FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

a. Purchased 2,450 units of copper tubing on account at $52.00 per unit . The standard price is 48.50 per unit . If an amount box does not require an entry ,leave it blank .

b. Used 1,900 units of copper tubing in the process of manufacturing 200 air conditioners. Ten units of copper tubing are required,at standard, to produce one air conditioner . If an amount box does not require an entry, leave it blank .

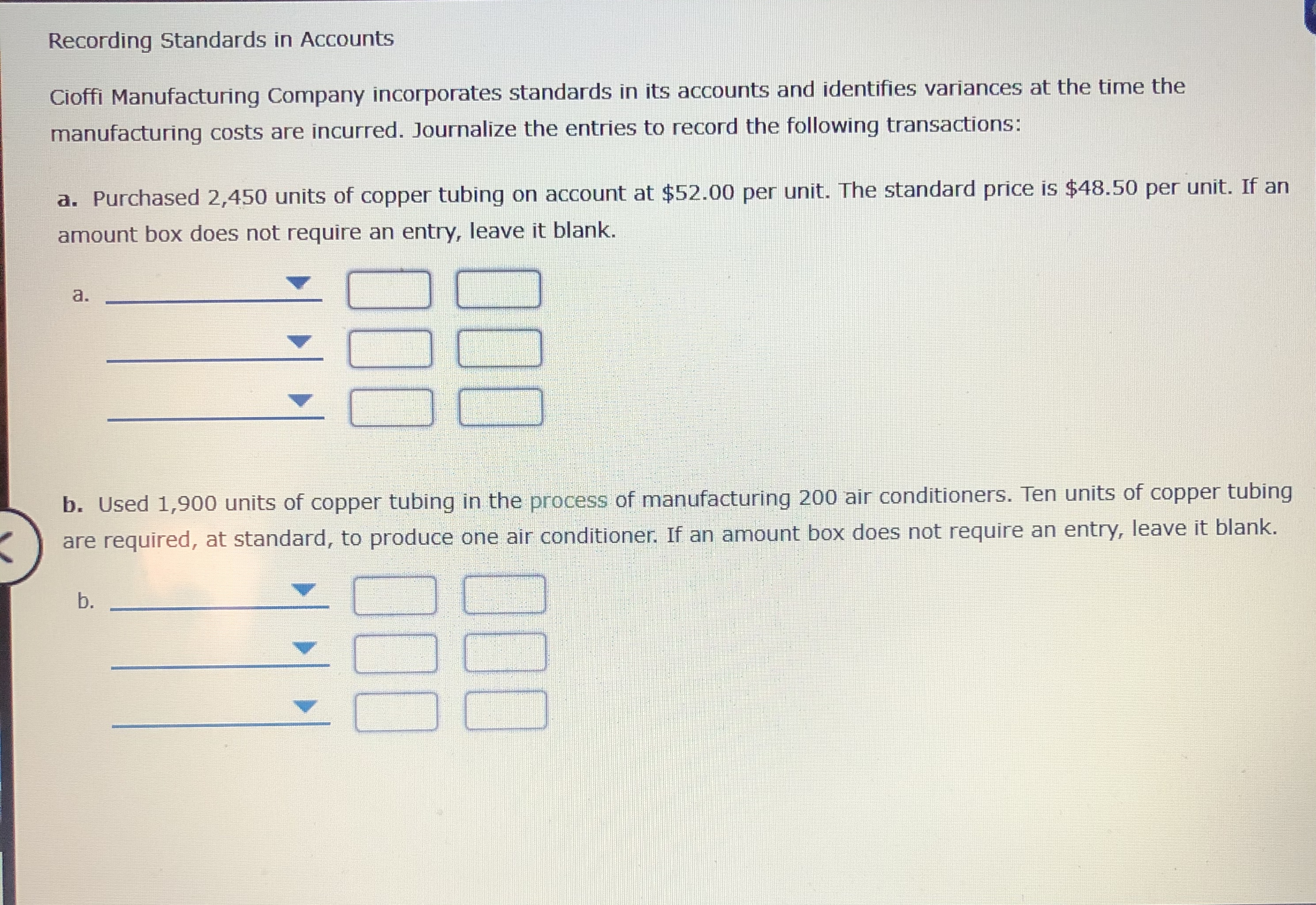

Transcribed Image Text:Recording Standards in Accounts

Cioffi Manufacturing Company incorporates standards in its accounts and identifies variances at the time the

manufacturing costs are incurred. Journalize the entries to record the following transactions:

a. Purchased 2,450 units of copper tubing on account at $52.00 per unit. The standard price is $48.50 per unit. If an

amount box does not require an entry, leave it blank.

а.

b. Used 1,900 units of copper tubing in the process of manufacturing 200 air conditioners. Ten units of copper tubing

are required, at standard, to produce one air conditioner. If an amount box does not require an entry, leave it blank.

b.

