FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

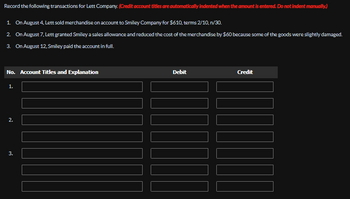

Transcribed Image Text:Record the following transactions for Lett Company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

1. On August 4, Lett sold merchandise on account to Smiley Company for $610, terms 2/10, n/30.

2. On August 7. Lett granted Smiley a sales allowance and reduced the cost of the merchandise by $60 because some of the goods were slightly damaged.

3. On August 12, Smiley paid the account in full.

No. Account Titles and Explanation

1.

2.

3.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For the accounts receive and interest revenue I for march 20, I got 13, however its wrong, can you tell me what I am doing wrong? our answer is partially correct. Try again. On January 10, Molly Amise uses her Windsor, Inc. credit card to purchase merchandise from Windsor, Inc. for $1,500. On February 10, Molly is billed for the amount due of $1,500. On February 12, Molly pays $1,300 on the balance due. On March 10, Molly is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12.Prepare the entries on Windsor, Inc.’s books related to the transactions that occurred on January 10, February 12, and March 10. (Omit cost of goods sold entries.) (Round answers to 0 decimal places, e.g. 825. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit choose a transaction…arrow_forwardPlease show all the work.arrow_forwardOn June 10, Riverbed Company purchased $7,850 of merchandise on account from Pronghorn Company, FOB shipping point, terms 2/10, n/30. Riverbed pays the freight costs of $490 on June 11. Goods totaling $650 are returned to Pronghorn for credit on June 12. On June 19, Riverbed pays Pronghorn Company in full, less the discount. Both companies use a perpetual inventory system.arrow_forward

- Urmilabenarrow_forwardOn December 15, Lee Corp requested credit for $500 of defective merchandise included in their December 9 purchase. We granted them an allowance and they disposed of the defective merchandise at our request.arrow_forwardBolton sold a customer service contract with a price of $37,000 to Sammy's Wholesale Company. Bolton offered terms of 1/10, n/30 and uses the gross method. Required: Hide Prepare the journal entry assuming the payment is made after 10 days (after the discount period). Account and Explanation Debit Credit Record collection of accounts receivablearrow_forward

- On June 14, Year 1, Sure-Fit Shoe Store sold $13,000 of merchandise that cost $8,700 and accepted credit cards as payment. Sure-Fit electronically transmitted the credit card forms to the credit card company which charges a 4% fee to handle such transactions. On June 18, Year 1, Sure-Fit received the proceeds from the credit card company. Required: a. How will the entry to record the sale of the merchandise on June 14, Year 1, affect the company's financial statements? b. How will the entry to record the credit card proceeds on June 18, Year 1, affect the company's financial statements? Complete this question by entering your answers in the tabs below. Required A Required B How will the entry to record the sale of the merchandise on June 14, Year 1, affect the company's financial statements? Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Assets Balance Sheet Liabilities Stockholders' Equity Revenue Income…arrow_forwardNkome Traders, owner T Nkome, is a registered VAT vendor. The VAT rate applicable is 15%. Transactions: 20.3 February 3 Received and invoice (re-numbered to 20.3/105) from Bapela Wholesalers for merchandise purchased on credit for R18 975. 5 Some of the items to the value of R1 265 on invoice number 20.3/105 was not received. Issued a debit note for the amount. Bapela Wholesalers granted the claim and issued a credit note for the amount claimed. 10 Bought stationery, R1 035, from Big Stationers and received their invoice. 12 Received an invoice from Electronics Traders for the purchase of a new printer for R3 680. 17 Bought merchandise to the value of R21 965 from Bangani Wholesalers and received their invoice. Complete the given Purchases journal and Purchases returns journal for February 20.3.arrow_forwardDengararrow_forward

- On March 2, Ivanhoe Company sold $890,000 of merchandise on account to Bridgeport Company, terms 2/10, n/30. The cost of the merchandise sold was $522,000. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation (b) Inventory Accounts Payable Your Answer Correct Answer (Used) (c) Account Titles and Explanation Accounts Payable On March 6, Bridgeport Company returned $89,000 of the merchandise purchased on March 2. The cost of the returned merchandise was $54,800. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Inventory Debit count Titles and Explanation Debit 890,000 Debit Credit…arrow_forward. Journalize the following transactions using the allowance method of accounting for uncollectible receivables. April 1 Sold merchandise on account to Jim Dobbs, $7,200. The cost of the merchandise is $5,400. June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. Oct. 11 Reinstated the account of Jim Dobbs and received cash in full payment.arrow_forwardCarla Vista Company uses the allowance method for estimating uncollectible accounts. Prepare journal entries to record the following transactions. Omit cost of goods sold entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) January 5 April 15 August 21 October 5 Date Sold merchandise to Ryan Seacrest for $2,800, terms n/15. Received $480 from Ryan Seacrest on account. Wrote off as uncollectible the balance of the Ryan Seacrest account when he declared bankruptcy. Unexpectedly received a check for $690 from Ryan Seacrest. V Account Titles and Explanation (To reverse write-off of Ryan Seacrest account) (To record collection from Ryan Seacrest account) Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education