FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

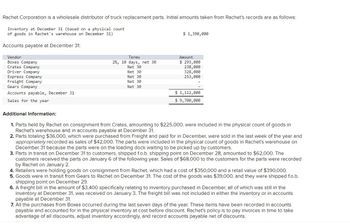

Transcribed Image Text:Rachet Corporation is a wholesale distributor of truck replacement parts. Initial amounts taken from Rachet's records are as follows:

Inventory at December 31 (based on a physical count

of goods in Rachet's warehouse on December 31)

Accounts payable at December 31:

Vendor

Boxes Company

Crates Company

Driver Company

Express Company

Freight Company

Gears Company

Accounts payable, December 31

Sales for the year

Additional Information:

Terms

2%, 10 days, net 30

Net 30

Net 30

Net 30

Net 30

Net 30

$ 1,390,000

Amount

$ 293,000

238,000

328,000

253,000

$ 1,112,000

$ 9,700,000

1. Parts held by Rachet on consignment from Crates, amounting to $225,000, were included in the physical count of goods in

Rachet's warehouse and in accounts payable at December 31.

2. Parts totaling $36,000, which were purchased from Freight and paid for in December, were sold in the last week of the year and

appropriately recorded as sales of $42,000. The parts were included in the physical count of goods in Rachet's warehouse on

December 31 because the parts were on the loading dock waiting to be picked up by customers.

3. Parts in transit on December 31 to customers, shipped f.o.b. shipping point on December 28, amounted $62,000. The

customers received the parts on January 6 of the following year. Sales of $68,000 to the customers for the parts were recorded

by Rachet on January 2.

4. Retailers were holding goods on consignment from Rachet, which had a cost of $350,000 and a retail value of $390,000.

5. Goods were in transit from Gears to Rachet on December 31. The cost of the goods was $39,000, and they were shipped f.o.b.

shipping point on December 29.

6. A freight bill in the amount of $3,400 specifically relating to inventory purchased in December, all of which was still in the

inventory at December 31, was received on January 3. The freight bill was not included in either the inventory or in accounts

payable at December 31.

7. All the purchases from Boxes occurred during the last seven days of the year. These items have been recorded in accounts

payable and accounted for in the physical inventory at cost before discount. Rachet's policy is to pay invoices in time to take

advantage of all discounts, adjust inventory accordingly, and record accounts payable net of discounts.

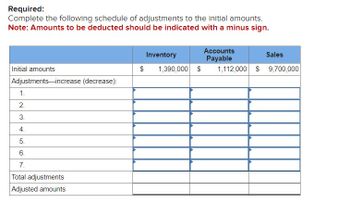

Transcribed Image Text:Required:

Complete the following schedule of adjustments to the initial amounts.

Note: Amounts to be deducted should be indicated with a minus sign.

Initial amounts

Adjustments increase (decrease):

1.

2.

3.

4.

5.

6.

7.

Total adjustments

Adjusted amounts

$

Inventory

1,390,000

$

Accounts

Payable

Sales

1,112,000 $9,700,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of November, Yoshi Inc.’s inventory consists of 67 units with a cost per unit of $96. The following transactions occur during the month of November. November 2 Purchase 75 units of inventory on account from Toad Inc. for $100 per unit, terms 1/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $150. November 9 Return 25 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Inc. in full. November 16 Sell 100 units of inventory to customers on account, $12,300. [Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $3 per unit for freight less $1 per unit for the purchase discount, or $102 per unit.] November 20 Receive full payment from customers related to the sale on November 16. November 21 Purchase 53 units of inventory from Toad Inc. for $106 per unit, terms 3/10, n/30. November 24 Sell 65 units of inventory to…arrow_forwardAt the beginning of November, Yoshi Inc.’s inventory consists of 64 units with a cost per unit of $96. The following transactions occur during the month of November. November 2 Purchase 80 units of inventory on account from Toad Inc. for $100 per unit, terms 1/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $320. November 9 Return 16 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Inc. in full. November 16 Sell 100 units of inventory to customers on account, $12,600. [Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $5 per unit for freight less $1 per unit for the purchase discount, or $104 per unit.] November 20 Receive full payment from customers related to the sale on November 16. November 21 Purchase 56 units of inventory from Toad Inc. for $106 per unit, terms 3/10, n/30. November 24 Sell 70 units of inventory to…arrow_forwardGladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions Units Unit Cost Beginning inventory, January 1 3,200 $ 45 Transactions during the year: a. Purchase, January 30 4,550 55 b. Sale, March 14 ($100 each) (2,850 ) c. Purchase, May 1 3,250 75 d. Sale, August 31 ($100 each) (3,300 ) Assuming that for the Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1.arrow_forward

