ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

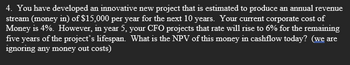

Transcribed Image Text:4. You have developed an innovative new project that is estimated to produce an annual revenue

stream (money in) of $15,000 per year for the next 10 years. Your current corporate cost of

Money is 4%. However, in year 5, your CFO projects that rate will rise to 6% for the remaining

five years of the project's lifespan. What is the NPV of this money in cashflow today? (we are

ignoring any money out costs)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. Charlie Chaplin borrowed P100,000.00 on October 31, 2019 from Mr. Beans and the loan has an interest rate of 6% per year until full payment. How much should Chaplin pay Bean on March 10, 2020 in order to fully satisfy the obligation?arrow_forwardAssume that the cost of a university education will be $250,000 when Mr. Parata's child enters university in 12 years' time. If the discount rate is 6.76% per annum, compounded monthly, what is the present value (in 2 decimal places)?" Do not enter "$" in your answer. For example, enter "1000.23" for "$1000.23".arrow_forwardplease explain so I can understand. Engineering Econarrow_forward

- Give typing answer with explanation and conclusion A small company purchased now for $120,000 will lose $300 each year for the first four years. An additional $600 in the company in the fourth year will result in a profit of $9500 each year from the fifth through the twelfth year. At the end of 12 years, the company can be sold for $135,000. a) Draw the cash flow diagram b) Determine the IRR for this project. c) Calculate the FW if MARR is 5%. d) Calculate the ERR when ε = 7%.arrow_forward2. Use the provided chart to solve this problem.arrow_forwardFind the value of P in the following cash flow. i-5% per annum. ▲$1500 0 1 2 3 4 5 6 7 8 A₁-$1000 A₂-$800 interest rate (IR): 5% interest rate (IR): 5% n n A/F 1 1 1.0000 2 2 0.4878 3 3 0.3172 4 4 0.2320 5 5 0.1810 6 0.1470 7 0.1228 0.1047 9 0.0907 10 0.0795 6 7 8 9 10 single payment FIP PIF 1.0500 0.9524 1.1025 0.9070 1.1576 0.8638 1.2155 0.8227 1.2763 0.7835 1.3401 0.7462 1.4071 0.7107 1.4775 0.6768 1.5513 0.6446 1.6289 0.6139 uniform payment series A/P FIA 1.0500 1.0000 0.5378 2.0500 0.3672 3.1525 0.2820 4.3101 0.2310 5.5256 0.1970 6.8019 0.1728 8.1420 0.1547 9.5491 0.1407 11.0266 0.1295 12.5779 PIA 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217arrow_forward

- 2. Which is more desirable: investing $2000 at 6% peryear compound interest for three years, or investing$2000 at 7% per year simple interest for three years? please include a cashflow(not excel)arrow_forwardSubject : Engineering Economics Please write handwritten Answerarrow_forwardAre the following cash flow diagrams economically equivalent if the interest rate is 15% per year? 0 7M 1 8M 2 ΕΟΥ 6M 3 5M 4 H 0 7M 1 7M 2 ΕΟΥ The left-hand diagram's discounted value at the EOY 0 is $[ M. (Round to three decimal places.) 7M 3 7M 4arrow_forward

- 1. Consider a wine dealer who has k bottles of wine. The dealer can sell them now (t = 0) or can store it for some time and then sell them later. The value of k bottles at t-th month is given by: Vt = ket The dealer can use the sales revenue as principal in a risk-free investment at rate r. (b) Write out the present value PV, of k bottles at t-th month.arrow_forwardAssume r=0.1. What is the present value of the following stream of cash flow? Year 0 Year 1 Year 2 Year Year 4 Year ... 1000 1000 1000 1000 1000 1000 11000 100000 12000 10000arrow_forward8. (10%) Two pumps are being considered for service in Africa. Each can draw water from a depth of 50 meters and both pumps deliver 60 horsepower (output) to the pumping operation. One of the pumps must be selected. It is expected that the pump will be in use 800 hours per year and electricity costs $0.14 per kilowatt-hour. The following data are available. Recall that 1 hp = 0.746 kW. Capital investment Electrical efficiency Annual maintenance cost Useful life Pump A $2,400 0.92 $320 3 years Pump B $2,000 0.80 $200 6 years The MARR is 15% per year. Determine which alternative should be selected if the repeatability assumption applies.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education