FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

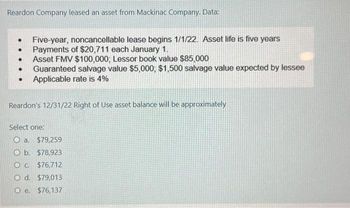

Transcribed Image Text:Reardon Company leased an asset from Mackinac Company. Data:

●

●

●

●

.

Five-year, noncancellable lease begins 1/1/22. Asset life is five years

Payments of $20,711 each January 1.

Asset FMV $100,000; Lessor book value $85,000

Guaranteed salvage value $5,000; $1,500 salvage value expected by lessee

Applicable rate is 4%

Reardon's 12/31/22 Right of Use asset balance will be approximately

Select one:

O a. $79,259

O b. $78,923

O c. $76,712

O d. $79,013

Oe. $76,137

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sanarrow_forward1- On January 1, year 8, Big Company leased equipment to Small Corporation under an operating lease. The present value of the end-of-year lease payments of $207,878 discounted at the implicit rate of 5% is $900,000. The expected economic life of the asset is seven years. The lease term is five years. What would Small Corporation record as amortization in year 8? Multiple Choice $135,000. $162,878. $180,000. $0. -------------------------------------------------------------------- 2- A Co. recorded a right-of-use asset of $400,000 in a 10-year operating lease. Payments of $65,100 are made annually at the end of each year. The interest rate charged by the lessor was 10%. The balance in the right-of-use asset after the first year will be: Multiple Choice $360,000. $374,900. $376,900. $400,000.arrow_forwardRecording Operating Lease-Lessor Gomez Inc. leases a vehicle from CareMax Inc. on January 1 for a three-year period. Gomez agrees to make $9,600 annual payments beginning on January 1. Prepare the journal entries during the year for CareMax Inc. assuming that the fair value of the vehicle is $44,800 and it has a useful life of 6 years with no salvage value (depreciated using the straight-line method). CarMax Inc. appropriately classifies the lease as an operating lease. Note: Round your answers to the nearest whole dollar. Account Name Date Jan, 1 Dec. 31 Dec. 31 Check To record receipt of lease payment To record lease revenue + # To record depreciation → = → # Dr. 0 0 0 0 0 0 Cr. 0 0 0 0 0 0arrow_forward

- Exhibit Leased assets have an expected life of 5 years Depreciation is straight line Annual lease payment is $1,400 Interest rate is 12% 3) Find the total expense in Year 1 if exhibit refers to an Operating Lease 4) Find the total expensee in Year 1 if exhibit refers to a Capital Leasearrow_forwardSouthwestern Edison Company leased equipment from Hi-Tech Leasing on January 1, 2018. Hi-Tech manufactured the equipment at a cost of $94,500. Other information: 3 years $49,000 on January 1 each year 3 years $136, 382 Lease term Annual payments Life of asset Fair value of asset Implicit interest rate 8% Incremental rate 8% There is no expected residual value. Required: Prepare appropriate journal entries for Hi-Tech Leasing for 2018. Assume a December 31 year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.) View transaction list Journal entry worksheet 2 3 > Record the lease. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2018arrow_forwardhik..3arrow_forward

- BNM Itd. Acquired on asset of Rs. 440,000 through a finance lease agreement pn 1-1-2018 with no residual value. The lease term is five years with annual lease rentals of Rs. 100,000 payable at the start of each year. The implicit rate of interest is 10%. Calculate: a. Gross investment in lease b. Net investment in lease C. Unearned finance income d. Lease amortization schedulearrow_forwardDont uploarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education