Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

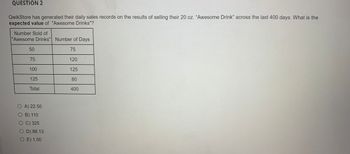

Transcribed Image Text:QUESTION 2

QwikStore has generated their daily sales records on the results of selling their 20 oz. “Awesome Drink" across the last 400 days. What is the

expected value of "Awesome Drinks"?

Number Sold of

"Awesome Drinks"

50

75

100

125

Total

O A) 22.50

O B) 110

O C) 325

O D) 88.13

O E) 1.00

Number of Days

75

120

125

80

400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Helparrow_forwardTrue calculationarrow_forwardPRINTER VERSION CALCULATOR 1 BACK NEX Problem 3-35 (Part Level Submission) Sandhill Company produces a molded briefcase that is distributed to luggage stores. The following operating data for the current year has been accumulated for planning purposes. $41.17 Sales price Variable cost of goods sold Variable selling expenses Variable administrative expenses 13.17 11.77 4.17 Annual fixed expenses $15,600,000 3,100,000 6,500,000 Overhead Selling expenses Administrative expenses Sandhill can produce 3,000,000 cases a year. The projected net income for the coming year is expected to be $3,600,000. Sandhill is subject to a 40% income tax rate. During the planning sessions, Sandhill's managers have been reviewing costs and expenses. They estimate that the company's variable cost of goods sold will increase 15% in the coming year and that fixed administrative expenses will increase by $300,000. All other costs and expenses are expected to remain the same.arrow_forward

- Fast pls solve this question correctly in 5 min pls I will give u like for sure Savtk Hanse, Inc., has a cash cycle of 45 days, an operating cycle of 66 days, and an inventory period of 28.5 days. The company reported cost of goods sold in the amount of $345,000, and credit sales were $568,000. What is the company’s average balance in accounts payable and accounts receivable? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward1-The annual demand for Samsung mobiles is 60,000. The cost to place an order is RO 200. The cost of purchase of mobile is RO 4.800 and the carrying cost is 20% of cost. Calculate the number of orders per year. 2-E-Max sold 40 laptops during November and their purchases are given below. Calculate the cost of goods sold by E-Max using average cost method. Purchases No of Laptops Cost/Unit November 10 13 80 November 18 25 100 November 27 30 120 a. 2940 RO b. 4600 RO c. 4200 RO d. 3780 ROarrow_forwardRestaurant Sales Summary for month of February, 2018. Item Prime Rib Fish n Chips Barbecued Duck Total sold 690 560 350 425 280 Cheese Burger Baked Lasagna Total a. Number of Covers sold per day_ PPOP % S.P. $19.00 $14.00 $11.00 $10.00 $11.00 Revenue b. Cost of average covers - $_ c. Total Revenue in the Restaurant in the month of February 2018 d. Restaurant has 50 seats, what is the restaurant turnover ratio?arrow_forward

- Bhupatbhaiarrow_forward8arrow_forwardMower-Blower Sales Co. started business on January 20, 2016. Products sold were snow blowers and lawn mowers. Each product sold for $1,400. Purchases during 2016 were as follows: Blowers Mowers January 21 20@$800 February 3 40 @780 February 28 30760 March 13 20 @ 760 April 6 20@$840 May 22 40860 June 3 40 @880 June 20 60920 August 15 20860 September 20 20840 November 7 20@800 The December 31, 2016 inventory included 10 blowers and 25 mowers. Assume the company uses a periodic inventory system. Required: Compute ending inventory valuation at December 31, 2016 under: a) FIFO b) LIFO (Hint: Compute ending inventory under each method, and then compare results.)arrow_forward

- Last month Annie's Homemade sold 5,000 servings of ice cream for $5.00 each. Its variable cost is $1.25 per serving and its total fixed costs were $11,000. Required: 1. What was last month's margin of safety? 2. What was last month's margin of safety percentage? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What was last month's margin of safety? Margin of safetyarrow_forwardqiestio tnhree attached in ss below thanks for help aprpeciated it t1pit14tip14jtp1i4gmgipg 4gip14mg1p4ig14 mpivvd pivdvarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education