FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

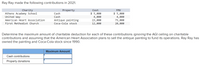

Transcribed Image Text:Ray Ray made the following contributions in 2021.

Charity

Property

Cost

FMV

$ 5,000

Athens Academy School

United Way

$ 5,000

4,000

15,000

Cash

Cash

4,000

75,000

20,000

American Heart Association

Antique painting

First Methodist Church

Coca-Cola stock

12,000

Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable

contributions and assuming that the American Heart Association plans to sell the antique painting to fund its operations. Ray Ray has

owned the painting and Coca-Cola stock since 1990.

Maximum Amount

Cash contributions

Property donations

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me. Thankyou.arrow_forwardBhikhoarrow_forward2. Five entries required Required: On January 1, 2024, a foundation made a pledge to pay $47,000 per year at the end of each of the next five years to the Cancer Research Center, a nonprofit voluntary health and welfare organization, as a salary supplement for a well-known researcher. On December 31, 2024, the first payment of $47,000 was received and paid to the researcher. On the books of the Cancer Research Center, record the pledge in January, assuming the appropriate discount rate is 5 percent on an annual basis. The appropriate present value annuity factor is 4.32950. Record the increase in the present value as of December 31. Record the receipt of the first $47,000 on December 31 and the payment to the researcher. Note: If no entry is required for a transaction or event, select "No Journal Entry Required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar. A. On the books of the Cancer Research Center, record the…arrow_forward

- Use Worksheet 15.1. When Jackson Holmes died in 2018, he left an estate valued at $8,300,000. His trust directed distribution as follows: $22,000 to the local hospital, $160,000 to his alma mater, and the remainder to his three adult children. Death-related costs were $17,000 for funeral expenses, $45,000 paid to attorneys, $3,000 paid to accountants, and $35,000 paid to the trustee of his living trust. In addition, there were debts of $135,000. Use Worksheet 15.1 and Exhibit 15.5 and Exhibit 15.6 to calculate the federal estate tax due on Jackson's estate. Round your answer to nearest whole dollar. $arrow_forwardWhich of the following transfers made by your client will be excluded from the client's total gifts in the year made? A) Made a $20,000 contribution to the Shriner's Hospital, which provides free medical care to children B) Paid a family member $15,000 so she could go to school C) Made a $30,000 gift to the donor's spouse D) Paid a hospital $11,000 for medical services rendered to a friendarrow_forwardCalvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Item Cost FMV Hobbs Medical Center IBM stock $ 8,200 $ 54,000 State Museum Antique painting 6,600 3,960 A needy family Food and clothes 720 430 United Way Cash 40,000 40,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Calvin’s AGI is $129,000. Charitable contribution deduction? Carryover?arrow_forward

- Accounting In 2021 Ron and Hermione made the following contributions to the following organizations. Category Charity Property Cost FMV Goodwill Clothes and misc. household items (several years old) $25,700 $5,350 Hogwarts Museum Coin Collection $12,500 $30,900 Ron and Hermione’s best friends whose house burned down Cash $3,500 $3,500 Salvation Army Cash $15,700 $15,700 Toys for Tots New toys $6,500 $6,500 Henry Ford Hospital Rigor stock (held 3 years) $22,000 $10,000 Wayne State University Exxon Mobil Stock (held 5 years) $26,900 $69,500 High School Stock (held 6 months) 6,500 10,000 Wayne State University Cash 13,000 $13,000 Determine the contribution category for each of these contributions – assuming that the Hogwarts Museum plans to display the coin collection in the museum – and place in the column above. Determine Ron and Hermione’s maximum…arrow_forward[The following information applies to the questions displayed below.] Calvin reviewed his canceled checks and receipts this year (2023) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Hobbs Medical Center State Museum A needy family United Way Item Problem 6-50 Part-b (Static) IBM stock Antique painting Food and clothes Cash Cost $ 5,000 5,000 400 8,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Note: Leave no answer blank. Enter zero if applicable. FMV $ 22,000 3,000 250 8,000 b. Calvin's AGI is $100,000, but the State Museum told Calvin that it plans to sell the painting.arrow_forwardIn need help with preparing the following for journal entries, balance and statement sheets. I would like to know how close I'm to the right answers A donor made a $1,000,000 pledge, giving the foundation a legally enforceable 90-day note for the full amount. The same donor paid $500,000 of the amount pledged. The foundation purchased a building for $900,000, paying $90,000 in cash and giving a ten-year mortgage for the balance. The building has a 25-year useful life. The foundation charges a half-year’s depreciation for all assets in the year they are acquired. The foundation hired five employees. By year-end, these employees have earned $10,000 in salaries and wages for which they have not been paid. The foundation accounts for its activities in a single fund. Prepare journal entries to record the transactions, making the following alternative assumptions as to the fund’s measurement focus: Cash only Cash plus other current financial resources (cash plus short-term receivables…arrow_forward

- Nonearrow_forwardAquamarine Corporation, a calendar year C corporation, makes the following donations to qualified charitable organizations during the current year: Painting: The amount of the contribution is Stock: The amount of the contribution is Groceries: The amount of the contribution is Adjusted Basis $6,000 $10,000 Painting held four years as an investment, to a church, which sold it immediately Apple stock held two years as an investment, to United Way, which sold it immediately Canned groceries held one month as inventory, to Catholic Meals for the Poor 15,750 35,000 7,800 13,000 Determine the amount of Aquamarine Corporation's charitable deduction for the current year. (Ignore the taxable income limitation.) Therefore, the total charitable contribution is $ Fair Market Valuearrow_forwardA6) Finance Walton bought one full bitcoin in March 2020. His bases in the coin is $5838. In July 2021, he donated 0.25 of the coin to a qualified charitable organization. The fair market value of a full coin at the time of donation was $33,800. what is his deductible charitable contribution? a: $1,460 b: $5,838 c: $8,450 d: $33,800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education