FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

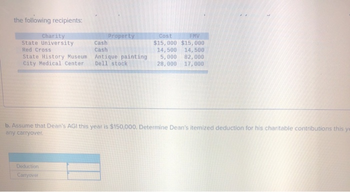

Transcribed Image Text:the following recipients:

Charity

State University

Red Cross

State History Museum

City Medical Center

Cash

Cash

Deduction

Carryover

Property

Antique painting

Dell stock

Cost

FMV

$15,000 $15,000

14,500

82,000

17,000

14,500

5,000

28,000

b. Assume that Dean's AGI this year is $150,000. Determine Dean's itemized deduction for his charitable contributions this ye

any carryover.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A not-for-profit organization receives $250 from a donor. The donor receives two tickets to a theater show and an acknowledgment in the theater program. The tickets have a fair market value of $50. What amount is recorded as contribution revenue? A.) 250 B.) 200 C.) 50 D.) 0arrow_forwardA donor gives the oroganization cash and specifies that the money is to be usedin 4 years. Is this change in net assets with or without donor restrictions?arrow_forward-Suppose that deans objective with the donation to the museum was to finance expansion of the historical collection. What is deans charitable contribution deduction for the painting in this situation?arrow_forward

- Scofield City received a donation from the estate of the late Lisa O’Reilly to be used to support the city’s public library. The gift consisted of $200,000 cash and a portfolio of securities with a market value of $350,000. The securities have a book value of $250,000. The donor stipulated that the principal of the gift, including investment gains (realized and unrealized) but excluding investment losses, must be kept intact. The income must be used to care for and maintain the book collection at the newly renamed O’Reilly Public Library. All appropriate costs, including investment losses, may be charged against the revenues yearly to determine the amount available for the specified purposes. During the year, the city engaged in the following transactions on behalf of the library. Prepare the appropriate entries in the city’s permanent fund. a) Accepted the donation. b) Received dividends and interest of $18,000. c) Purchased securities for $200,000. d) Sold securities that were part…arrow_forwardP. 10-8 Fiduciary funds are accounted for on a full accrual basis. Upon the death of a police officer, Leff City establishes a trust fund to provide for the education of the officer's college-age children. 1. In what type of fund should the resources contributed to the fund be recorded?arrow_forwardIshak Center for Families, a nonprofit organization, receives $300,000 from a donor who requires that the Center raise $300,000 in matching funds, or the Center will have to return the $300,000. What journal entry would the Center record upon receipt of the gift? Debit cash $150,000; credit deferred revenue $300,000 Debit cash $300,000; credit contribution revenue with donor restrictions $300,000 Debit cash $300,000; credit contribution revenue without donor restrictions $300,000 No entry would be recordedarrow_forward

- Subject:arrow_forwardRequired information [The following information applies to the questions displayed below.] Calvin reviewed his canceled checks and receipts this year (2023) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Hobbs Medical Center State Museum A needy family United Way Item IBM stock Antique painting Food and clothes Cash Charitable contribution deduction Carryover Cost $ 7,800 6,400 680 36,000 FMV $ 50,000 3,840 410 36,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Note: Leave no answer blank. Enter zero if applicable. b. Calvin's AGI is $240,000, but the State Museum told Calvin that it plans to sell the painting.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education