FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:$52,628

$61,908

$86,759

$55,695

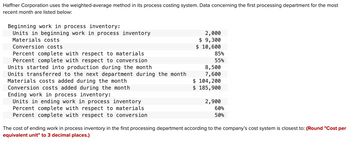

Transcribed Image Text:Haffner Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most

recent month are listed below:

Beginning work in process inventory:

Units in beginning work in process inventory

Materials costs

Conversion costs

Percent complete with respect to materials

Percent complete with respect to conversion

Units started into production during the month

Units transferred to the next department during the month

Materials costs added during the month

Conversion costs added during the month

Ending work in process inventory:

Units in ending work in process inventory

Percent complete with respect to materials

Percent complete with respect to conversion

2,000

$9,300

$ 10,600

85%

55%

8,500

7,600

$ 104,200

$ 185,900

2,900

60%

50%

The cost of ending work in process inventory in the first processing department according to the company's cost system is closest to: (Round "Cost per

equivalent unit" to 3 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Upton Company produces two main products and a by-product out of a joint process. The ratio of output quantities to input quantities of direct material used in the joint process remains consistent from month to month. Upton has employed the physical quantities method to allocate joint production costs to the two main products. The net realizable value of the by-product is used to reduce the joint production costs before the joint costs are allocated to the main products. Data regarding Upton's operations for the current month are presented in the chart below. During the month, Upton incurred joint production costs of $3,116,640. The main products are not marketable at the split-off point and, thus, have to be processed further. Monthly output in pounds Selling Price per pound Separable process costs First Main Product 99,600 $24 $ 597,600 Second Main Product 162,000 $ 13 $ 712,800 By-Product 67,200 $2 The amount of joint production cost that Upton would allocate to the Second Main…arrow_forward2014 2013 Revenue $14,147,293 $13,566,296 Cost of goods sold $-8,447,560 $-8,131,586 Selling, general, andadministrative expenses $-998,843 $-980,283 Depreciation $-1,497,919 $-1,472,544 EBIT $3,202,971 $2,981,883 Interest expense $-376,259 $-355,627 Taxes $-1,074,151 $-997,977 Net income $1,752,561 $1,628,279 Right-click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet. Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 ASSETS 2014 2013 LIABILITIES 2014 2013 Current assets Current liabilities Cash $191,068 $187,833 Accounts payable $1,546,427 $1,455,115 Investments…arrow_forwardSpang Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Recently, Job P505 was completed with the following characteristics: Total machine-hours Direct materials Direct labor cost $ The total job cost for Job P505 is closest to: 200 $ 540 7,200 20,000 $ 176,000 $ 2.20arrow_forward

- Problem 13-15 (AICPA Adapted) On April 30, 2020, a fire damaged the office of Waterloo Company. The following balances were gathered from the general ledger on March 31, 2020: Accounts receivable Inventory - January 1 Accounts payable Sales Purchases 920,000 1,880,000 950,000 3,600,000 1,680,000 An examination of the April bank statement and canceled checks revealed checks written during the period April 1-30; 240,000 80,000 160,000 Accounts payable as of March 31 April merchandise shipments Еxрenses Deposits during the same period amounted to P440,000 which consisted of collections from customers with the exception of P20,000 refund from a vendor for merchandise returned in April. Customers acknowledged indebtedness of P1,040,000 at April 30. Customers owed another P60,000 that will never be recovered. Of the acknowledged indebtedness, P40,000 may prove uncollectible. Correspondence with suppliers revealed unrecorded obligations at April 30 of P340,000 for April merchandise shipment,…arrow_forwardInformation for Hobson Corporation for the current year ($ in millions): Income from continuing operations before tax Loss on discontinued operation (pretax) Temporary differences (all related to operating income): Accrued warranty expense in excess of expense included in operating income Depreciation deducted on tax return in excess of depreciation expense Permanent differences (all related to operating income): Nondeductible portion of entertainment expense The applicable enacted tax rate for all periods is 25%. How much tax expense on income from continuing operations would be reported in Hobson's income statement? Note: Round the final answer to 2 decimal places. $ 230 10 85 175 20arrow_forwardShade Company adopted a standard cost system several years ago. The standard costs for direct labor and direct materials for its single product are as follows: Materials (5 kilograms × $12 per kilogram) = $60 per unit; direct labor (3.5 hours per unit × $20 per hour) = $70 per unit. All materials are issued at the beginning of processing. The operating data shown below were taken from the records for December: In-process beginning inventory In-process ending inventory-80% complete as to labor Units completed during the period Budgeted output Purchases of materials (in kilograms) Total actual direct labor cost incurred Direct labor hours worked (AQ) Materials purchase-price variance Increase in materials inventory in December The direct labor rate variance for December was: Multiple Choice O $3,822 favorable. $7.882 favorable. None 1,040 units 6,860 units 7,440 units 44,000 $ 542,178 27,300 hours $5,280 favorable 3,550 kilogramsarrow_forward

- Prob. of state S&P 500 Technology T-Bills -15% State International Fund + 1% GDP .25 8% 5% 30% + 2% GDP .50 12% 15% 15% + 3% GDP .25 16% 45% 5% 0%arrow_forwardA=$32982 p=27,200 r=5.93% t=?arrow_forwardTB MC Qu. 10-83 (Algo) The Millard Division's operating... The Millard Division's operating data for the past two years are provided below: Return on investment Net operating income. Turnover Margin Sales Year 1 128 ? ? ? Year 2 36% $ 540,000 3 ? ? $ 3,290,000 Millard Division's margin in Year 2 was 150% of the margin in Year 1. The net operating income for Year 1 was: (Round intermediate percentage computations to the nearest whole percent.)arrow_forward

- 22-A company purchased goods worth RO 10,000 excluding VAT and sold to customers for RO 25,000 excluding VAT. Assume the VAT rate as 5%. How much will be the VAT collected by the government? a. RO 1,750 b. RO 750 c. RO 1,250 d. RO 500arrow_forwardData for January for Bondi Corporation and its two major business segments, North and South, appear below: Sales revenues, North Variable expenses, North Traceable fixed expenses, North Sales revenues, South Variable expenses, South Traceable fixed expenses, South $ 673,000 $ 390,600 $ 80,600 $ 520,300 $ 296,900 $ 67,400 In addition, common fixed expenses totaled $182,700 and were allocated as follows: $94,900 to the North business segment and $87,800 to the South business segment. A properly constructed segmented income statement in a contribution format would show that the segment margin of the North business segment is:arrow_forwardClothing Company has two service departments-purchasing and maintenance, and two production departments-fabrication and assembly. The distribution of each service department's efforts to the other departments is shown below: FROM Purchasing Maintenance Purchasing Purchasing Maintenance Fabrication. Assembly TO ex Maintenance: 55% 0% Fabrication 30% 50% The direct operating costs of the departments (including both variable and fixed costs) were as follows: $ 126,000 48,000 102,000 78,000 Assembly 15% 15% The total cost accumulated in the fabrication department using the direct method is (calculate all ratios and percentages to 4 decimal places, for example 33,3333%, and round all dollar amounts to the nearest whole dollar):arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education