Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

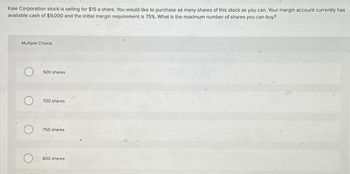

Transcribed Image Text:Kale Corporation stock is selling for $15 a share. You would like to purchase as many shares of this stock as you can. Your margin account currently has

available cash of $9,000 and the initial margin requirement is 75%. What is the maximum number of shares you can buy?

Multiple Choice

500 shares

700 shares

750 shares

800 shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- 2. You purchase 600 shares of Jenkins Corporation at $30 per share using an initial margin of 70%. The stock is now selling for $41 per share and you want to use the excess equity in your account to pyramid. You want to purchase 400 shares of Watson Corporation at $122 per share. If the minimum initial margin is 60%, what is the minimum amount of equity that you will have to put up in this transaction?arrow_forwardYou purchased 400 ordinary shares of GE Corporation at $60 per share. The initial margin is 60%. What is your initial equity in this investment? Select one: $12,000 $14,400 $14,800 $15,600 $12,800 Give typing answer with explanation and conclusionarrow_forwardplease show formulaarrow_forward

- You buy 300 shares of Suncor Energy for $25 per share and deposit initial margin of 50%. The next day, Suncor Energy 's price drops to $20 per share. What is your actual margin the next day? Multiple Choice 25% 40% 50% 62.5% 60%arrow_forwardYou own 100 shares of stock that are earning $2 per share per year. According to market analysts, the stock is expected to continue to earn $2 long into the future. Using the annuity rule, and assuming an interest rate of 6.5 percent, it follows that the present value of these 100 shares is: Multiple Choice O O O O $30.77. $307.79. $3,076.92. $30,076.92.arrow_forwardApisco Tiger Inc. stock is currently selling for $72.00 a share. The stock has a dividend yield of 3.50 percent. How much dividend income will you receive per year if you purchase 500 shares of this stock? Group of answer choices $1,450 $1,170 $921 $1,260 $850arrow_forward

- Please answer is 24840, only post if your answer comes this with explanation and concept. Thabks!arrow_forwardYou have a margin account and deposit Rs.90,000. Assuming the prevailing marginrequirement is 20%, commissions are ignored and D.G.K Cement stock is selling atRs.55 per share while Askari Cement stock is selling at Rs. 85 per share. You invest 40%of your investment in D.G.K cement while remaining is deposited in Askari cement.a. How many shares of each stock can you purchase using the maximum allowablemargin if you invest in both?b. What is your total and percentage profit (loss) if:1. the price of D.G.K Cement Rises to Rs.65 per share while Askari Cement stockrises to Rs. 97 per share?2. the price of D.G.K Cement reduces to Rs.42 per share while Askari Cementstock reduces to Rs. 76 per share?c. If you invest all money in D.G.K cement ONLY and the maintenance margin is 25%,to what price can D.G.K Cement stock fall before you will receive a margin call?d. If you invest all money in Askari cement ONLY and the maintenance margin is 25%,to what price can Askari cement stock fall before you…arrow_forwardYou own 350 shares of Maslyn Tours stock that sells for $52.48 per share. If the stock has a dividend yield of 2.4 percent, how much do you expect to receive next year in dividend income from this investment? Multiple Choice $468.38 $489.81 $429.35 $455.53 $440.83arrow_forward

- You currently own 600 shares of stock AAA. The stock currently trades at $3 a share. The company is contemplating a 1-for-3 reverse stock split. Which of the following best describes your position after the proposed stock split takes place? You will have 200 shares of stock with $9 a share. You will have 1,800 shares of stock with $1 a share. You will have 200 shares of stock with $9 a share. You will have 1,800 shares of stock with $9 a share.arrow_forwardYour corporation currently has 200,000 shares of stock outstanding that sells for $50.00 per share. What will be the amount of shares outstanding and the share price after the reverse stock split. Please show your calculations in the space provided.Your corporation declared a three-for-six reverse stock split.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education