FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

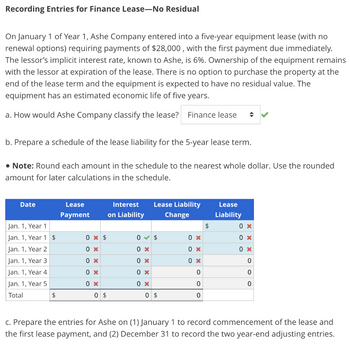

Transcribed Image Text:Recording Entries for Finance Lease-No Residual

On January 1 of Year 1, Ashe Company entered into a five-year equipment lease (with no

renewal options) requiring payments of $28,000, with the first payment due immediately.

The lessor's implicit interest rate, known to Ashe, is 6%. Ownership of the equipment remains

with the lessor at expiration of the lease. There is no option to purchase the property at the

end of the lease term and the equipment is expected to have no residual value. The

equipment has an estimated economic life of five years.

a. How would Ashe Company classify the lease? Finance lease ◆

b. Prepare a schedule of the lease liability for the 5-year lease term.

• Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded

amount for later calculations in the schedule.

Date

Jan. 1, Year 1

Jan. 1, Year 1 $

Jan. 1, Year 2

Jan. 1, Year 3

Jan. 1, Year 4

Jan. 1, Year 5

Total

$

Lease

Payment

0 x $

0 x

0 x

0 x

0 x

0 $

Interest

on Liability

Lease Liability

Change

0 $

0 x

0 x

0 x

0 x

0 $

0 x

0 x

0 x

0

0

0

$

Lease

Liability

0 x

0 x

0 x

0

0

0

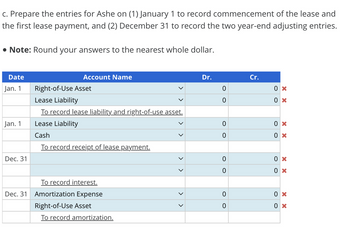

c. Prepare the entries for Ashe on (1) January 1 to record commencement of the lease and

the first lease payment, and (2) December 31 to record the two year-end adjusting entries.

Transcribed Image Text:c. Prepare the entries for Ashe on (1) January 1 to record commencement of the lease and

the first lease payment, and (2) December 31 to record the two year-end adjusting entries.

• Note: Round your answers to the nearest whole dollar.

Date

Jan. 1

Jan. 1

Dec. 31

Dec. 31

Account Name

Right-of-Use Asset

Lease Liability

To record lease liability and right-of-use asset.

Lease Liability

Cash

To record receipt of lease payment.

To record interest.

Amortization Expense

Right-of-Use Asset

To record amortization.

>

Dr.

0

0

0

0

0

0

0

0

Cr.

0x

0x

0 x

0x

0x

0x

0 x

0x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sanarrow_forwardMetlock Corporation recordeda right-of-use asset for $268,800 as a result of a finance lease on December 31, 2019. Metlock's incremental borrowing rate is 11%, and the implicit rate of the lessor was not known at the commencement of the lease. Metlock made the first lease payment of $51,390 on on December 31, 2019. The lease requires 7 annual payments. The equipment has a useful life of 7 years with no residual value. Prepare Metlock's December 31, 2020, entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places e.g. 5,275.) Date Account Titles and Explanation Debit Credit December 31, 2020 (To record interest expense) December 31, 2020 (To record amortization of the right-of-use asset)arrow_forwardPlease do not give image formatarrow_forward

