ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

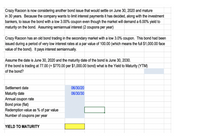

Transcribed Image Text:Crazy Racoon is now considering another bond issue that would settle on June 30, 2020 and mature

in 30 years. Because the company wants to limit interest payments it has decided, along with the investment

bankers, to issue the bond with a low 3.00% coupon even though the market will demand a 6.00% yield to

maturity on the bond. Assuming semiannual interest (2 coupons per year)

Crazy Racoon has an old bond trading in the secondary market with a low 3.0% coupon. This bond had been

issued during a period of very low interest rates at a par value of 100.00 (which means the full $1,000.00 face

value of the bond). It pays interest semiannually.

Assume the date is June 30, 2020 and the maturity date of the bond is June 30, 2030.

If the bond is trading at 77.00 (= $770.00 per $1,000.00 bond) what is the Yield to Maturity (YTM)

of the bond?

Settlement date

06/30/20

Maturity date

Annual coupon rate

Bond price (flat)

Redemption value as % of par value

Number of coupons per year

06/30/30

YIELD TO MATURITY

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 12. The initial investment for a geothermal power plant is $60,000,000 and is to be paid in two years (year 0 and year 1) equally. The electricity generated by the plant is expected to bring revenue of 10,000,000 per year increasing at a rate of 3% annually. The total annual expenses of the plant will be 1,500,000 increasing at a rate 4% annually. The company that owns the plant plans to borrow 50% of the capital expenditure at a rate 6%. The discount rate for this company is 12% and its taxation rate is 35%. A 10 year depreciation period is allowed for this power plant. The plant is expected to generate electricity for 30 years after which it will have zero value. What is the present value of this investment? Should the company undertake the investment? 13. What would be the answer to the plant of problem 12 if the company were allowed to borrow 80% of the cost of the geothermal power plant at an annual rate of 5%.arrow_forwardA loan of nominal amount £200000 in bonds of nominal amount £100 is to be repaid by 20 annual drawings, each of 100 bonds, the first drawing being 1 year after the issue date. Interest will be payable quarterly in arrears at the rate of 8% per annum. Redemption will be at par for the first 10 drawings and at 140% thereafter. An investor, who will be liable to income tax at the rate of 10%, purchases the entire loan on the issue date at a price to obtain a yield per annum of 5% net effective. What price does the investor pay for the entire loan?arrow_forward4. You have developed an innovative new project that is estimated to produce an annual revenue stream (money in) of $15,000 per year for the next 10 years. Your current corporate cost of Money is 4%. However, in year 5, your CFO projects that rate will rise to 6% for the remaining five years of the project's lifespan. What is the NPV of this money in cashflow today? (we are ignoring any money out costs)arrow_forward

- Find the Future Worth (F) of the following geometric series cash flow: 0 1 1000 i = 10% 23 4 1100 1210 g= 10% 10 2,358arrow_forwardA bond is sold at a face value of $200 with an annual yield of 3%. how much will the bondholder have recieved in payment from the bodn issuer after the bond has reached its maturity date of one year? A) 200 B) 406 C) 206 D) 6arrow_forwardHow much money would have to be placed in a saving account each year to replace machine costing $10,000 today at the end of 10 years if i= 10% annual interest rate compounded yearly and if the first cost of the machine is assumed to increase at a 6% rate? Assume the salvage value is zero. a) $1,340 b) $2,030 c) $1,510 d) $1123arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education