FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

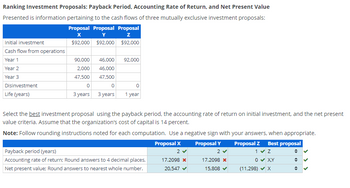

Transcribed Image Text:Ranking Investment Proposals: Payback Period, Accounting Rate of Return, and Net Present Value

Presented is information pertaining to the cash flows of three mutually exclusive investment proposals:

Proposal Proposal Proposal

Initial investment

Cash flow from operations

Year 1

x

Y

Z

$92,000 $92,000 $92,000

Year 2

Year 3

Disinvestment

Life (years)

90,000 46,000 92,000

2,000

46,000

47,500

47,500

0

0

0

3 years 3 years

1 year

Select the best investment proposal using the payback period, the accounting rate of return on initial investment, and the net present

value criteria. Assume that the organization's cost of capital is 14 percent.

Note: Follow rounding instructions noted for each computation. Use a negative sign with your answers, when appropriate.

Proposal X

Proposal Y

Proposal Z Best proposal

Payback period (years)

Accounting rate of return; Round answers to 4 decimal places.

Net present value; Round answers to nearest whole number.

2 ▾

17.2098 x

2▾

1 ▾ Z

÷

20,547 ✔

17.2098 x

15,808

0 X,Y

(11,298) X

÷

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- All information is providedarrow_forwardRanking roposals: Presented is information pertaining to the cash flows of three mutually exclusive investment proposals: Proposal A Proposal B $ 60,000 $ 60,000 Initial investment Cash flow from operations Year 1 Year 2 Year 3 Disinvestment Life (years) 50,000 6,000 29,000 0 3 years 30,000 30,000 25,000 0 3 years Payback period (years): Round answers 2 decimal places. Proposal C $ 60,000 Accounting rate of return; Round answers to 4 decimal places. 60,000 • Round payback period (years) to two decimal places. • Round accounting rate of return to four decimal places. • Round net present value to the nearest whole number. • Use negative signs with your answers, when appropriate. Net present value; Round answers to neare whole number. 0 1 year (a) Select the best investment proposal using the payback period, the accounting rate of return on initial investment, and the net present value criteria. Assume that the organization's cost of capital is 12 percent. Rate of Proposal A 2.14 13.8888…arrow_forwardAssume that an investment provides the following cash inflows over a three-year period: Year 1 Year 2 Year 3 Total $5,000 5,000 7,000 $ 17,000 Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Assuming a discount rate of 17%, what is the present value of these cash inflows?arrow_forward

- Comparison of NPV and IRR: The Case of Mutually Exclusive Projects Estimated cashflow data for each of two projects, A and B, and the discount rate, r, to be used for the analysis ofcapital investment projects are given below:[LO 12-9][LO 12-9]Year Project A Project B0 ($10,000) ($10,000)1 $7,000 $2,000 2 $3,000 $3,000 3 $2,000 $4,000 4 $2,000 $6,000 Discount rate, r = 10.0%.Required 1. In a capital budgeting context, explain the difference between independent and mutually exclusiveinvestments. Give an example of each type of investment project. What is the primary implication ofthis distinction for the analysis of capital investment projects?2. Use the built-in functions in Excel to calculate the IRR and the NPV for each investment project. Whichof these projects—if either—should be accepted if they are considered independent projects? RoundIRRs to 2 decimal places and NPVs to the nearest whole dollar. 3. An NPV profile for a project is a plot of the project’s NPV as a function of the…arrow_forwardInformation on four investment proposals is given below. Investment required Present value of cash inflows Net present value Life of the project Required: 1 Compute the profitability index for each investment proposal. Note: Round your answers to 2 decimal places. 2. Rank the proposals in terms of preference Investment Profitability Proposal Index A B C D S (150,000) 211,800 $61,500 Rank Preference 5 years Investment Proposal $(80,000) 110,400 $ 30,400 7 years $ (160,000) 241,600 $ 81,600 6 years D $ (910,000) 1.214,500 $ 304,500 6 yearsarrow_forwardGarrison Company has two Investment opportunitles. A cash flow schedule for the Investments Is provided below: Year Investment A Investment B $(4,900) 1,960 1,960 1,960 $(5,850) 2,940 2 1,960 1,960 4 1,960 980 Considering the unequal Investments, which of the following techniques would be most approprlate for choosIng between Investment A and Investment B? Multiple Choice Payback method Present value index Net present value method None of these answers is correctarrow_forward

- Attend all partarrow_forwardnformation on four investment proposals is given below: Investment Proposal A B C D Investment required $ (900,000) $ (170,000) $ (90,000) $ (1,430,000) Present value of cash inflows 1,263,600 233,400 136,500 1,908,300 Net present value $ 363,600 $ 63,400 $ 46,500 $ 478,300 Life of the project 5 years 7 years 6 years 6 years Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference.arrow_forwardPayback Period and Accounting Rate of Return: Equal Annual Operating Cash Flows with Disinvestment Minn is considering an investment proposal with the following cash flows: Initial investment-depreciable assets $227,500 Net cash inflows from operations (per year for 10 years) 32,500 Disinvestment-depreciable assets 22,750 For parts b. and c., round answers to three decimal places, if applicable. a. Determine the payback period. 7 years b. Determine the accounting rate of return on initial investment. 5.495 c. Determine the accounting rate of return on average investment. 4.902arrow_forward

- A techniques-Decision among mutually exclusive investments Pound Industries is attempting to select the best of three mutually exclusive projects. The initial investment and after-tax cash inflows associated with these projects are shown in the following table. Cash flows Initial investment (CF) Project A $60,000 Project B $100,000 Project C $90,000 Cash inflows (CF), t=1 to 5 $20,000 $31,500 $32,000 a. Calculate the payback period for each project. b. Calculate the net present value (NPV) of each project, assuming that the firm has a cost of capital equal to 12%. c. Calculate the internal rate of return (IRR) for each project. d. Indicate which project you would recommend. a. The payback period of project A is years. (Round to two decimal places.) % [7%arrow_forwardMemanarrow_forwardPls give me a correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education