Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

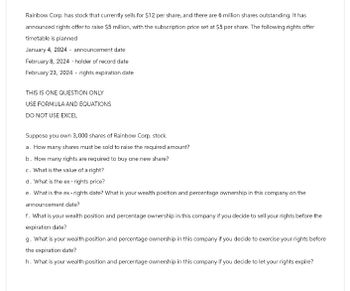

Transcribed Image Text:Rainbow Corp. has stock that currently sells for $12 per share, and there are 6 million shares outstanding. It has

announced rights offer to raise $5 million, with the subscription price set at $5 per share. The following rights offer

timetable is planned

January 4, 2024 - announcement date

February 8, 2024 - holder of record date

February 23, 2024 - rights expiration date

THIS IS ONE QUESTION ONLY

USE FORMULA AND EQUATIONS

DO NOT USE EXCEL

Suppose you own 3,000 shares of Rainbow Corp. stock.

a. How many shares must be sold to raise the required amount?

b. How many rights are required to buy one new share?

c. What is the value of a right?

d. What is the ex-rights price?

e. What is the ex-rights date? What is your wealth position and percentage ownership in this company on the

announcement date?

f. What is your wealth position and percentage ownership in this company if you decide to sell your rights before the

expiration date?

g. What is your wealth position and percentage ownership in this company if you decide to exercise your rights before

the expiration date?

h. What is your wealth position and percentage ownership in this company if you decide to let your rights expire?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 3. Based on the bids and asks of MSFT below, please answer? How much money do I need to pay to buy 2,000 shares of MSFT • How much money do I receive for selling 1000 shares of MSFT Microsoft Corporation (MSFT) NasdaqGS-NasdaqGS Real Time Price. Currency in USD 101.50 -0.07 (-0.07%) As of 1:21PM EST. Market open. . Order Book Top of Book Price 101.46 101.45 Bld 101.44 101.43 101.42 Size 100 357 200 400 427 Price 101.47 101.48 101.49 101.50 101.51 Ask Size 199 Watchlist 600 300 700 400arrow_forwardYou purchased 400 ordinary shares of GE Corporation at $60 per share. The initial margin is 60%. What is your initial equity in this investment? Select one: $12,000 $14,400 $14,800 $15,600 $12,800 Give typing answer with explanation and conclusionarrow_forwardA customer buys 100 shares of ABC stock at $50 and buys 1 ABC Jan 50 Put @ $5. The maximum potential gain is: A $500 B $4,500 C $5,500 D unlimitedarrow_forward

- I don’t understandarrow_forwardPlease do not give solution in image format ?.arrow_forwardAtlas Inc. currently has 20 million shares outstanding. The current stock price is $35/share. The company has decided to do a rights issue. Every existing shareholder will be given 1 right for each share that they own. It will take 4 rights to buy one new share at a price of $25 per share. How much money will the company raise if all of the rights are exercised? Question 9 options: A) $700,000,000 B) $450,000,000 C) $500,000,000 D) $125,000,000 E) $105,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education