- Penultimate Company uses a perpetual inventory system and has a December 31 year-end. Its records show the following data for the current year: Inventory beginning of year per General Ledger - 36,450 Inventory end of year unadjusted per General Ledger - $35,000 Purchases during the year - $60,000 Physical inventory count end of year - 43,900 Accounts Payable invoices dated December for inventory purchases ordered but in transit at year end - $6,000 Trade terms with suppliers – Net 30 days, FOB destination Required 1: Assuming no other transaction happened, what value will show on Penultimate's year end balance sheet for inventory? $ Required 2: Assuming no other transaction happened, what value will show on Ultimate's Income Statement as the Cost of Goods Sold? $ Required 3: Assuming no other transaction happened, what was the amount of Merchandise Available For Sale? $arrow_forwardKirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Assessment Tool iFrame Transactions Beginning inventory, January 1 Transactions during the year: a. Purchase, January 30 b. Purchase, May 1 c. Sale ($5 each) d. Sale ($5 each) Units 400 Unit Cost $ 3.00 300 460 3.40 4.00 (160) (700) Required: a. Compute the amount of goods available for sale. b. & c. Compute the amount of ending inventory and cost of goods sold at December 31, under Average cost, First-in, first-out, Last-in, first-out and Specific identification inventory costing methods. For Specific identification, assume that the first sale was selected two- fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the second sale was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1. Complete this…arrow_forwardResgan Corporation is a wholesale distributor of truck replacement parts. Initial amounts taken from Reagan's records are as follows: Inventory at Decenber 31 (based on a physical count of goods in Reagan's warchouse on December 31) $1,400,e0e Accounts payable at December 31: Vendor Baker Corpany Charlie Corpany Dolly Corpany Еagler Companу Full Company Amount $ 295,000 248, 000 Terms 28, 10 days, пet 38 Net 30 Net 30 330,eee Net 30 255, 0ee Net 30 Greg Company Net 30 Accounts payable, December 31 $1,120,000 Sales for the year $9,750,eee Additional Information: 1. Parts held by Reagan on consignment from Charlie, amounting to $230,000, were included in the physical count of goods in Reagan's warehouse and in accounts payable at December 31. 2 Parts totaling $37,000, which were purchased from Full and paid for in December, were sold in the last week of the year and appropriately recorded as sales of $43,000. The parts were included in the physical count of goods in Reagan's worehouse on…arrow_forward

- Stellar Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. Inventory, May 1 Purchases (gross) Freight-in Sales revenue Sales returns Purchase discounts (a) $161,900 697,000 31,400 924,000 73,200 12.100 Compute the estimated inventory at May 31, assuming that the gross profit is 25% of sales. The estimated inventory at May 31 $arrow_forwardAssume that on September 1, Office Depot had an inventory that included a variety of calculators. The company uses a perpetual inventory system. During September, these transactions occurred. Sept. 6 Purchased calculators from Dragoo Co. at a total cost of $1,600, on account, terms n/30 FOB shipping point. 9 Paid freight of $50 on calculators purchased from Dragoo Co. 10 Returned calculators to Dragoo Co. for $66 credit because they did not meet specifications. 12 Sold calculators costing $520 for $690 to Fryer Book Store, on account, terms n/30. 14 20 Granted credit of $45 to Fryer Book Store for the return of one calculator that was not ordered. The calculator cost $34. Sold calculators costing $570 for $760 to Heasley Card Shop, on account, terms n/30. Journalize the September transactions for Office Depot. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education