Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

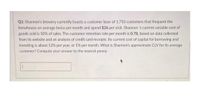

Transcribed Image Text:Q1: Shannon's brewery currently boasts a customer base of 1,750 customers that frequent the

brewhouse on average twice per month and spend $26 per visit. Shannon 's current variable cost of

goods sold is 50% of sales. The customer retention rate per month is 0.78, based on data collected

from its website and an analysis of credit card receipts. Its current cost of capital for borrowing and

investing is about 12% per year, or 1% per month. What is Shannon's approximate CLV for its average

customer? Compute your answer to the nearest penny.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Please answer the question in the picture belowarrow_forwardElaborate and discuss the following quetions 1. While you are working as a bookkeeper in retail company, Sage 50 is giving you a warning message that the customer has exceeded his credit limit. What would you do? How would you advice your manager as a professional? 2. What is overdraft and how does it happen? 3. What is a Cash Flow Report? What does it help us? 4. Explain the concept of aging in customer accounts? 5. How do you record a Senior's Discount?arrow_forwardMy bank requires me to establish a four digit pin My bank requires me to establish a four digit pin number for my debit card. a. How many possible pin numbers can I choose from? b. What is the probability that someone can correctly guess my pin number? My bank requires me to establish a four digit pinarrow_forward

- Can someonearrow_forwardIf a cash payments journal is supposed to save time spent writing, why are there so many entries in the Other Accounts Debit column?arrow_forwardYou have established your performance materiality for accounts payable and revenue; now you must determine the posting materiality for individual items. The materiality judgement is at 4%. What is the posting materiality? Show your work. Your work should look like: APPROPRIATE AMOUNT x MATERIALITY JUDGEMENT = POSTING MATERIALITYarrow_forward

- To calculate the withdrawal amount from an account in which you want to decrease the balance, you use the __________________ formulaarrow_forwardEarly payment discounts offered by vendors are __________________ if payment is made within the discount period. Select one: A. automatically calculated by QBO B. displayed in the pay bills window C. displayed on the bill form D. None of the above are correctarrow_forwardFor the following transactions, show which Balance Sheet line items will be affected and if the effect will result in the line item increase or reduction. • Purchase a Treasury Bill for cash• Client withdraws savings• Receive a donation• A current loan becomes past due• Purchase motorcycle for staff with short-term creditarrow_forward

- Using Excel, create a table that shows the relationship between the interestearned and the amount deposited, as shown. we will first create the dollar amount column and the interest row, as shown . Next we will type into cell B3 the formula = $A3*B$2. We can now use the Fill command to copy the formula in other cells, resulting in the table as shown. Note that the dollar sign before A3 means column A is to remain unchanged in the calculations when the formula is copied into other cells. Also note that the dollar sign before 2 means that row 2 is to remain unchanged in calculations when the Fill command is used.arrow_forwardOne advantage and one disadvantage of offering a settlement discount to your customers?.arrow_forwardHow do you create a loan in Quickbooks? A. Select Banking > Create Loan B. Use the loan manager C. Create the loan account D. Create a liability accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education