FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

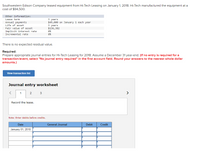

Transcribed Image Text:Southwestern Edison Company leased equipment from Hi-Tech Leasing on January 1, 2018. Hi-Tech manufactured the equipment at a

cost of $94,500.

Other information:

3 years

$49,000 on January 1 each year

3 years

$136, 382

Lease term

Annual payments

Life of asset

Fair value of asset

Implicit interest rate

8%

Incremental rate

8%

There is no expected residual value.

Required:

Prepare appropriate journal entries for Hi-Tech Leasing for 2018. Assume a December 31 year-end. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar

amounts.)

View transaction list

Journal entry worksheet

2

3

>

Record the lease.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 01, 2018

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardEastern Edison Company leased equipment from Low-Tech Leasing on January 1, 2018. Low-Tech recently purchased the equipment at a cost of $247,570. Other information: Lease term Annual payments Life of asset 4 years $71,000 on January 1 each year Incremental rate 4 years Fair value of asset Implicit interest rate 10% $247,570 10% There is no expected residual value. Required: Prepare appropriate journal entries for Low-Tech Leasing for 2018. Assume a December 31 year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.)arrow_forwardManufacturers Southern leased high-tech electronic equipment from International Machines on January 1, 2024. International Machines manufactured the equipment at a cost of $105,000. Manufacturers Southern's fiscal year ends December 31. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Related Information: Lease term Quarterly rental payments Economic life of asset Fair value of asset Implicit interest rate Required: 2 years (8 quarterly periods) $ 17,000 2 at the beginning of each period years $ 127,024 8% 1. Show how International Machines determined the $17,000 quarterly lease payments. 2. Prepare appropriate entries for International Machines to record the lease at its beginning, January 1, 2024, and the second lease payment on April 1, 2024. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Show how International Machines determined the $17,000 quarterly lease payments.…arrow_forward

- Manufacturers Southern leased high-tech electronic equipment from Edison Leasing on January 1, 2011. Edison purchased the equipment from International Machines at a cost of $112,080. Related Information: 2 years (8 quarterly periods) $15,000 at the beginning of each period 2 years $112,080 Lease term Quarterly rental payments Economic life of asset Fair value of asset 8% Implicit interest rate (Also lessee's incremental borrowing rate) Required: Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the inception off the lease through January 1, 2012. Depreciation is recorded at the end of each financial year (December 31) on a straight-line basis.arrow_forwardManufacturers Southern leased high-tech electronic equipment from International Machines on January 1, 2024. International Machines manufactured the equipment at a cost of $101,000. Manufacturers Southern's fiscal year ends December 31. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Related Information: Lease term Quarterly rental payments Economic life of asset Fair value of asset Implicit interest rate Required 1 Required 2 Required: 1. Show how International Machines determined the $18,000 quarterly lease payments. 2. Prepare appropriate entries for International Machines to record the lease at its beginning, January 1, 2024, and the second lease payment on April 1, 2024. PV factors based on Table or Calculator function: PV of Lease 2 Complete this question by entering your answers in the tabs below. Lease Payment $ 18,000 2 $ 132,289 n = 10% Show how International Machines determined the $18,000 quarterly…arrow_forwardEastern Edison Company leased equipment from Low-Tech Leasing on January 1, 2018. Low-Tech recently purchased the equipment at a cost of $334.936. Other information: 5 years $79,000 on January 1 each year 5 years Lease term Annual payments Life of asset Fair value of asset $334,936 Implicit interest rate 9% Incremental rate 9% There is no expected residual value. Required: Prepare appropriate journal entries for Low-Tech Leasing for 2018. Assume a December 31 year-end. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar amounts.) View transaction list Journal entry worksheet 1 2 3 > Record the entry at the inception of the lease. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2018arrow_forward

- Please don't provide answer in image format thank you.arrow_forwardHanshabenarrow_forwardRequired information [The following information applies to the questions displayed below.] High Time Tours leased rock-climbing equipment from Adventures Leasing on January 1, 2021. High Time has the option to renew the lease at the end of two years for an additional three years for $8,100 per quarter. Adventures purchased the equipment at a cost of $196,141. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Related Information: Lease term Lease renewal option for an additional Quarterly lease payments Economic life of asset Interest rate charged by the lessor 2 years (8 quarterly periods) 3 years at $8,100 per quarter $15,100 at Jan. 1, 2021, and at Mar. 31, June 30, Sept. 30, and Dec. 31 thereafter. 5 years 10%arrow_forward

- Manufacturers Southern leased high-tech electronic equipment from International Machines on January 1, 2021. International Machines manufactured the equipment at a cost of $92,000. Manufacturers Southern's fiscal year ends December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Related Information: Lease term 2 years (8 quarterly periods) Quarterly rental payments $18,000 at the beginning of each period Economic life of asset 2 years Fair value of asset $134,496 Implicit interest rate 8% Required:1. Show how International Machines determined the $18,000 quarterly lease payments.2. Prepare appropriate entries for International Machines to record the lease at its beginning, January 1, 2021, and the second lease payment on April 1, 2021.arrow_forwardPrepare the journal entries Leasing AG would make in 2020 related to the lease arrangement.arrow_forwardHelp with parts 4 and 5. 4. Prepare journal entries for Sax for the years 2016 and 2017. 5. Next Level If the lease term is 3 years and the annual payment is $110,000, how would Sax classify the lease under (a) U.S. GAAP and (b) IFRS?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education