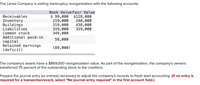

a. record the entry to adjust asset values to fair value

b. record the entry to reduce additional paid in capital balance to correct figure, to close out gain account, and eliminate deficit.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Record the entry to adjust asset values to fair value.

Record the entry to reduce additional paid in capital balance to correct figure, to close out gain account, and to eliminate deficit.

How do I do this? What part of this is the adjust asset value and what part is the deficit entry

Record the entry to adjust asset values to fair value.

Record the entry to reduce additional paid in capital balance to correct figure, to close out gain account, and to eliminate deficit.

How do I do this? What part of this is the adjust asset value and what part is the deficit entry

- Record the entry to adjust asset values to fair value. Record the entry to reduce additional paid in capital balance to correct figure, to close out gain account, and to eliminate deficit. How do I do this? What part of this is the adjust asset value and what part is the deficit entryarrow_forwardDo the following: (1) Assign a formula to (1) Tot. current assets, (2) Net fixed assets, (3) Total assets (2) Do the same to other cells if they are calculated. This can vary depending on YOUR financial statements FIN CF and Toves Last Namo vlex (sheet name:arrow_forwardWhich of the following is incorrect? A. Capital + Liabilities = Assets B. Assets Liabilities Capital Capital + Liabilities = Capital - Liabilities C. Assets D. Assets -arrow_forward

- Claim against assets are represented by__.I am not satisfy give downvote A. saved earning B. retained earnings C. maintained earnings D.saving account earningarrow_forwardIdentify the statement below that is correct: Multiple Choice Debits decrease asset and expense accounts, and increase liability, equity, and revenue accounts. The left side of a T-account is the credit side. Credits increase asset and expense accounts, and decrease liability, equity, and revenue accounts. The total amount debited need not equal the total amount credited for a particular transaction. The left side of a T-account is the debit side.arrow_forwardIf an asset account is credited, it indicates O An error. An increase in the asset. O A decrease in the asset. O A credit was made to a liability account.arrow_forward

- Match the statements below with the accounting assumption, characteristic, or principle to which the statement relates. Assumptions/characteristics/principles may be used once, more than once, or not at all. Recorded when the performance obligation is satisfied. a. Revenue recognition principle V The reason for recording accruals and deferrals in adjusting entries. b. Matching principle Valuing assets at amounts originally paid for them. C. Historical cost principle Entity assumed to have a long life d. Going concern assumption Description of significant accounting policies and unusual events. e. Full disclosure principle v Information has predictive and confirmatory value. T. Relevance characteristic 8. Consistency characteristicarrow_forwardAdjusting entries are necessary to 1. obtain a proper matching of revenue and expense. 2. achieve an accurate statement of assets and equities. 3. adjust assets and liabilities to their fair market value. A. 1 and 2 B. 1 C. 3 D. 2arrow_forward7. Net Working Capital is the difference between Current Assets andLong-Term Liabilities. T/F 8. APR takes into consideration compounding, whereas EAR does notfactor in compounding. T/Farrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education