ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

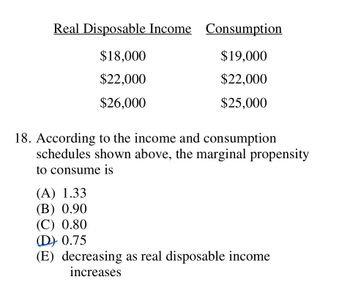

18. According to the income and consumption schedules shown above, the marginal propensity to consume is

(A) 1.33

(B) 0.90

(C) 0.80

(D) 0.75

(E) decreasing as real disposable income

How come MPC equals 0.75?

Transcribed Image Text:Real Disposable Income Consumption

$18,000

$19,000

$22,000

$22,000

$26,000

$25,000

18. According to the income and consumption

schedules shown above, the marginal propensity

to consume is

(A) 1.33

(B) 0.90

(C) 0.80

(D) 0.75

(E) decreasing as real disposable income

increases

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Utility Optimization Problem Suppose a household has the following lifetime utility function: (a) Finding Partial Derivatives of Utility U = c1/2 + Bc1/2 Find expressions for the partial derivatives of lifetime utility, U, with respect to period t and period t + 1 consumption. Is marginal utility of consumption in both periods always positive? (b) Finding Second Derivatives of Utility a²U Find expressions for the second derivatives of lifetime utility with respect to period t and t + 1 consumption, i.e., 321 and 227. Are these second derivatives always negative for any positive values of period t and t+1 consumption? c) Deriving Indifference Curve Expression Derive an expression for the indifference curve associated with lifetime utility level Uo (i.e., derive an expression for C++1 as a function of U₁ and c). What is the slope of the indifference curve? How does the magnitude of the slope vary with the value of Ę? d) Combining Budget Constraints Suppose that the household faces two…arrow_forward4) Distinguish between the short-run and long-run factors that affect residential investment.arrow_forwardQ4) Refer to the information provided in table below to answer the questions that follow. Y C S 0 100 180 190 1. Find the consumption, if the consumption function is: C= 120 +0.2Y. 2. Find aggregate saving. 3. Illustrate that by graph from the information provided in table.arrow_forward

- Suppose that Maria spends 84,500 on consumption, her disposable income is $90,000 and her Marginal Propensity to Save is .15. What does Maria's autonomous consumption equal? Select one: a. $5,500 b. $6,500 c. $7,000 d. $8,000arrow_forward61)If the marginal propensity to save is 0.2, then a $10,000 decrease in disposable income will Select one: a. increase consumption by $2,000. b. increase consumption by $8,000. c. decrease consumption by $8,000. d. decrease consumption by $2,000.arrow_forwardPlease help! Thank you very much for your time. If your disposable income increases from $12,000 to $17,000 and your consumption increases from $10,000 to $14,500, your MPC is_____ A. 0.2. B. 0.4. C. 0.6. D. 0.9.arrow_forward

- This problem has been solved! See the answer Explain the relationship between the aggregate expenditures model in graph (A) below and the aggregate demand–aggregate supply model in graph (B) below. In other words, explain how points 1, 2, and 3 are related to points 1’, 2’, and 3’.arrow_forwardIn an economy MPC equals to 0.85 if investment is increased by $20 how more would be the increase in incomearrow_forwardIncome choices: a. What will a 2% increase in tax rates do to disposable income? b. If Eduardo’s disposable income increases from $1,200 to $1,700 and his level of saving increases from minus $100 to a plus $100, his marginal propensity to save is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education