ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:from

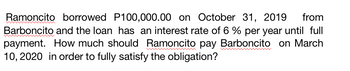

Ramoncito borrowed P100,000.00 on October 31, 2019

Barboncito and the loan has an interest rate of 6 % per year until full

payment. How much should Ramoncito pay Barboncito on March

10, 2020 in order to fully satisfy the obligation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Joel borrows $60,000 at 7% interest per year for a 10-year period. He can make payments of $450 at the beginning of each month until the loan is closed. He plans on making a balloon payment at the end of the period. What is the expected size of the balloon payment?arrow_forwardQ.4. Subject :- Economicarrow_forwardI borrowed $25,000 with an add-on rate, 4% for two years and I have to make weekly payments. Using this information, determine the amount of weekly instalment I will be making. a) Between $234 and $245 b) None of the answers is correct c) Between $254 and $265 d) Between $334 and $345 e) Between $354 and $365arrow_forward

- Suzanne is a recent chemical engineering graduate who has been offered a 5-year contract at a remote O location. She has been offered two choices. The first is a fixed salary of $80,000 per year. The second has a starting salary of $70,000 with annual raises of 8% starting in Year 2. (For simplicity, assume that her salary is paid at the end of the year, just before her annual vacation.) If her interest rate is 10%, which should she take?arrow_forwardGurpreet already had a balance of $1700 on her credit card when she used it to purchase items worth another $335. The minimum monthly payment is 3% of the outstanding balance or $30 dollars, whichever is greater, and the interest rate is 19.7%, compounded daily. If Gurpreet pays only the minimum each month, how long will it take her to pay off the balance? How much interest would she end up paying?arrow_forwardAn employee is earning P12,000 a month and he can afford to purchase a car which will require down payment of P10,000 and a monthly amortization of not more than 30% of his monthly salary. What would be the maximum cash value of a car he can purchase if the seller will agree to a down payment of P10,000 and the balance payable in four years at 18% per year payable in monthly basis. The first payment will be due at the end of the first month?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education