FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

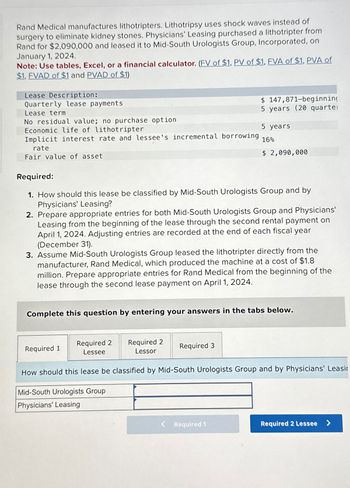

Transcribed Image Text:Rand Medical manufactures lithotripters. Lithotripsy uses shock waves instead of

surgery to eliminate kidney stones. Physicians' Leasing purchased a lithotripter from

Rand for $2,090,000 and leased it to Mid-South Urologists Group, Incorporated, on

January 1, 2024.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of

$1, FVAD of $1 and PVAD of $1)

Lease Description:

Quarterly lease payments

Lease term

No residual value; no purchase option

Economic life of lithotripter

Implicit interest rate and lessee's incremental borrowing

rate

Fair value of asset

Required:

1. How should this lease be classified by Mid-South Urologists Group and by

Physicians' Leasing?

2. Prepare appropriate entries for both Mid-South Urologists Group and Physicians'

Leasing from the beginning of the lease through the second rental payment on

April 1, 2024. Adjusting entries are recorded at the end of each fiscal year

(December 31).

3. Assume Mid-South Urologists Group leased the lithotripter directly from the

manufacturer, Rand Medical, which produced the machine at a cost of $1.8

million. Prepare appropriate entries for Rand Medical from the beginning of the

lease through the second lease payment on April 1, 2024.

Complete this question by entering your answers in the tabs below.

Required 2

Lessee

Required 1

$ 147,871-beginning

5 years (20 quarter

5 years

16%

$ 2,090,000

Required 2

Lessor

How should this lease be classified by Mid-South Urologists Group and by Physicians' Leasir

Mid-South Urologists Group

Physicians' Leasing

Required 3

< Required 1

Required 2 Lessee >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with all Questionsarrow_forwardRequired information [The following information applies to the questions displayed below.] Hospital Equipment Company (HEC) acquired several fMRI machines for its inventory at a cost of $4,200 per machine. HEC usually sells these machines to hospitals at a price of $7,440. HEC also separately sells 12 months of training and repair services for fMRI machines for $1,860. HEC is paid $7,440 cash on November 30 for the sale of an fMRI machine delivered on December 1. HEC sold the machine at its regular price, but included one year of free training and repair service. Required: 1. For the machine sold at its regular price, but with one year of "free" training and repair service, determine the dollar amount of revenue earned from the equipment sale versus the revenue earned from the training and repair services. Equipment Service Allocated Transaction Pricearrow_forwardWhat would be the total fire insurance premium for Best Hardware if their $685,000 building belongs in structural classification B? The contents are worth $840,250 and they received an area rating of 4. The rates per $100 are found in Table 19-4. (Round your answer to the nearest cent.) a. $12,071.40 b. $12,180.08 c. $14,434.18 d. $14,698.10arrow_forward

- Pls helparrow_forwardRand Medical manufactures lithotripters. Lithotripsy uses shock waves instead of surgery to eliminate kidney stones. Physicians' Leasing purchased a lithotripter from Rand for $2,450,000 and leased it to Mid-South Urologists Group, Incorporated, on January 1, 2024. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) Lease Description: Quarterly lease payments Lease term No residual value; no purchase option $159,882-beginning of each period 5 years (20 quarters) 5 years Implicit interest rate and lessee's incremental borrowing rate 12% $ 2,450,000 Economic life of lithotripter Fair value of asset Required: 1. How should this lease be classified by Mid-South Urologists Group and by Physicians' Leasing? 2. Prepare appropriate entries for both Mid-South Urologists Group and Physicians' Leasing from the beginning of the lease through the second rental payment on April 1, 2024. Adjusting entries are recorded at the end of…arrow_forwarddont give answer in image formatarrow_forward

- Rand Medical manufactures lithotripters. Lithotripsy uses shock waves instead of surgery to eliminate kidney stones. Physicians’ Leasing purchased a lithotripter from Rand for $2,050,000 and leased it to Mid-South Urologists Group, Inc., on January 1, 2021. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Lease Description: Quarterly lease payments $ 122,913—beginning of each period Lease term 5 years (20 quarters) No residual value; no purchase option Economic life of lithotripter 5 years Implicit interest rate and lessee's incremental borrowing rate 8% Fair value of asset $ 2,050,000 Required:1. How should this lease be classified by Mid-South Urologists Group and by Physicians' Leasing?2. Prepare appropriate entries for both Mid-South Urologists Group and Physicians' Leasing from the beginning of the lease through the second rental payment on April 1, 2021.…arrow_forwardConsultants notify management of Discount Pharmaceuticals that a stroke medication poses a potential health hazard. Counsel indicates a product recall is probable and is estimated to cost the company $10.00 million. Required: How will this affect the company's income statement and balance sheet this period? Note: Enter your answers in dollars, not in millions (i.e., $5.5 million should be entered as $5,500,000). Amounts to be deducted should be indicated by a minus sign. Assets Balance Sheet Stockholders' Equity Liabilities Revenues Common Stock Retained Earnings Income Statement Expenses Net Incomearrow_forwardAlva Community Hospital has five laboratory technicians who are responsible for doing a seriesof standard blood tests. Each technician is paid a salary of $30,000. The lab facility representsa recent addition to the hospital and cost $300,000. It is expected to last 20 years. Equipmentused for the testing cost $10,000 and has a life expectancy of 5 years. In addition to the salaries,facility, and equipment, Alva expects to spend $200,000 for chemicals, forms, power, and othersupplies. This $200,000 is enough for 200,000 blood tests.Required:Assuming that the driver (measure of output) for each type of cost is the number of blood testsrun, classify the costs by completing the following table. Put an X in the appropriate box forvariable cost, discretionary fixed cost, or committed fixed cost.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education