SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

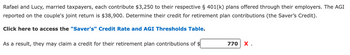

Transcribed Image Text:Rafael and Lucy, married taxpayers, each contribute $3,250 to their respective § 401(k) plans offered through their employers. The AGI

reported on the couple's joint return is $38,900. Determine their credit for retirement plan contributions (the Saver's Credit).

Click here to access the "Saver's" Credit Rate and AGI Thresholds Table.

As a result, they may claim a credit for their retirement plan contributions of $

770 X.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Darrell is an employee of Whitneys. During the current year, Darrells salary is 136,000. Whitneys net self-employment income is also 136,000. Calculate the Social Security and self-employment taxes paid by Darrell and Whitney. Write a letter to Whitney in which you state how much she will have to pay in Social Security and self-employment taxes and why she owes those amounts.arrow_forwardVirginia and Richard are married taxpayers with adjusted gross income of $28,000 in 2019 If Virginia is able to make a $1,500 contribution to her IRA and Richard makes a $1,500 contribution to his IRA, what is the Saver's Credit Virginia and Richard will be eligible for? $0 $1,500 $2,000 $3,000 $4,000arrow_forwardTia is married and is employed by Carrera Auto Parts. In 2019, Carrera established high-deductible health insurance for all its employees. The plan has a 2,700 deductible for married taxpayers. Carrera also contributes 5 percent of each employees salary to a Health Savings Account. Tias salary is 30,000 in 2019 and 32,000 in 2020. Tia makes the maximum allowable contribution to her HSA in 2019 and 2020. She received 600 from the HSA for her 2019 medical expenses. In 2020, she spends 1,400 on medical expenses from her HSA. The MSA earns 28 in 2019 and 46 in 2020. a. What is the effect of the HSA transactions on Tias adjusted gross income? b. How much does Tia have in her HSA account at the end of 2020?arrow_forward

- Linda is an employee of JRH Corporation. Which of the following would be included in Lindas gross income? a. Premiums paid by JRH Corporation for a group term life insurance policy for 50,000 of coverage for Linda. b. 1,000 of tuition paid by JRH Corporation to State University for Lindas masters degree program. c. A 2,000 trip given to Linda by JRH Corporation for meeting sales goals. d. 1,200 paid by JRH Corporation for an annual parking pass for Linda.arrow_forwardRafael and Lucy, married taxpayers, each contribute $3,400 to their respective § 401(k) plans offered through their employers. The AGI reported on the couple's joint return is $40,100. Determine their credit for retirement plan contributions (the Saver's Credit). Click here to access the "Saver's" Credit Rate and AGI Thresholds Table. As a result, they may claim a credit for their retirement plan contributions of $ Feedback Check My Work 3,400 X Taxpayers may claim a nonrefundable credit for certain retirement plan contributions based on eligible contributions to certa retirement plans, such as traditional and Roth IRAs and § 401(k) plans.arrow_forwardRafael and Lucy, married taxpayers, each contribute $3,250 to their respective § 401(k) plans offered through their employers. The AGI reported on the couple's joint return is $38,900. Determine their credit for retirement plan contributions (the Saver's Credit). Click here to access the "Saver's" Credit Rate and AGI Thresholds Table. As a result, they may claim a credit for their retirement plan contributions of $ 0 X.arrow_forward

- Rafael and Lucy, married taxpayers, each contribute $2,900 to their respective § 401(k) plans offered through their employers. The AGI reported on the couple's joint return is $42,000. Determine their credit for retirement plan contributions (the Saver's Credit). Click here to access the "Saver's" Credit Rate and AGI Thresholds Table. As a result, they may claim a credit for their retirement plan contributions of $arrow_forwardRafael and Lucy, married taxpayers, each contribute $2,900 to their respective § 401(k) plans offered through their employers. The AGI reported on the couple's joint return is $38,000. Click here to access the "Saver's" Credit Rate and AGI Thresholds Table. As a result, they may claim a credit for their retirement plan contributions of $arrow_forwardRafael and Lucy, married taxpayers, each contribute $2,900 to their respective § 401(k) plans offered through their employers. The AGI reported on the couple's joint return is $41,000. As a result, they may claim a credit for their retirement plan contributions of $arrow_forward

- Determine the retirement savings contributions credit in each of the following independent cases. Use Table 9-2. a. A married couple filing jointly with modified AGI of $37,500 and an IRA contribution of $1,800. b. A married couple filing jointly with modified AGI of $58,000 and an IRA contribution of $1,900. c. A head of household taxpayer with modified AGI of $33,000 and Roth IRA contribution of $1,990. d. A single taxpayer with modified AGI of $12,000 and an IRA contribution of $2,800. Retirement Savings Contributions Creditarrow_forwardsavitaarrow_forwardMr. Gilbert is self-employed and makes annual contributions to a SEP plan. Ms. Gilbert's employer doesn't offer any type of qualified retirement plan. Each spouse contributes the maximum $6,000 to a traditional IRA. Required: a. Compute the AGI on their joint return if AGI before an IRA deduction is $144,000. b. Compute the AGI on their joint return if AGI before an IRA deduction is $210,100. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Compute the AGI on their joint return if AGI before an IRA deduction is $210,100. $198,100 AGIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT