FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

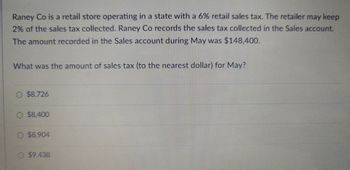

Transcribed Image Text:Raney Co is a retail store operating in a state with a 6% retail sales tax. The retailer may keep

2% of the sales tax collected. Raney Co records the sales tax collected in the Sales account.

The amount recorded in the Sales account during May was $148,400.

What was the amount of sales tax (to the nearest dollar) for May?

O $8.726

O $8,400

O $8.904

O $9.438

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The following selected transactions apply to Topeca Supply for November and December, Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November, Year 1, were $165,000 plus sales tax of 7 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December, Year 1, were $180,000 plus sales tax of 7 percent. Required: a. Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). b. What was the total amount of sales tax paid in Year 1? c. What was the total amount of sales tax collected in Year 1?…arrow_forwardDuring December, Far West Services makes a $3,600 credit sale. The state sales tax rate is 6% and the local sales tax rate is 2.5%. (Note: the sales tax amount is in addition to the credit sale amount.) Record sales and sales tax payable. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardAccounting Question: The following are independent situations: Record the sales transactions and related taxes for each client. Show steps please. 1. Max rang up $14,000 of sales, plus HST of 13%, on it's cash register on April 10. 2. Quince rang up $35,400 of sales, before sales taxes, on its cash register on April 21. The company charges 5% GST and No PST. 3. Jace charges 5% GST and 7% PST on all sales. On April 27, the company collected $23,200 sales in cash plus sales taxes.arrow_forward

- NYFG, Inc.I has sales including sales taxes for the month of $742,000. If the sales tax rate is 6%, how much does NYFG owe for sales tax? Select one: O a. $48,000 O b. $42,000 c. $38,260 d. $45,420 e. $44,520arrow_forwardWindsor's Boutique has total receipts for the month of $27510 including sales taxes. If the sales tax rate is 5%, what are Windsor's sales for the month? $26200 $26135 $27510 It cannot be determined.arrow_forwardCheyenne Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $10,812. All sales are subject to a 6% sales tax. (a1) Compute sales taxes payable. Sales taxes payable $ eTextbook and Media List of Accounts Save for Later Attempts: unlimited Submit Answer (a2)arrow_forward

- Record the following selected transactions: a. Sold $900 of merchandise on account, subject to 7% sales tax. The cost of the goods sold was $510. b. Paid $436 to the state sales tax department for taxes collected. Required: Journalize the entries. Refer to the Chart of Accounts for exact wording of account titles. Chart of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Inventory 131 Estimated Returns Inventory 140 Supplies 142 Prepaid Insurance 180 Land 190 Equipment 191 Accumulated Depreciation LIABILITIES 210 Accounts Payable 216 Salaries Payable 221 Sales Tax Payable 222 Customers Refunds Payable 231 Unearned Rent 241 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends REVENUE 410 Sales EXPENSES 510 Cost of Goods Sold 521 Delivery Expense 522…arrow_forwardSales Tax Transactions Journalize the entries to record the following selected transactions. a. Sold $486,000 of merchandise on account, subject to a sales tax of 5%. The cost of the goods sold was $286,740. If an amount box does not require an entry, leave it blank. b. Paid $42,780 to the state sales tax department for taxes collected. If an amount box does not require an entry, leave it blank. Check My Work ▾ Previous Nextarrow_forwardDuring month of May, UMPI, Inc. had cash sales of $243,624 and credit sales of $153,687, both of which include Maine sales tax of 5.5% that must be remitted to the state by June 15th. Note that UMPI did not segregate the sales tax from the sales when made during the month. They just record the full amount as sales revenue. Prepare the adjusting journal entry to fairly present the May 31 financial statements.arrow_forward

- Required Information [The following information applies to the questions displayed below.] The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1. Cash sales for November Year 1 were $65,500 plus sales tax of 7 percent. 2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1. 3. Cash sales for December Year 1 were $82,500 plus sales tax of 7 percent. b. What was the total amount of sales tax paid in Year 1? Sales tax paidarrow_forwardGAS" Company does not segregate sales and sales taxes at the time of sale. The sales register total for the month of March was $25000. Assume that all sales are subject to a 13% sales tax. Required: Based on the above-given information, answer the following questions: • What amount must be presented as a sales tax expense on the Income statement for the month of March? • What is the amount that must be presented as sales revenue on the income statement for the month of March? If the "GAS" Company did not pay the income tax payable as of 31/3, then the company must present sales tax payable with a value of:arrow_forwardCoronado Co. is a retail store operating in a state with a 7% retail sales tax. The retailer may keep 2% of the sales tax collected. Coronado Co. records the sales tax in the Sales Revenue account. The amount recorded in the Sales Revenue account during May was $ 744720.The amount of sales taxes (to the nearest dollar) for May is $ 48720. $ 67263. $ 61656. $ 52131.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education