Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

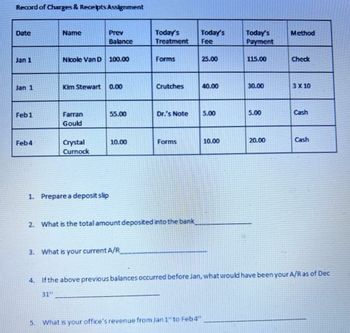

Transcribed Image Text:Record of Charges & Receipts Assignment

Date

Jan 1

Jan 1

Feb1

Feb4

Name

Nicole Van D 100.00

Prev

Balance

Kim Stewart 0.00

Farran

Gould

5.

Crystal

Curnock

1. Prepare a deposit slip

55.00

10.00

3. What is your current A/R_

Today's

Treatment

Forms

Crutches

2. What is the total amount deposited into the bank

Forms

Today's

Fee

25.00

Dr.'s Note 5.00

40.00

What is your office's revenue from Jan 1 to Feb4"

10.00

Today's

Payment

115.00

30.00

5.00

20.00

Method

Check

3 X 10

Cash

4. If the above previous balances occurred before Jan, what would have been your A/R as of Dec

31st

Cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The accompanying table, Data table Date Deposit (Withdrawal) Date Deposit (Withdrawal) 1/1/20 $8,000 1/1/22 $3,272 1/1/21 $(6,540) 1/1/23 $5,255 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) , shows a series of transactions in a savings account. The account pays 5% simple interest, and the account owner withdraws interest as soon as it is paid. Calculate the following: a. The account balance at the end of each year. (Assume that the account balance at December 31, 2019, is zero.) b. The interest earned each year. c. The true rate of interest that the investor earns in this account. Question content area bottom Part 1 a. The account balance at the end of 2020 is $8,0008,000. (Round to the nearest dollar.) Part 2 The account balance at the end of 2021 is $1,9531,953. (Round to the nearest dollar.)arrow_forwardA ____ is an interest-bearing checking account. Group of answer choices NOW account certificate of deposit Treasury bill regular checking account Series EE US savings bondarrow_forwardPrepare the journal entry to reconcile the bank statement in EB9.arrow_forward

- 6. A portion of your bank statement is shown. Your previous balance was $228.73. What is your present balance Date Checks and Other Charges Number 13-Oct 18-Oct 143 27-Oct 144 31-Oct ATM AT-Phone Service Charge >>> Amount $43.60 112.76 10.64 50.00 5.14 Date Deposits and Credits Amount $146.90 188.42 135.65 5-Oct 12-Oct 19-Oct [ATM] Present Balancearrow_forwardPlease help me solvearrow_forward2. DETAILS rise BRECMBC9 4.11.TB.011. On May 27, you received your bank statement showing a balance of $1,026.34. Your checkbook shows a balance of $1,056.29. Outstanding checks are $245.50 and $377.20. The account earned $62.59. Deposits in transit amount to $705.24, and there is a service charge of $10.00. Calculate the reconciled balance. O $29.95 O $943.80 O $1,003.70 $1,108.88arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardUsing the stylized balance sheet below, please 1) finish the balance sheet, and 2) use that information to answer the following question, entering your answer in the place provided. Avg. Avg. Amount Amount Interest Interest Demand Vault Cash $1,573 $1,123 Deposits US Treas. Savings 3.43% 2,212 3.02% 8,497 Securities Deposits Consumer/Bus. 8.23% 15,315 CD's 3.54% ???? Loans Mortgage 6.82% 8,719 Borrowings 3.10% 2,747 Loans Property 2,032 Equity 3,423 Equipment Total Liab.& Total Assets ???? ???? Equity What is the net interest income the this bank? (Please enter the answer to the nearest penny!) ed 39,211.64 ver 1,091.41 margin of error +/- 1arrow_forwardThank you :)arrow_forward

- Need asap show complete solutionarrow_forwardThe followingarrow_forwardEnrichment Activity 8-2. Preparation of Deposit Slip ( After the collections and sales for March 25, 2020, Rosemarie B. Luzvimin is to prepare her deposit slip for the following collections: P1,000 bill 3 pcs. P20 bill 13 pcs. 500 bill 6 pcs. 10.00 coin 3 рcs. 200 bill 1 pcs. 9 pcs. 5.00 coin 100 bill 8 pcs. 1.00 coin 3 pcs. 50 bill 14 pcs. .25 coin 2 pcs. Checks to be deposited: BDO Check Tanauan Branch Check No. 14578 amounting to P5,500 BPI Check Malvar Branch Check No. 454532 amounting to P9,000 Landbank Tanauan Bracnh Check No. 789923 amounting to P12,250 Requirement: Prepare the deposit slip/s for all the collections using the account name of the owner with her account number of 0070425184882. (Remove the first numbers if the spaces for account number is not enough)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College