FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Ralph Lauren Corporation designs, markets, and distributes a variety of apparel, home decor,

accessory, and fragrance products. The company's products include such brands as Polo

by Ralph Lauren, Ralph Lauren Purple Label, Ralph Lauren, Polo Jeans Co., and Chaps.

Polo Ralph Lauren reported the following (in thousands) for two recent years:

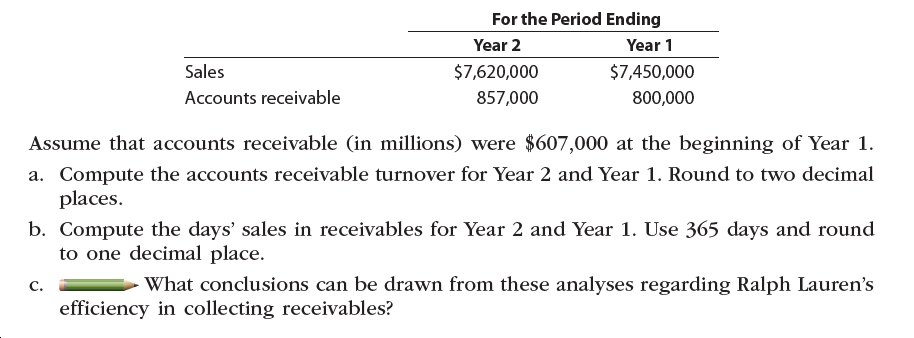

Transcribed Image Text:For the Period Ending

Year 2

Year 1

Sales

$7,620,000

$7,450,000

Accounts receivable

857,000

800,000

Assume that accounts receivable (in millions) were $607,000 at the beginning of Year 1.

a. Compute the accounts receivable turnover for Year 2 and Year 1. Round to two decimal

places.

b. Compute the days' sales in receivables for Year 2 and Year 1. Use 365 days and round

to one decimal place.

What conclusions can be drawn from these analyses regarding Ralph Lauren's

c.

efficiency in collecting receivables?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- Logan Sales provides the following information: Net credit sales: $770,000 Beginning net accounts receivable: $45,000.00 Ending net accounts receivable: $22,000 Calculate the accounts receivable turnover ratio. (Round your answer to the nearest whole number.) A. 23 times B. 35 times C. 33 times D. 17 timesarrow_forwardAccounts receivables = $6,500 Net Sales = $18,122 Use 360 days when when calculating average days collectionarrow_forwardaarrow_forward

- At what amount will accounts receivable for Anderson Company be reported on the balance sheet if the gross receivable balance is $52,000 and the allowance for doubtful accounts is estimated at 4% of gross receivables? Select one: A. $28,200 B. $49,920 C. $52,960 D. $47,000arrow_forwardAccounts Receivable Turnover and Days' Sales in Receivables Rosco Co. manufactures and markets food products throughout the world. The following sales and receivable data were reported by Rosco for two recent years: Year 2 Year 1 Sales $7,259,850 $6,860,175 Accounts receivable 719,050 704,450 Assume that the accounts receivable were $602,250 at the beginning of Year 1. a. Compute the accounts receivable turnover for Year 2 and Year 1. Round your answers to one decimal place. Year 2: Year 1: b. Compute the days' sales receivables at the end of Year 2 and Year 1. Use 365 days per year your calculations. Round your answers to one decimal place. Year 2: days Year 1: days C. The change in the accounts receivable turnover from year 1 to year 2 indicates a(n) indicates a(n) - in the efficiency of collecting accounts receivable and is a(n) change. The change in the days' sales in receivables change. Check My Work Previousarrow_forwardcompute number of days sales in receivables round your calculation and answer assume 365 days ina yeararrow_forward

- ccounts receivable turnover and days’ sales in receivables Financial statement data for years ending December 31 for Schultze-Solutions Company follow: 20Y2 20Y1 Sales $1,848,000 $1,881,000 Accounts receivable: Beginning of year 195,300 184,700 End of year 224,700 195,300 a. Determine the accounts receivable turnover for 20Y2 and 20Y1. If required, round the final answers to one decimal place. AccountsReceivableTurnover 20Y2 fill in the blank 1 20Y1 fill in the blank 2 b. Determine the days’ sales in receivables for 20Y2 and 20Y1. Use 365 days, if required round the final answers to one decimal place. Days’ Salesin Receivables 20Y2 fill in the blank 3 days 20Y1 fill in the blank 4 daysarrow_forwardAccounts receivable turnover and days’ sales in receivables Financial statement data for years ending December 31 for Schultze-Solutions Company follow: 20Y2 20Y1 Sales $1,848,000 $1,881,000 Accounts receivable: Beginning of year 195,300 184,700 End of year 224,700 195,300 a. Determine the accounts receivable turnover for 20Y2 and 20Y1. If required, round the final answers to one decimal place. AccountsReceivableTurnover 20Y2 fill in the blank 1 20Y1 fill in the blank 2 b. Determine the days’ sales in receivables for 20Y2 and 20Y1. Use 365 days, if required round the final answers to one decimal place. Days’ Salesin Receivables 20Y2 fill in the blank 3 days 20Y1 fill in the blank 4 days c. Does the change in accounts receivable turnover and the days’ sales in receivables from 20Y1 to 20Y2 indicate a favorable or unfavorable changearrow_forwardAccount Title Beginning Balance Ending Balance Accounts receivable $28,600 $40,500 Allowance for doubtful accounts 1,760 2,160 Notes receivable 47,200 47,200 Interest receivable 930 4,234 The note receivable has a two-year term with a 7.00 percent interest rate. What amount of interest revenue was recognized during the period? How much cash was collected from interest? Please explain how you find the cash received for interestarrow_forward

- 12arrow_forwardAccounts receivable turnover and days’ sales in receivables For two recent years, Robinhood Company reported the following: 20Y9 20Y8 Sales $7,980,000 $6,726,000 Accounts receivable: Beginning of year 610,000 530,000 End of year 590,000 610,000 a. Determine the accounts receivable turnover for 20Y9 and 20Y8. Round answers to one decimal place. 20Y8: 20Y9: b. Determine the days’ sales in receivables for 20Y9 and 20Y8. Use 365 days and round all calculations to one decimal place. 20Y8: days 20Y9: days c. Are the changes in the accounts receivable turnover and days’ sales in receivables from 20Y8 to 20Y9 favorable or unfavorable?arrow_forwardAnalyzing Accounts ReceivableThe following information is taken from the annual report of Coca-Cola Enterprises, Inc.: (amounts in millions) Year 1 Year 2 Net sales $19,058 $19,606 Accounts receivable (net) 1,884 1,802 Calculate the receivable turnover ratio and the receivable collection period for Year 1 and Year 2. Round your answer to two decimal places. Year 1 Year 2 Receivable turnover ratio Receivable collection period days days How much additional cash flow from operations could Coca-Cola Enterprises generate in Year 2 if it could reduce its receivable collection period to just 30 days?Round your final answer to the nearest million dollar. Year 2 Additional cash flow millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education