- Recording Operating Lease-Lessor Gomez Inc. leases a vehicle from CareMax Inc. on January 1 for a three-year period. Gomez agrees to make $9,600 annual payments beginning on January 1. Prepare the journal entries during the year for CareMax Inc. assuming that the fair value of the vehicle is $44,800 and it has a useful life of 6 years with no salvage value (depreciated using the straight-line method). CarMax Inc. appropriately classifies the lease as an operating lease. Note: Round your answers to the nearest whole dollar. Account Name Date Jan, 1 Dec. 31 Dec. 31 Check To record receipt of lease payment To record lease revenue + # To record depreciation → = → # Dr. 0 0 0 0 0 0 Cr. 0 0 0 0 0 0arrow_forwardO On January 1, 2024, Majestic Mantles leased a lathe from Equipment Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by Majestic. Portions of the Equipment Leasing’s lease amortization schedule appear below: January 1 Payments Effective Interest Decrease in Balance Outstanding Balance $ 314,048 2024 $ 24,000 $ 24,000 $ 290,048 2025 $ 24,000 $ 14,502 $ 9,498 $ 280,550 2026 $ 24,000 $ 14,028 $ 9,972 $ 270,578 2027 $ 24,000 $ 13,529 $ 10,471 $ 260,107 2028 $ 24,000 $ 13,005 $ 10,995 $ 249,112 2029 $ 24,000 $ 12,456 $ 11,544 $ 237,568 2030 $ 24,000 $ 11,878 $ 12,122 $ 225,446 — — — — — — — — — — — — — — — 2041 $ 24,000 $ 11,272 $ 12,728 $ 44,627 2042 $ 24,000 $ 2,231 $ 21,769 $ 22,858 2043 $ 24,000 $ 1,143 $ 22,857 $ 0 Required: What is Majestic’s lease liability at the beginning of the lease (after the first payment)? What…arrow_forward7arrow_forward

- On January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing's lease amortization schedule appear below: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Jan. 1 2021 2021 2022 2023 2024 2025 2026 1. 2. WN 3. 4. 2038 2039 2040 2041 7 Payments 14,500 14,500 14,500 14,500 14,500 14,500 14,500 14,500 14,500 38,449 5. 6. Net investment Effective Decrease in Interest Balance 11,800 11,584 11,351 11,099 10,827 5,250 4,510 3,711 2,848 Lease term Asset's residual value Effective annual interest rate Lease payments for United Lease payments for NIC 7. 8. Right-of-use asset Required: 1. What is the lease term In years? 2. What is the asset's residual value expected at the end of the lease term?…arrow_forwardhe following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Ivanhoe Company, a lessee. Commencement date January 1, Annual lease payment due at the beginning of each year, beginning with January 1, $99,118 Residual value of equipment at end of lease term, guaranteed by the lessee $53,000 Expected residual value of equipment at end of lease term $48,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, $554,000 Lessor’s implicit rate 6 % Lessee’s incremental borrowing rate 6 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment.Click here to view factor tables. (a) Your answer is partially correct. Try again. Prepare an amortization schedule that would be suitable for the lessee for the lease term.…arrow_forwardDetermining Amounts in Operating Lease-Lessee Kulver's Inc. leases equipment from Equip Inc. on January 1 under a 3-year operating lease. Kulver's agrees to pay Equip Inc. $15,000 annually with the first payment due on January 1. As an incentive for Kulver's to sign the lease by January 1, Equip Inc. paid Kulver's Inc. $700. Kulver's also incurred legal fees for the review of the lease agreement ($200) and salaries for employees involved in negotiating the lease ($1,300). Assuming an incremental borrowing rate of 7% for Kulver's Inc., determine the value of the lease liability and the right-of- use asset on January 1 for Kulver's. Note: Round your answers to the nearest whole dollar. Lease liability $ 11,620 X Right-of-use asset $ 41,620✔ Checkarrow_forward

- Assume that on January 1, 2021, Fredder Corporation sells equipment to Finance Co. for $1,700,000 and immediately leases back the equipment. The relevant information is as follows. 1. The equipment was carried on Fredder's books at a value of $1,500,000. 2. The term of the non-cancelable lease is 3 years; title will not transfer to Fredder, and the expected residual value at the end of the lease is $125,000, all of which is unguaranteed. 3. The lease agreement requires equal rental payments of $277,635 at the beginning of each year. 4. The incremental borrowing rate for Fredder is 7%. Fredder is aware that Finance set the annual rental to ensure a rate of return of 7%. 5. The equipment has a fair value of $1,700,000 on January 1, 2021, and an estimated economic life of 10 years. What type of lease is this for Fredder? What type of lease is this for Finance? Explain briefly. Prepare all necessary journal entries for the lessee for 2021. Prepare the 1/1/22 journal entry for the lessee.…arrow_forwardThere are 7 account titles, not 2.arrow_forwarddont uplode image in answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education