ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Q2-17

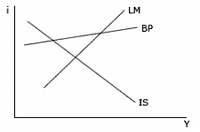

Refer to the following diagram to help you answer this question.

Under fixed exchange rates, the automatic adjustment mechanism will lead to

Under fixed exchange rates, the automatic adjustment mechanism will lead to

Select one:

a. a fall in the money supply, a fall in income, and a fall in the interest rate.

b. a rise in the money supply, a fall in income, and a fall in the interest rate.

c. a fall in the money supply, a rise in income, and a rise in the interest rate.

d. a fall in the money supply, a fall in income, and a rise in the interest rate.

Transcribed Image Text:LM

BP

IS

Y

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Central Banks are responsible for setting interest rates not the value of the domestic currency. The Bank of Canada doesn’t try to set the dollar’s exchange rate. "We let markets set its value. Because the Bank of Canada lets the Canadian dollar float, we can focus on setting interest rates to maintain inflation at 2 percent in Canada" https://www.bankofcanada.ca/2020/08/understanding-exchange-rates/Read the above explainer from the Bank of Canada and then offer your own understanding of why the Canadian dollar moves against other currencies. Use recent movements in the C$ against the US$ to illustrate your comments.arrow_forwardE2 a, Show the impact of uncertainty in the United Kingdom’s financial system on the market for dollars. What is the effect on the dollar exchange rate? b. How, in this case, could the Federal Reserve maintain a fixed exchange rate? Refer to the central bank’s role in setting interest rates in your answer.arrow_forward3. The currency stabilization fund Suppose the Russian government recognizes that its reliance on oil exports makes it vulnerable to the Dutch Disease. On the one hand, if oil prices increase, the Russian ruble will appreciate, the real exchange rate will increase, and the nation's exports will become more expensive for other countries to buy. On the other hand, if oil prices fall, the Russian ruble will depreciate, and the country's revenues will decline. The Russian government creates a currency stabilization fund to maintain a stable exchange rate to avoid a negative outcome. To stabilize the value of a currency within a certain range, the stabilization fund managers take one of the following actions: • If the ruble depreciates below some threshold value (a floor) per ruble, the fund managers will purchase the excess supply of rubles in the international exchange market to increase the value of the ruble to at least the floor value. • If the ruble appreciates above some threshold…arrow_forward

- Data from The Economist BigMac index from January 2022 shows that the localprice of a Big Mac in Argentina is 450 Argentine pesos (ARS) and the price of a BigMac in Britain is 3.59 pounds sterling (GBP). The exchange rate XARS/GBP = 140.895.Assume there is no bid-ask spread. Calculate the pound sterling price of a Big Mac in Buenos Aires (capital ofArgentina) and the Argentine peso price of a Big Mac in London (capital ofthe UK)arrow_forward8arrow_forwardSuppose you observe the following exchange rates and interest rates for the USD and JPY: Bid Ask USD/JPY 105.20 105.95 USD,JPY F,360 104.25 105.10 Trader lends at Trader borrows at I USD ? ? I JPY 1.40% 1.50% Which answer is closest to the maximum US lending rate that prevents covered interest rate arbitrage? 3.21% 3.16% 3.05% 2.32% 2.42%arrow_forward

- At the official exchange rate of 2.5 dirham per euro, the euro is and the Moroccan dirham is that Moroccans pay for European exports than they would with a free-floating exchange rate. At the official dirham price of euros, there is a of euros in the foreign exchange market. which means Suppose the governments of the Eurozone and Morocco reevaluate their currencies so that their official exchange rate is now 1 dirham per 1 euro. This action results in of the euro.arrow_forwardA country with higher nominal interest rates than its trading partners will see its exchange rate depreciate in value relative to the currencies of its trading partners in the long run. Is this statement true or false? Briefly explain why.arrow_forwardParagraph H H Euros per Dollar Quantity of Dollars Styles 1 Title 1. Headline: Fed raises interest rates; attracts foreign investors. Supply of dollars (increase / decrease / stay the same) Demand for dollars (increase / decrease / stay the same) Euros per Dollar (increase / decrease / stay the same) Quantity of Dollars (increase / decrease / stay the same) Select- Editing Create PDF C and Share link Sh A Consider the foreign exchange market for dollars as discussed in Chapter 14, section 3.2 of your text and depicted above. How would the news headlines below affect the market for foreign exchange? Highlight or change the color of your response. 2 Display Settingsarrow_forward

- In France a loaf of bread costs 3 euros. In Great Britain a loaf of bread costs 4 pounds. If the exchange rate is .9 pounds per euro, what is the real exchange rate? (explain the answer) a. 4/2.7 loaves of British bread per loaf of French bread b. 3.6/3 loaves of British bread per loaf of French bread c. 3/3.6 loaves of British bread per loaf of French bread d. 2.7/4 loaves of British bread per loaf of French breadarrow_forward6. Fixed exchange rates Consider the exchange rate between the Moroccan dirham and the euro. Suppose the Moroccan government and the Eurozone governments agree to fix the exchange rate at 1.25 dirham per euro, as shown by the grey line on the following graph. Refer to the following graph when answering the questions that follow. EXCHANGE RATE (Dirham per euro) 2.00 1.75 1.50 1.25 1.00 0.75 0.50 0.25 0 02 4 6 8 12 QUANTITY OF EUROS (Billions) Supply of Euros Demand for Euros 10 14 At the official exchange rate of 1.25 dirham per euro, the euro is 16 (? , and the Moroccan dirham is I which meansarrow_forwardThe figure to the right shows the market for Kuwait's currency, the dinar. Suppose that the following two events take place in the market for the dinar: The U.S. demand for oil, Kuwait's main export good, declines and market interest rates on financial assets denominated in dinar decrease relative to U.S. interest rates. Moreover, assume that exchange rates are flexible. Using the line drawing tool, show how the market for the dinar is impacted by these events Properly label this line, Carefully follow the instructions above, and only draw the required objects. According to your graph, the dinar has with respect to the dollar. Dollars per Dinar 6.0 5.5 5.0 4.5 4.0 3.5- 3.0 2.5 2.0 1.5- 1.0 0.5- 0.0+ 0 1 2 6 Quantity of Dinars (billions) 8 9 D S 10 Lyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education