Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

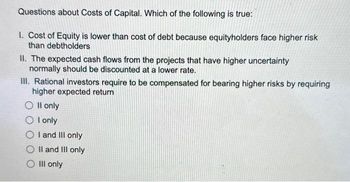

Transcribed Image Text:Questions about Costs of Capital. Which of the following is true:

1. Cost of Equity is lower than cost of debt because equityholders face higher risk

than debtholders

II. The expected cash flows from the projects that have higher uncertainty

normally should be discounted at a lower rate.

III. Rational investors require to be compensated for bearing higher risks by requiring

higher expected return

O II only

OI only

OI and III only

II and III only

O III only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- QUESTION #1: Which of the following is a disadvantage of using the IRR method of capital budgeting over other types: A- IRR does not consider the time and value of money. B- IRR assumes reinvestment of project cash flows at the same rate as the IRR C- IRR ignores the prudent simplicity of paybacks D- None of the above QUESTION #2: The net present value (NPV) of an investment is___________. A- The present value of all benefits (cash inflows) B- The present value of all costs (cash outflows) of the project C- The present value of all benefits (cash inflows) minus the present value of all costs (cash outflows) of the project D- The present value of all benefits (cash outflows) minus the present value of all costs (cash inflows) of the projectarrow_forwardQuestion 5 Which of the following is not a pro of DCF valuation?: It's very robust to assumptions about the terminal value. It's insulated from market aberrations. It's especially good for larger, stabler companies as it's based on projected cash flows. It allows for a flexible sensitivity analysis.arrow_forwardForecasting risk can be defined as the possibility that _____ will lead to incorrect decisions. a. the inclusion of opportunity costs b. erosion c. errors in projected cash flows d. the exclusion of sunk costs e. net working capital costsarrow_forward

- Which of the following statements are true? I At higher discount rate, a project is more likely to be rejected. II A project is acceptable if the IRR = 8% while the cost of capital = 5%. III IRR does not account for time value of money. Group of answer choices 1. All of the above. 2. I and II 3. I and III 4. II and IIIarrow_forwardIn understanding capital structure, one approach, which I adopt, is to demonstrate, under certain assumptions, that financing decisions are irrelevant – in that they have no impact on firm value. Then, we show how relaxing these assumptions impacts optimal financing choices. Group of answer choices True Falsearrow_forwardThe rationale for funds transfer pricing is that there are: Group of answer choices D. Less chances for controversy in organizations B. Controls that can be exercised over the dynamics of yield curves C. Controllable interest rate risks removed from business results A. Economies of scale in managing interest rate riskarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education