FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

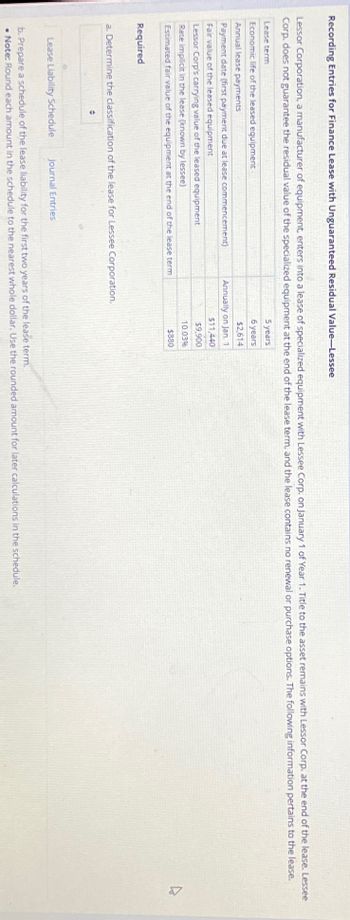

Transcribed Image Text:Recording Entries for Finance Lease with Unguaranteed Residual Value-Lessee

Lessor Corporation, a manufacturer of equipment, enters into a lease of specialized equipment with Lessee Corp. on January 1 of Year 1. Title to the asset remains with Lessor Corp. at the end of the lease. Lessee

Corp. does not guarantee the residual value of the specialized equipment at the end of the lease term, and the lease contains no renewal or purchase options. The following information pertains to the lease.

Lease term

Economic life of the leased equipment

Annual lease payments

Payment date (first payment due at lease commencement)

Fair value of the leased equipment

Lessor Corp's carrying value of the leased equipment

Rate implicit in the lease (known by lessee)

Estimated fair value of the equipment at the end of the lease term

Required

a. Determine the classification of the lease for Lessee Corporation.

•

Lease Liability Schedule Journal Entries

5 years

6 years

$2,614

Annually on Jan. 1

$11,440

$9,900

10.03%

$880

b. Prepare a schedule of the lease liability for the first two years of the lease term.

. Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Garvey Company (the lessee) entered into an equipment lease with Richie Company (the lessor) on January 1 of Year 1. 1. The equipment reverts back to the lessor at the end of the lease, and there is no bargain purchase option. The equipment is not specialized for Garvey. 2. The lease term is 5 years and requires Garvey to make annual payments of $65,949.37 at the end of each year. 3. The discount rate is 10%, which is implicit in the lease. Garvey knows this rate. 4. The fair value of the equipment at the lease inception is $250,000. The present value of an ordinary annuity of five payments of $65,949.37 each at 10% is $250,000. 5. The equipment has an estimated economic life of 7 years and has zero residual value at the end of this time. Straight-line depreciation is used for similar assets. Required: Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. Assume that Garvey…arrow_forwardThe following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Vance Company, a lessee. Commencement date January 1, 2020 Annual lease payment due at the beginning of each year, beginning with January 1, 2020 $113,864 Residual value of equipment at end of lease term, guaranteed by the lessee $50,000 Expected residual value of equipment at end of lease term $45,000 Lease term 6 years Economic life of leased equipment 6 years Fair value of asset at January 1, 2020 $600,000 Lessor's implicit rate 8% Lessee's incremental borrowing rate 8% The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment. Instructions a. Prepare an amortization schedule that would be suitable for the lessee for the lease term. b. Prepare all of the journal entries for the lessee for 2020 and 2021 to record the lease agreement, the lease…arrow_forwardThe following information relates to Wilson, Inc.’s equipment lease with an inception date of January 1: Fair value of equipment at lease inception, $91,200 Lease term, 4 years Economic life of property, 5 years Implicit interest rate, 6% Annual lease payment due on December 31, $25,600 Present value of the lease payments, $88,707 The equipment reverts back to the lessor at the end of the lease term. How much is interest expense on the lease for the first year? Select one: a. $5,472 b. $2,736 c. $5,322 d. $1,331arrow_forward

- Please help solvearrow_forwardMorgan Corp enters into a lease of nonspecialized equipment with Hoffman Corp. The following is information about the lease: Lease term five years, no renewal option Economic life of equipment is 6 years no purchase option annual lease payments $11,000 Morgan Corp's incremetal borrowing rate is 7% Title to the asset remains with Hoffman Corm upon lease expiration The fair value of equipment is $50,000 Morgan Corp does not guarantee the residual value of equipment at end of lease term Morgan Corp pays for all maintenance of equipment separate from lease No initial direct costs incurred by Morgan corp Hoffman Corp does not provide any incentives 1. How should Morgan Corp classify the lease? 2. How would Morgan Corp measure and record this lease? 3. How would Morgan Corp measure the right-of-use asset and lease liability over the lease term?arrow_forwardThe following facts pertain to a non-cancelable lease agreement between Sheridan Leasing Company and Skysong Company, a lessee. Commencement date Annual lease payment due at the beginning of each year, beginning with May 1, 2020 Bargain purchase option price at end of lease term Lease term Economic life of leased equipment Lessor's cost Fair value of asset at May 1, 2020 Lessor's implicit rate Lessee's incremental borrowing rate May 1, 2020 $15,349.90 $6,000 50 10 $65,000 $76,000 4 years years 96 The collectibility of the lease payments by Sheridan is probable. Prepare a lease amortization schedule for Skysong for the 5-year lease termarrow_forward

- Salaur Company is evaluating a lease arrangement being offered by TSP Company for use of a computer system. The lease is noncancelable, and in no case does Salaur receive title to the computers during or at the end of the lease term. The lease starts on January 1, 2017, with the first rental payment due on January 1, 2017. Additional information related to the lease is as follows. Check the below image for additional information AccountingAnalyze the lease capitalization criteria for this lease for Salaur Company. Prepare the journal entry for Salaur on January 1, 2017.AnalysisBriefly discuss the impact of the accounting for this lease for two common ratios: return on assets and debt to total assets.PrinciplesWhat element of faithful representation (completeness, neutrality, free from error) is being addressed when a company like Salaur evaluates lease capitalization criteria?arrow_forwardThe following facts pertain to a non-cancelable lease agreement between Faldo Leasing Company and Pharoah Company, a lessee. Commencement date Annual lease payment due at the beginning of each year, beginning with January 1, Residual value of equipment at end of lease term, guaranteed by the lessee Expected residual value of equipment at end of lease term Lease term Economic life of leased equipment Fair value of asset at January 1, Lessor's implicit rate Lessee's incremental borrowing rate January 1, $126,840 $55,000 $50,000 6 years 6 years $653,000 9 % 9 % The asset will revert to the lessor at the end of the lease term. The lessee uses the straight-line amortization for all leased equipment.arrow_forwardOn January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing's lease amortization schedule appear below: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Jan. 1 2021 2021 2022 2023 2024 2025 2026 1. 2. WN 3. 4. 2038 2039 2040 2041 7 Payments 14,500 14,500 14,500 14,500 14,500 14,500 14,500 14,500 14,500 38,449 5. 6. Net investment Effective Decrease in Interest Balance 11,800 11,584 11,351 11,099 10,827 5,250 4,510 3,711 2,848 Lease term Asset's residual value Effective annual interest rate Lease payments for United Lease payments for NIC 7. 8. Right-of-use asset Required: 1. What is the lease term In years? 2. What is the asset's residual value expected at the end of the lease term?…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education