ОО‑

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer full question .arrow_forwardOzzy Opticals is a full-service optical store providing eye exams and eyeglasses to customers. To maintain a wide selection of inventory frames, Ozzy purchases the eyeglasses from various manufacturers under different FOB terms. For each of the scenarios, determine which party is responsible for the inventory. a. What is the significance of shipping terms? b. $1,500 in eyeglass frames were shipped FOB shipping point to Ozzy Opticals but were damaged in transit during a hurricane. Who is responsible for the inventory? c. $1,900 in eyeglass frames were shipped FOB destination to Ozzy Opticals but were lost in transit. Who is responsible for the inventory?arrow_forwardassume the selling cost was 7000$ and it was shipping FOB shipping point. We received the goods on 2/30. Terms of the sale were 2/10. n/45. Shipping costs covered by the suppliers, were 500$. we chose to insure the goods while in transit for 80$. While in transit, the driver of the truck was issued a speeding ticket for $120. To unload the goods and get them out onto our sales floor cos an additional $200. We paid for the goods on 12/31. As of 12/31/2020. what is the value of this particular inventory on our balance sheet?arrow_forward

- Provide all relevant journal entries for the following scenarios (please provide the date on when each journal entry is recorded): 1) Scenario 1: Earthwear ordered 20 kayaks for $ 1,250 each from manufacturer B and paid the full amount on May 6th. The manufacturer shipped 10 kayaks out on May 8th which arrived on May 14th, and shipped the rest of the order out on May 25th which arrived on June 3rd. 2) Scenario 2: Earthwear ordered 40 snowboards on account for $500 each from manufacturer F on September 8th. Manufacturer offered a 2% discount if Earthwear pays the invoice within 30 days. The manufacturer shipped out all 40 snowboards on September 10th and all arrived on September 16th. Earthwear paid the full amount outstanding on October 5th.arrow_forwardPlease answer completelyarrow_forwardOn October 1, 8A Bicycle Store had an inventory of 20 ten speed bicycles at a cost of $200 each. During the month of October, the following transactions occurred. Oct 4. Purchased 30 bicycles at a cost of $200 each from 8B Bicycle Company, terms 2/10, n/30. Oct 6. Sold 18 bicycles to 8C Group for $300 each, terms 1/10, n/30. Oct 7. Returned 2 defective bicycles to 8B Bicycle Company for the Oct. 4 transaction. Oct 13. Agreed to 8C's request for $300 allowance of the Oct. 6 transaction due to inferior Oct 14. Paid 8B Bicycle Company in full, less discount. Oct 20. Received a payment from 8C for the balance of the Oct. 6 transaction. a. Journalize the April transactions using a perpetual inventory system. b. Journalize the April transactions using a periodic inventory system.arrow_forward

- Please help mearrow_forwardHarold Manufacturing produces denim clothing. This year, it produced 5,280 denim jackets at a manufacturing cost of $41.00 each. These jackets were damaged in the warehouse during storage. Management investigated the matter and identified three alternatives for these jackets. 1. Jackets can be sold to a secondhand clothing shop for $7.00 each. 2. Jackets can be disassembled at a cost of $32,800 and sold to a recycler for $11.00 each. 3. Jackets can be reworked and turned into good jackets. However, with the damage, management estimates it will be able to assemble the good parts of the 5,280 jackets into only 3,050 jackets. The remaining pieces of fabric will be discarded. The cost of reworking the jackets will be $101,400, but the jackets can then be sold for their regular price of $41.00 each. Required: 1. Calculate the incremental income. Incremental revenue Incremental costs Incremental income Alternative 1 Sell to a second- hand shop Alternative 2 Disassemble and sell to a recycler…arrow_forwardAuge Company annually purchases 1,000 tons of raw material at a cost of $100,000 with terms of 2/10, n/30. Auge uses the net price method to account for purchase discounts. Freight costs amount to $10,000 and storage and handling costs to $7,500. What is Net Purchase Amount?arrow_forward

- udy Marigold Corp. began the year with 9 units of marine floats at a cost of $12 each. During the year, it made the following purchases: May 5, 35 unit at $17; July 16, 18 units at $20; and December 7, 23 units at $24. Assume there are 31 units on hand at the end of the period. Marigold uses the periodic approach. ▼ (a) Your answer has been saved and sent for grading. See Gradebook for score details. Determine the cost of goods sold under FIFO. Cost of good sold $ FIFO Click if you would like to Show Work for this question: Open Show Work Cost of good sold $ (b) Your answer has been saved and sent for grading. See Gradebook for score details. Determine the cost of goods sold under LIFO. LIFO Show Transcribed Text Cost of good sold $ 983 1229 Your answer has been saved and sent for grading. See Gradebook for score details. Determine the cost of goods sold under LIFO. Average unit cost $ LIFO C 1229 Click if you would like to Show Work for this question: Open Show Work (c1) Calculate…arrow_forwardBonita's Used Cars uses the specific identification method of costing inventory. During March, Indrisano purchased three cars for $11500, $14700, and $19100, respectively. During March, two cars are sold for a total of $35000. Bonita determines that on March 31, the $14700 car is still on hand. What is Bonita's gross profit for March? $5200 Ⓒ$1200 $8800 $4400arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education