kind of profit will the company make? Marginal Cost 0 5 20 Xarrow_forwardBen opened his ice cream stand and he aims to maximize profits by making 100 ice cream cones a day. Ben planned to buy two ice cream makers, but his sister happened to have an extra one and she gave it to him for free. Ben's fixed costs decrease and the market price remains constant. The short run profit maximizing level of output a day a) becomes zero b) is still 100 ice cream cones c) is more than 100 ice cream cones d) is less than 100 ice cream conesarrow_forward

- Quizzes 2 $15+ $12 $10+ $7 0000 FIRM I MC ATC AVC q 20 30 38 48 55 The above graph represents a firm in a perfectly competitive market. If the price the firm receives for its product is $10 and the firm is producing a profit-maximizing quantity, then what is the firm's profit? -$60 $96 $114 $0arrow_forward3. What are the three common pitfalls that people make when they do "cost-benefit" analysis. Explain why the opportunity cost of walking downtown to save $10 on a $2000 laptop is the same as walking downtown to save $10 on a $25 book.arrow_forwardConsider a competitive firm with total costs given by T C(q) = 100 + 10q + q^2. The firm faces a market price p = 50. (a) Graph the AT C, AV C, MC, and MR curves in a single graph, and indicate the profit maximizing level of output. If there are profits, shade the region corresponding to profit and label it. (b) If fixed costs increase from 100 to 500, what happens to the profit maximizing level of output, T R, T C, and π? (c) If fixed costs increase from 100 to 500, should the firm continue to operate in the short-run? What about the long-run?arrow_forward

- In the long run, new firms enter a perfectly competitive market when A) normal profit is greater than zero. B) normal profit is equal to zero. C) economic profit is greater than zero. D) economic profit is equal to zero. E) the existing firms are weak because they are incurring economic losses.arrow_forwardAnswer the following, providing a graphical illustration along with your answer where necessary:a) What is the profit maximising condition in a market with perfect competition?b) Explain what is meant by abnormal profit? What is the adjustment process from short-runabnormal profit to long-run equilibrium in a perfectly competitive market?c) Please find below Pricing options for firm A and B, along with individual payoffs (Firm A’spayoff/Firm B’s payoff)Firm BFirm APrice £2 Price £1Price £2 £20,000/£20,000 £10,000/£24,000Price £1 £24,000/£10,000 £12,000/£12,000Assume you are the pricing manager at Firm A;i) What is your payoff for a ‘maximin’ strategy?ii) What is your payoff for a ‘maximax’ strategy?iii) Does a dominant strategy exist within this prisoners’ dilemma?arrow_forwardThe following graph illustrates the demand and marginal revenue curve (D-MR) of a perfectly competitive firm. Suppose that when the firm produces 40 units, its average variable cost equals $65 per unit and its average total cost equals $80 per unit. Use the green rectangle (triangle symbols) to plot the total cost of producing 40 units. Next, use the grey rectangle (star symbols) to plot the total variable cost of producing 40 units. Then, use the tan rectangle (dash symbols) to plot the total revenue at 40 units. Finally, use the purple rectangle (diamond symbols) to plot the profit or loss at 40 units. PRICE AND COST (Dollars) 100 90 80 70 60 50 40 30 20 10 0 0 10 + 20 +ATC + AVC 30 40 50 60 QUANTITY (Units) 70 80 D=MR 90 H 100 Total Cost Total Variable Cost I Total Revenue Profit or Loss ?arrow_forward

- The graphs suggest that in the long run, assuming no changes in the given information,arrow_forwardSuppose that you have a management job at a firm like Estrella River Ranch, a beautiful vineyard and one of more than 200 vineyards growing cabernet sauvignon grapes in California. Assume that the market is perfectly competitive. Also, assume that you cannot instantly change production when demand changes, and grapes cannot be stored, so your firm must sell all of the grapes it grows. The adjacent figure (Figure A) shows the situation at your California vineyard. If demand is high, the price is $3,000 per ton of grapes, and if the price is low, the price is $1,000 per ton of grapes. Producing 300 tons of grapes maximizes your firm's expected profit. Suppose that there is no fixed cost. If demand is high and your firm produces 300 tons of grapes, its economic profit on the tons of grapes between 100 and 300 tons is $ If demand is low and your firm produces 300 tons of grapes, its economic loss on the tons of grapes between 100 and 300 tons is dollars. (Enter a negtive sign to indicate a…arrow_forwardCrabby Bob’s is a seafood restaurant in a beach resort in Delaware. Crabby Bob’s earns a profit each month from May through September, suffers losses in October, November, and April but remains open, and remains closed from December through March. Given that the restaurant market in this town is perfectly competitive, how would you explain Crabby Bob’s decisions?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education