ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

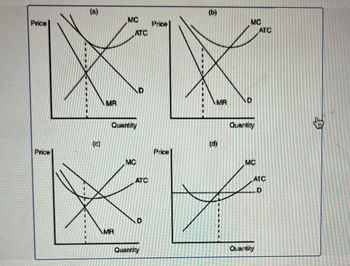

Transcribed Image Text:Price

Price

@

(c)

MA

MC

MR

ATC

Quantity

MC

ATC

D

Quantity

Price

Price

(b)

MR

6

MC

D

Quantity

MC

ATC

ATC

D

Quantity

छे

110

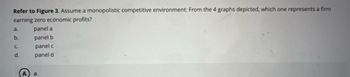

Transcribed Image Text:Refer to Figure 3. Assume a monopolistic competitive environment: From the 4 graphs depicted, which one represents a firm

earning zero economic profits?

panel a

panel b

panel c

panel d

a.

b.

C.

d.

a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The following graph characterizes a firm in a monopolistically competitive market. 32 24 18 16 12 8- ATC This show that the firm is 12 MC earing zero economic profits. producing 16 units of the good. in a long run equilibrium. in a short run position. MR 16 20 24 Demand 28 32 Qarrow_forwardQ. 2arrow_forwardWataDine is one of a city’s many restaurants that serve lunch and dinner in a monopolistically competitive market. Assume WataDine, as a typical restaurant in the city, is currently producing the profit-maximizing output level, and earns positive short-run economic profit. (a) How is monopolistic competition similar to each of the following market structures? (i) Perfect competition (ii) Monopoly (b) WataDine is currently earning short-run economic profits. Draw a correctly labeled graph for WataDine in short-run equilibrium and show each of the following. (i) The profit-maximizing quantity, labeled QM (ii) The profit-maximizing price, labeled PM (c) Given that WataDine is currently earning short-run economic profits, what will happen to each of the following in the long run? (i) WataDine's economic profit. Explain. (ii) WataDine's demand curve for its restaurant meals. (d) Assume WataDine is in long-run equilibrium. (i) Is WataDine taking advantage of its economies of scale? Explain.…arrow_forward

- Why is it that monopolies can enjoy long run profits, but firms under monopolistic competition face a zero-profit long run equilibrium?arrow_forwardConsider the model with monopolistic competition and full symmetry between the firms (internal returns to scale) in a single integrated market. Now assume that a new technology becomes available that reduces a firm's marginal cost of production by a given amount but requires a larger fixed-cost investment to implement. Suppose that all fırms adopt the new technology. How does this impact the equilibrium number of varieties and the equilibrium price? Show your work. Edit View Insert Format Tools Tablearrow_forwardWhat are the assumptions of a Monopolistic Competition market structure? Briefly distinguish the meaning of these assumptions compared to those of the Monopoly and Perfect Market.arrow_forward

- !!! Draw a Graph!!! Consider the monopolistic competition model (with the CC and PPcurves). Suppose:a. S = 100b. b = 1c. c = 2d. F = 10Solve for the equilibrium number of firms n and the price, P.Now suppose c falls to 1. Solve for the new number of firms, n, and the new price, P.Tell a story for what happens.arrow_forwardFor each of the following characteristics, say whether it describes a monopolistic competitive or oligopoly market, both or neither. There is a single model to explain the firm's behavior. Firms in this market produce the socially efficient level of output. Firms make zero economic profit in the long run. Market is dominated by a few firms. Strategic behavior is very important. EditViewInsertFormatToolsTable 12pt Paragrapharrow_forwardThe diagram below describes a monopolistically competitive firm in long-run equilibrium. On the diagram illustrate. a. The quantity of output, qo , that maximizes profit. b. The quantity of output, qfe , that would represent the firm’s full capacity. c. The quantity of output, qs , that would represent the socially optimal output level.arrow_forward

- Which of the following statements is true about the difference between monopoly and monopolistic competition? a.Monopolies always earn positive profits b.Monopolistically competitive firms have no barriers to entry or exitarrow_forwardUsing only things found in an average home, please provide one example of something from each kind of market, and briefly explain why this thing is in that particular market. Try to be creative. You will need an example of something from a: Perfectly competitive market Imperfectly competitive market (monopolistically competition or oligopoly), and Monopoly marketarrow_forwardIn the long run, the economic profits for a monopolistically competitive firm will bearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education