FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:New Teb

* Summit Leaming

i summitlearning.org

G student.k12.tulsaschools.org bookmarks

DERELL SYLVESTER

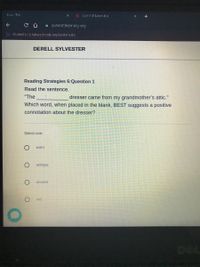

Reading Strategies 6:Question 1

Read the sentence.

"The

dresser came from my grandmother's attic."

Which word, when placed in the blank, BEST suggests a positive

connotation about the dresser?

Select one:

worn

antique

ancient

old

DEL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- -My Home * CengageNOwv2 | Online teach x b Kingsford Furnishings Compan x n/ilrn/takeAssignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator=&inprogress-false Maps еВook Show Me How Print Item Entries for Materials Kingsford Furnishings Company manufactures designer furniture. Kingsford Furnishings uses a job order cost system. Balances on April 1 from the materials ledger are as follows: Fabric $26,200 Polyester filling 7,900 Lumber 58,700 Glue 2,500 The materials purchased during April on account are summarized from the receiving reports as follows: Fabric $130,200 Polyester filling 181,000 Lumber 356,700 Glue 12,400 Materials were requisitioned to individual jobs as follows: Polyester Fabric Lumber Glue Total Filling Job 601 $49,500 $62,400 $166,800 $278,700 Job 602 38,100 67,800 146,000 251,900 Job 603 35,100 46,000 81,200 162,300 Factory overhead-indirect materials $6,400 6,400 Total $122,700 $176,200 $394,000 $6,400 $699,300 The glue is not a significant cost, so…arrow_forwardGive typing answer with explanation and conclusionarrow_forwardeducation.wiley.com/was/ui/v2/assessment-player/index.html?launchid=63b6bdc2-60b0-49f0-8567-aeb590318d19#/question/0 PO → bofa workjam (ulta) school b bartleby b bartleby we wiley 4 Homework Question 1 of 12 X Your answer is incorrect. Prepaid Insurance Equipment Accumulated Depreciation 1. The trial balance of Cullumber Fitness shows the following balances for selected accounts on November 30, 2022: 2. 3. 4. connect BARE MYOCC h 5. 87,552 14,976 zoom $12,800 Unearned Fitness Revenue $29,184 Note Payable Rent Receivable 40,800 quizletE google docs 640 Using the additional information given below, prepare the appropriate monthly adjusting entries at November 30. (Use Fitness Revenue instead of Service Revenue.) (List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) google slides 0/1 instagram Revenue earned for fitness center fees, but not yet billed, totaled $3,456 on November 30. The note payable…arrow_forward

- McGraw-Hill Connect Deep Integ X Question 3-SET-CH 04 HW-C X Connect ion.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%25 Problem 4-49 (LO 4-3) Pre-move house-hunting costs Lodging and travel expenses (not meals) while moving Cost of moving furniture and personal belongings. Dulari's moving expenses deduction Dulari, a single, member of the military, was stationed at Camp Pendleton, California. On July 1, 2022, her army company transferred her to Washington, DC, as a permanent duty station. Dulari was active duty for the entire year. During 2022, she incurred and paid the following expenses related to the move: Multiple-Choice Questions H mheducation.com%252Fmghmiddleware%252Fmheproducts%252FlmsCloseWindow.htm#/activity/question-group/kEZASsBkEPSL-pFo... Q Search Required: She did not receive reimbursement for any of these expenses from the army; her AGI for the year was $35,500. What amount can Dulari deduct as moving expenses on her 2022 return? +…arrow_forward1. Jenny must have multiple skills to complete her job as a cashier at the grocery store. She must be able to operate the register, use excellent customer service skills, and bag groceries. Which core dimension does this describe for the multiple skills required for Jenny's job? skill variety O feedback O autonomy O task significance 6:07 PM (? O 55°F Mostly clear 3/5/2022 O Type here to search delete home end pg up prt scr insert 米 & backspace numlk $4 4 %3D %23 6 7. 8. 6. 3arrow_forwardplem Set: Mod x * CengageNOW2| On x * Cengage Learning B Milestone Two Guidel x G module 5 problem se x+ ow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogres.. еBook Show Me How Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $44,000 in cash and giving a short-term note for $272,000. Legal fees paid were $1,780, delinquent taxes assumed were $14,700, and fees paid to remove an old building from the land were $21,700. Materials salvaged from the demolition of the building were sold for $4,700. A contractor was paid $960,600 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. Next Previous 3:20 PM Check My Work 11/28/2021 56 Farrow_forward

- how do I do thisarrow_forward合日 Document1 Q. Search in Document Home Insert Draw Design Layout References Mailings Review View + Share a A. A- E -E - E , E E Times New R... - AaBbCcDc AaBbCcDdEe AaBb( AabbCcDdEe AaBbCcDdEe AaBbCcDdEe AgBbCcDdEe AgBbCcDdEe Paste в I U - abe X, x2 Normal Heading 1 Subtle Emph.. Emphasis Styles Pane No Spacing Heading 2 Title Subtitle You are considering opening your own restaurant. To do so, you will have to quit your current job, which pays $46k per year, and cash in your life savings of $200k, which have been in a certificate of deposit paying 6% per year. You will need this $200k to purchase equipment for your restaurant operations. You estimate that you will have to spend $4k during the year to maintain the equipment so as to preserve its market value at $200k. Fortunately, you own a building suitable for the restaurant. You currently rent out this building on a month-by-month basis for $2,500 per month. You anticipate that you will spend $50k for food, $40k for extra help, and…arrow_forwardPlease help on part a and it’s subparts and part barrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education