ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

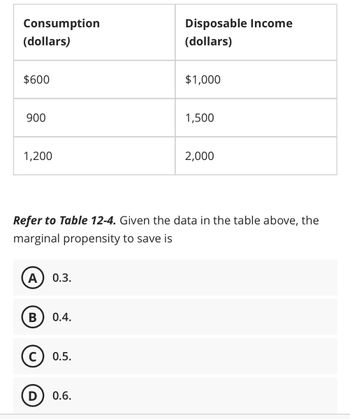

Transcribed Image Text:Consumption

(dollars)

$600

900

1,200

A 0.3.

B

0.4.

Refer to Table 12-4. Given the data in the table above, the

marginal propensity to save is

с 0.5.

Disposable Income

(dollars)

D 0.6.

$1,000

1,500

2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Contrast Say’s Law from Keynes’ Law. Give a rationale given by supporters of each perspective. Are these perspectives compatible? (11.1)arrow_forwardThe value of average propensity to save can be less than 0 True / Falsearrow_forward97) You observe that unplanned inventories are increasing. You predict that there will be ________. A) a business cycle B) an expansion C) a trough D) a recession 98) Business cycle turning points are A) unaffected by, and unrelated to the multiplier. B) easy to predict. C) brought about by changes in autonomous expenditures that are then subject to the multiplier effect. D) None of the above is correct. 99) Which of the following does NOT occur as the economy moves from an expansion to a recession? A) An initial decrease in autonomous spending is the trigger that creates the business cycle turning point. B) The change in planned spending exceeds the change in real GDP. C) The multiplier process reinforces any decrease in spending and pushes the economy into recession. D) Incomes fall during recessions as firms cut production in response to unplanned increases in inventories. 100) Which of the following is INCORRECT? A) Expansions usually begin…arrow_forward

- Exercise 4. You are a manager at a certain factory that designs small gadgets. The factory has been quite successful in the past years. Your CEO is wondering whether or not it is a good idea to expand the factory this year. The cost to expand the factory is $1.5M. Doing nothing will result in expected $3M in revenue if the economy stays good and people continue to buy plenty of gadgets, but only $1M in revenue is expected if the economy is bad. On the other hand, expanding the factory carries an expected $6M in revenue if economy is good and $2M if the economy is bad. Assume there is a 40% chance of a good economy and a 60% chance of a bad economy. Also, assume the costs of operating the factory account to $.5M if the factory is expanded and $.3M if not. a. Illustrate a Decision Tree showing these choices. b. What should you do?arrow_forwardThe formula for economic impact is I(r)=(A)/1-r The formula for impact change is ∆I= I'(r)*∆r The formula for percentage change is g(r)=(r)/1-rarrow_forwardIf average income goes from $30,000 to $33,000 and consumption increases from $29,000 to $31,000, the marginal propensity to consume is Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. 67 b 1.5 1.06 0.96arrow_forward

- Use the attached graph .. which of the following can cause the relationship shown between MSC and MPC? a) an increase in cases of asthma due to pollution b) a decrease in financial instability from unlawful investing c) a increase in investment to support educational funding. d) a decrease in air pollution caused by a nuclear energy plant e)an increase in research and development funding of a productarrow_forwardIt is conceivable that the APC, APS, MPC, and MPS could simultaneously be A. APC 1.0; APS= 0; MPC= 0.15; MPS= 0.15. OB. APC= 1.0; APS= 0.1; MPC = 0.85; MPS = 0.25. OC. APC= 1.3; APS - 0.3; MPC = 0.8; MPS = 0.2. OD. APC 0.8; APS= 0.2; MPC = 1.1; MPS = 0.1.arrow_forwardSuppose that out of the original 100 increase in government spending, 60 will be recycled back into purchases of domestically produced goods and services. Following this multiplier effect, what value will be recycled in the next round in the cycle? A) 16.66 B) 42 C) 3.6 D) 36arrow_forward

- Holy cow! The giant manufactory company Whamazon is considering your city to locate its new factory. You are the mayor of the city. Suppose that you estimate the MPC of your city to be 0.67. Suppose further that Whamazon estimates the immediate new Investment impact upon your city will be $350 million. Whamazon is asking for a tax subsidy of $1,000 million ($1 Billion) to locate there. Should you take the offer? Why or why not? Absolutely not. $1 Billion! Your city would end up in the hole the entire $1,000 million. No, your city would end up in the behind $650 million (the $1,000 subsidy minus the $350 new investment). Yes, your city comes out ahead $650 million ($1,000 subsidy cost $350 investment) - Yes, your city comes out ahead $1,350 ahead ($1,000 subsidy + $350 investment) Yes, your city comes out ahead $60 million ($1,060 new economic development - $1,000 cost of the subsidy).arrow_forwardHow COVID-19 Has Affected the U.S. Economy?arrow_forwardAssume that Kelly is a life cycle consumer and receives incomes of 20, 30, 45 and 0 in her four period life. What is Kelly's marginal propensity to consume out of her new wealth (AC/AW) in the following situations: [Hint: Let AC be the the change in consumption compared to what she would have done before the inheritance changed her wealth AW]. 19. In period 2 following an unexpected inheritance of 10: (a) 0.25; (b) 0.33; (c) 0.75; (d) 1.0; 20. In period 3 following an expected lump sum payment from her trust fund of 15: (a) 0.33; (b) 0.75; (c) 0.45; (d) 0.50; 21. What is her desired optimal consumption in period 3 with the anticipated trust fund gift of 15: (a) 20; (b) 30; (c) 27.50; (d) 22.50; 22. In what period of her working life (Y > 0) would her marginal propensity to consume out of an unexpected inheritance of 10 be the highest: (a) 1; (b) 2; (c) 3; (d) 4;arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education